Page 3: of Maritime Reporter Magazine (February 1980)

Read this page in Pdf, Flash or Html5 edition of February 1980 Maritime Reporter Magazine

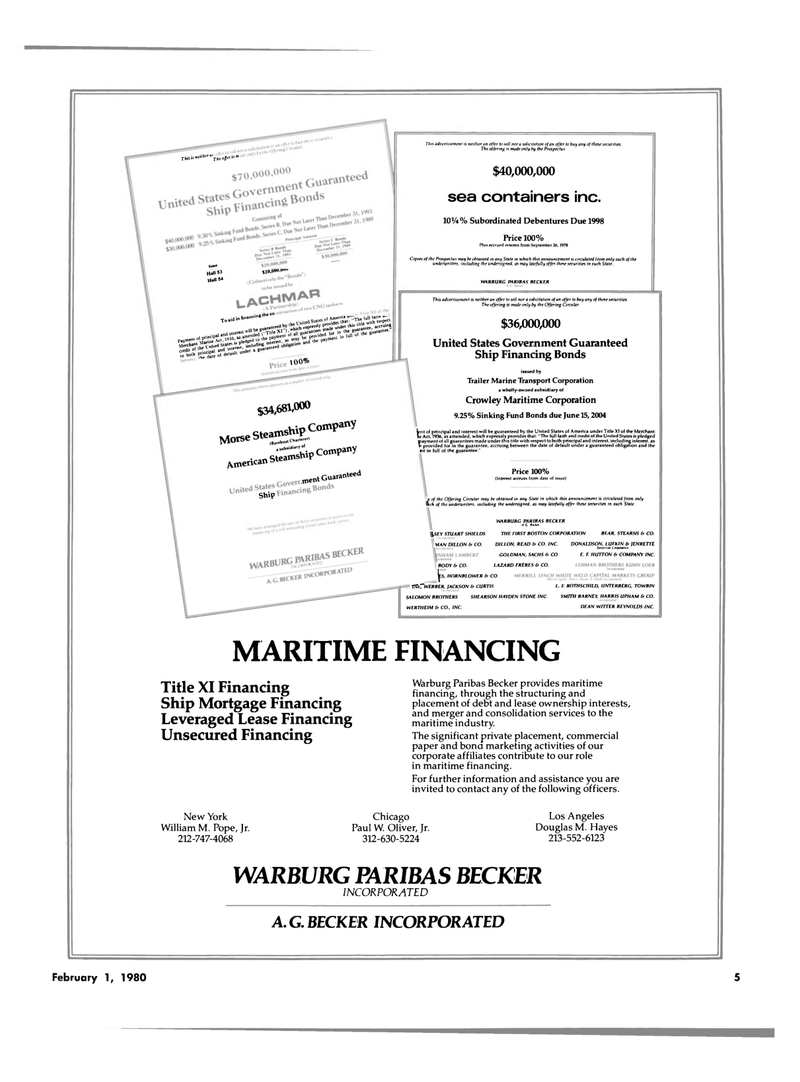

rltiJ is ntith" The of" h m

Ivsut tloll 5'

Hull 54 5j0.0WI.v-

To " . hv ibeV.' ,n hna°cl " ^ ,.< \n\etica U""T. (u\\ laun »•• gsBSSSS^ 100% $34,681,000

Morse Steamship Company (Bareboat Charterer) a subsidiary of American Steamship Company teed .inent Guaia"1

Ship

This advertisement is neither an offer to sell nor a solicitation of an offer to buy any of these securities.

The offering is made only by the Prospectus $40,000,000 sea containers inc. 10V4% Subordinated Debentures Due 1998

Price 100%

Plus accrued interest from September 26, 1978

Copies of the Prospectus may be obtained in any Slate in which this announcement is circulated from only such of the underwriters, including the undersigned, as may lawfully offer these securities in such State.

WARBURG PAR1BAS BECKER

This advertisement is neither an offer to sell nor a solicitation of an offer to buy any of these securities

The offering is made only by the Offering Circular. $36,000,000

United States Government Guaranteed

Ship Financing Bonds issued by

Trailer Marine Transport Corporation a wholly-owned subsidiary of

Crowley Maritime Corporation 9.25% Sinking Fund Bonds due June 15, 2004

Lent of principal and interest will be guaranteed by the United States of America under Title XI of the Merchant \e Act, 1936, as amended, which expressly provides that: "The full faith and credit of the United States is pledged payment of all guarantees made under this title with respect to both principal and interest, including interest, as v provided for in the guarantee, accruing between the date of default under a guaranteed obligation and the rtt in full of the guarantee."

Price 100% (Interest accrues from date of issue) s of the Offering Circular may be obtained in any State in which this announcement is circulated from only

IVc/i of the underwriters, including the undersigned, as may lawfully offer these securities in such State. \[SEY STUART SHIELDS

VIAN DILLON & CO.

WARBURG PAR1BAS BECKER A C Brckrr

THE FIRST BOSTON CORPORATION

DILLON, READ & CO. INC.

GOLDMAN, SACHS & CO.

BODY & CO. LAZARD FRtRES & CO. jp, HORNBLOWER & CO.

TfitTwEBBER, JACKSON & CURTIS

SALOMON BROTHERS SHEARSON HAYDEN STONE INC.

WERTHEIM & CO., INC.

BEAR, STEARNS & CO.

DONALDSON, LUFKIN b JENRETTE Sfturitm Corporation

E. F. HUTTON & COMPANY INC.

L. F. ROTHSCHILD, UNTERBERG, TOWBIN

SMITH BARNEY, HARRIS UPHAM & CO.

DEAN WITTER REYNOLDS INC.

MARITIME FINANCING

Title XI Financing

Ship Mortgage Financing

Leveraged Lease Financing

Unsecured Financing

Warburg Paribas Becker provides maritime financing, through the structuring and placement of debt and lease ownership interests, and merger and consolidation services to the maritime industry.

The significant private placement, commercial paper and bona marketing activities of our corporate affiliates contribute to our role in maritime financing.

For further information and assistance you are invited to contact any of the following officers.

New York

William M. Pope, Jr. 212-747-4068

Chicago

Paul W. Oliver, Jr. 312-630-5224

Los Angeles

Douglas M. Hayes 213-552-6123

WARBURG PARIBAS BECKER

INCORPORATED

A. G. BECKER INCORPORATED

February 1, 1980 5

2

2

4

4