Page 22: of Maritime Reporter Magazine (March 1974)

Read this page in Pdf, Flash or Html5 edition of March 1974 Maritime Reporter Magazine

Study Indicates U.S.

Waterborne Trade To

Triple By Year 2000

The domestic waterborne commerce of the United States is projected to triple by the year 2000, according to a study recently released by the

Maritime Administration.

The study, which was carried out for the U.S. Department of Com- merce agency by the international management consulting firm of A.T.

Kearney, Inc., reflects a detailed ex- amination of current traffic flow pat- terns of each of the domestic marine transportation segments—inland wa- terways, domestic ocean and Great

Lakes carriers. It also assesses the economic and competitive forces that are expected to influence their opera- tions during the remainder of this century.

Tonnage handled by these three segments, which aggregated 892 mil- lion tons in 1969, is expected to rise to 2.7 billion tons by the year 2000.

Currently, the water carriers account for 17.6 percent of the domestic ton- nage movement, 26.9 percent of the total freight ton-miles, but only 2.3 percent of the freight revenues.

Tonnage handled annually by the inland waterways segment is expected to more than double, reaching 869 mil- lion tons in the year 2000. The do- mestic ocean segment, encompassing the coastwise and intercoastal move- ments, as well as the noncontiguous trades (Puerto Rico, Hawaii and

Alaska), is projected to show a 326 percent increase to 1.5 billion tons.

The Great Lakes marine tonnage is forecast to double by 2000, reaching 325 million tons.

It is predicted that by the year 2000, fossil fuels will account for 1.7 billion of the 2.7 billion tons han- dled by the marine mode, with crude and refined petroleum accounting for 1.4 billion tons of this.

INLAND WATERWAYS

The inland waterways system gen- erally is a very efficient mode for transporting bulk commodities and semifinished goods, having experienc- ed a 40-fold man-hour productivity increase over the past four decades.

However, the points of interface at ports between modes of transpor- tation were found in the study to be far behind the level of available tech- nology.

The need for concentrating atten- tion and resources on this problem over the coming years is documented in the study. At present, it is not unusual for cargo handling costs at terminals to equal or exceed direct transportation costs of a typical do- mestic marine shipment.

A second area for concentration cited by the study is relief of capacity restraints on main thoroughfares.

Beyond that — and depending on the nature of any shifts in the sources of energy—developments appear fa- vorable for the Inland Waterways

Trade Area during the 25-year time- frame of the study.

To realize the potential, though, the industry will also have to be suc- cessful in obtaining reasonable sup- port to assure practical water resource development and pollution abatement policies, the report concludes, along with adequate waterways project funding.

DOMESTIC OCEAN

The Domestic Ocean Trade Area is expected to experience the greatest increase in traffic among the three areas, more than quadrupling present tonnage to 2.22 billion by 2000.

The domestic ocean coastwise traf- fic is dominated by petroleum and chemical bulk commodities move- ments. Thus, the trade depends on the direction of energy-related policy.

Trade to and from Puerto Rico is afforded the best service levels of any similar traffic lane in the world, with more than 400 sailings per year.

Containerization has made the trade profitable for carriers since the mid- 1950s. However, the study indicated that this custom may have been eroded, and rate relief may be nec- essary during the coming years if the service level on which the Puerto

Rican economy depends is to be main- tained.

Trade to and from Hawaii princi- pally is consumption-oriented, with some back-haul of agricultural com- modities. Future trade is expected to involve Alaskan oil shipments ; in fact

North Slope development is expected (Continued next page)

