Page 31: of Maritime Reporter Magazine (June 1985)

Read this page in Pdf, Flash or Html5 edition of June 1985 Maritime Reporter Magazine

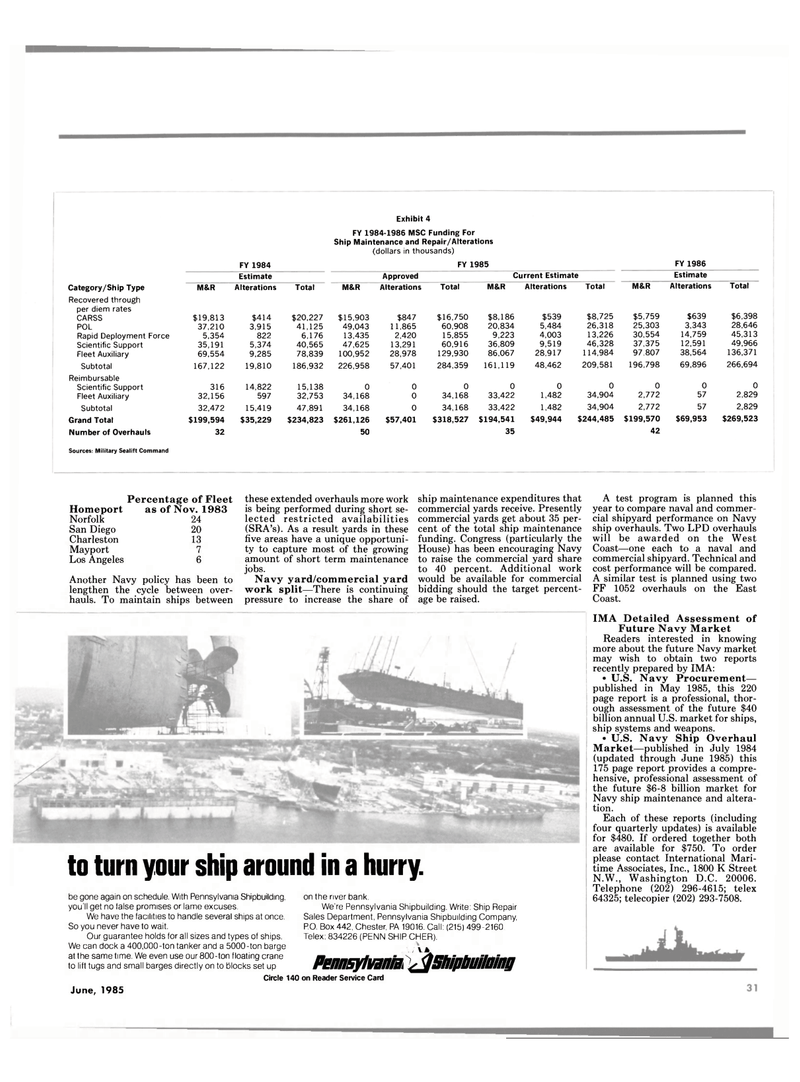

Exhibit 4

FY 1984

FY 1984-1986 MSC Funding For

Ship Maintenance and Repair/Alterations (dollars in thousands)

FY 1985 FY 1986

Estimate Approved Current Estimate Estimate

Category/Ship Type M&R Alterations Total M&R Alterations Total M&R Alterations Total M&R Alterations Total

Recovered through per diem rates

CARSS $19,813 $414 $20,227 $15,903 $847 $16,750 $8,186 $539 $8,725 $5,759 $639 $6,398

POL 37,210 3,915 41,125 49,043 11,865 60,908 20,834 5,484 26,318 25,303 3,343 28,646

Rapid Deployment Force 5,354 822 6,176 13,435 2,420 15,855 9,223 4,003 13,226 30,554 14,759 45,313

Scientific Support 35,191 5,374 40,565 47,625 13,291 60,916 36,809 9,519 46,328 37,375 12,591 49,966

Fleet Auxiliary 69,554 9,285 78,839 100,952 28,978 129,930 86,067 28.917 114,984 97.807 38,564 136,371

Subtotal 167,122 19,810 186,932 226,958 57,401 284,359 161,119 48,462 209,581 196,798 69,896 266,694

Reimbursable

Scientific Support 316 14,822 15,138 0 0 0 0 0 0 0 0 0

Fleet Auxiliary 32,156 597 32,753 34,168 0 34,168 33,422 1,482 34,904 2,772 57 2,829

Subtotal 32,472 15,419 47,891 34,168 0 34,168 33,422 1,482 34,904 2,772 57 2,829

Grand Total $199,594 $35,229 $234,823 $261,126 $57,401 $318,527 $194,541 $49,944 $244,485 $199,570 $69,953 $269,523

Number of Overhauls 32 50 35 42

Sources: Military Sealift Command

Percentage of Fleet

Homeport as of Nov. 1983

Norfolk 24

San Diego 0

Charleston 13

Mayport 7

Los Angeles 6

Another Navy policy has been to lengthen the cycle between over- hauls. To maintain ships between these extended overhauls more work is being performed during short se- lected restricted availabilities (SRA's). As a result yards in these five areas have a unique opportuni- ty to capture most of the growing amount of short term maintenance jobs.

Navy yard/commercial yard work split—There is continuing pressure to increase the share of ship maintenance expenditures that commercial yards receive. Presently commercial yards get about 35 per- cent of the total ship maintenance funding. Congress (particularly the

House) has been encouraging Navy to raise the commercial yard share to 40 percent. Additional work would be available for commercial bidding should the target percent- age be raised.

A test program is planned this year to compare naval and commer- cial shipyard performance on Navy ship overhauls. Two LPD overhauls will be awarded on the West

Coast—one each to a naval and commercial shipyard. Technical and cost performance will be compared.

A similar test is planned using two

FF 1052 overhauls on the East

Coast. be gone again on schedule. With Pennsylvania Shipbuilding, you'll get no talse promises or lame excuses.

We have the facilities to handle several ships at once.

So you never have to wait.

Our guarantee holds for all sizes and types of ships.

We can dock a 400,000-ton tanker and a 5000-ton barge at the same time. We even use our 800-ton floating crane to lift tugs and small barges directly on to blocks set up

Circle 140

June, 1985 on the river bank.

We're Pennsylvania Shipbuilding. Write: Ship Repair

Sales Department, Pennsylvania Shipbuilding Company,

P.O. Box 442, Chester, PA 19016. Call: (215) 499-2160

Telex: 834226 (PENN SHIP CHER).

Pennsylvania ^Shipbuilding on Reader Service Card

IMA Detailed Assessment of

Future Navy Market

Readers interested in knowing more about the future Navy market may wish to obtain two reports recently prepared by IMA: • U.S. Navy Procurement— published in May 1985, this 220 page report is a professional, thor- ough assessment of the future $40 billion annual U.S. market for ships, ship systems and weapons. • U.S. Navy Ship Overhaul

Market—published in July 1984 (updated through June 1985) this 175 page report provides a compre- hensive, professional assessment of the future $6-8 billion market for

Navy ship maintenance and altera- tion.

Each of these reports (including four quarterly updates) is available for $480. If ordered together both are available for $750. To order please contact International Mari- time Associates, Inc., 1800 K Street

N.W., Washington D.C. 20006.

Telephone (202) 296-4615; telex 64325; telecopier (202) 293-7508. to turn your ship around in a hurry.

30

30

32

32