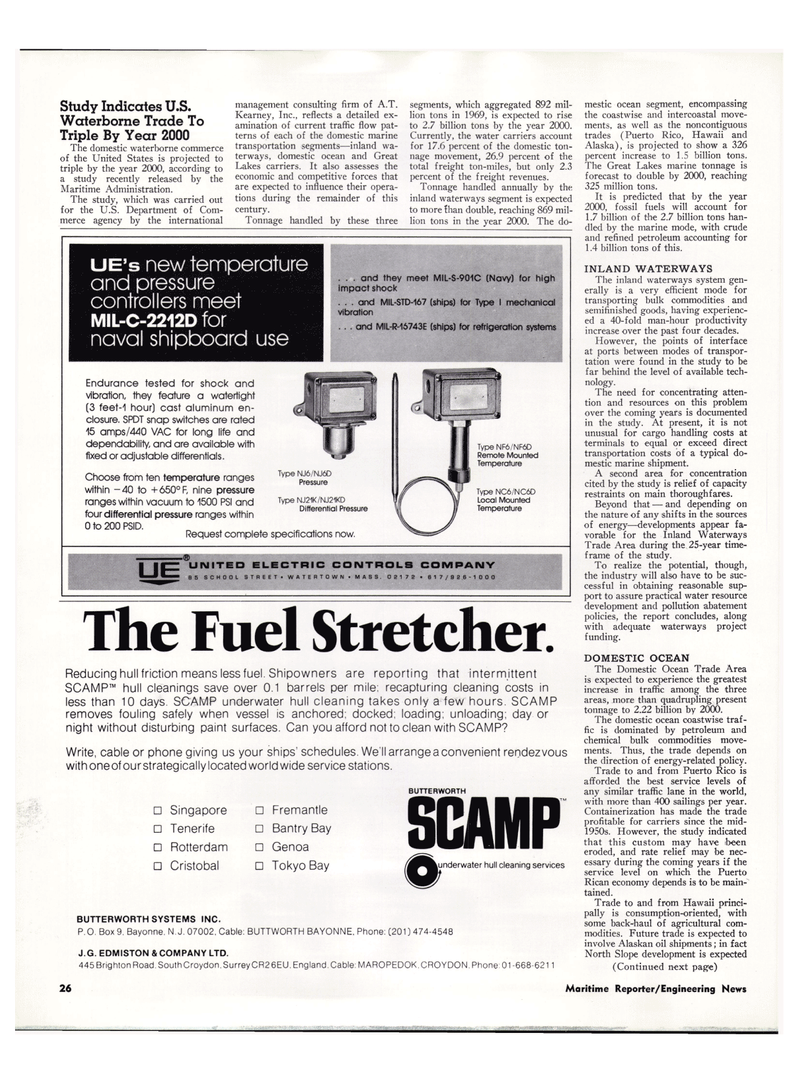

UE's new temperature and pressure controllers meet

MIL-C-2212D for naval shipboard use

Endurance tested for shock and vibration, they feature a watertight (3 feet-1 hour) cast aluminum en- closure. SPOT snap switches are rated 15 amps/440 VAC for long life and dependability, and are available with fixed or adjustable differentials. . . . and they meet MIL-S-901C (Navy) for high impact shock . . . arid MIL-STD-167 (ships) for Type I mechanical vibration . . . and MIL-R-16743E (ships) for refrigeration systems

Choose from ten temperature ranges within -40 to +650°F, nine pressure ranges within vacuum to 1500 PSI and four differential pressure ranges within 0 to 200 PSID. Request complete specifications now.

Type NJ6/NJ6D

Pressure

Type NJ21K/NJ21KD

Differential Pressure

Type NF6/NF6D

Remote Mounted

Temperature

Type NC6/NC6D

Local Mounted

Temperature

UNITED ELECTRIC CONTROLS COMPANY 85 SCHOOL STREET* WATERTOWN • MASS. 02172 • 617/82 6 -1000

The Fuel Stretcher.

Reducing hull friction means less fuel. Shipowners are reporting that intermittent

SCAMP™ hull cleanings save over 0.1 barrels per mile; recapturing cleaning costs in less than 10 days. SCAMP underwater hull cleaning takes only a few hours. SCAMP removes fouling safely when vessel is anchored: docked: loading; unloading; day or night without disturbing paint surfaces. Can you afford not to clean with SCAMP?

Write, cable or phone giving us your ships' schedules. We'll arrange a convenient rendezvous with oneofourstrategically located worldwide service stations.

BUTTERWORTH • Singapore • Tenerife • Rotterdam • Cristobal • Fremantle • Bantry Bay • Genoa • Tokyo Bay

SCAMP ® underwater hull cleaning services

BUTTERWORTH SYSTEMS INC.

P.O. Box 9. Bayorme. N.J. 07002, Cable: BUTTWORTH BAYONNE, Phone: (201) 474-4548

J.G. EDMISTON & COMPANY LTD. 445 Brighton Road. South Croydon, Surrey CR26EU. England. Cable: MAROPEDOK. CROYDON. Phone: 01 -668-621 26 Maritime Reporter/Engineering News

21

21

23

23