Page 30: of Maritime Reporter Magazine (February 1989)

Read this page in Pdf, Flash or Html5 edition of February 1989 Maritime Reporter Magazine

U.S. NAVY

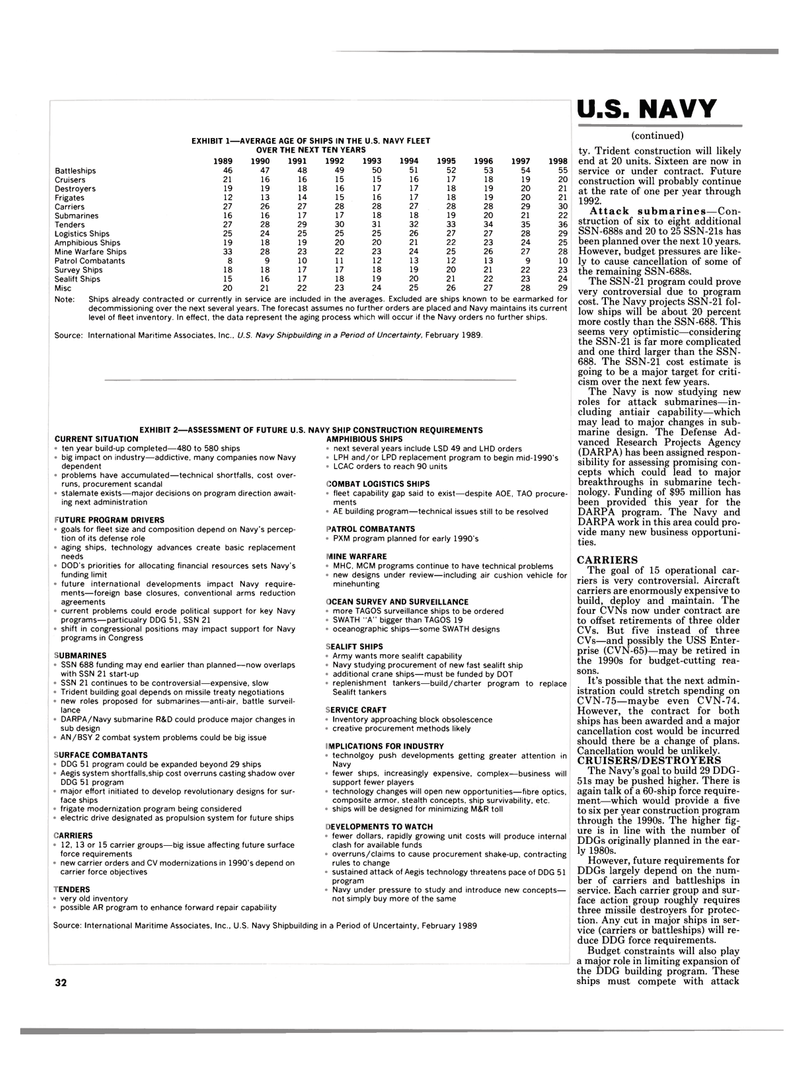

EXHIBIT 1—AVERAGE AGE OF SHIPS IN THE U.S. NAVY FLEET

OVER THE NEXT TEN YEARS 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998

Battleships 46 47 48 49 50 51 52 53 54 55

Cruisers 21 16 16 15 15 16 17 18 19 20

Destroyers 19 19 18 16 17 17 18 19 20 21

Frigates 12 13 14 15 16 17 18 19 20 21

Carriers 27 26 27 28 28 27 28 28 29 30

Submarines 16 16 17 17 18 18 19 20 21 22

Tenders 27 28 29 30 31 32 33 34 35 36

Logistics Ships 25 24 25 25 25 26 27 27 28 29

Amphibious Ships 19 18 19 20 20 21 22 23 24 25

Mine Warfare Ships 33 28 23 22 23 24 25 26 27 28

Patrol Combatants 8 9 10 11 12 13 12 13 9 10

Survey Ships 18 18 17 17 18 19 20 21 22 23

Sealift Ships 15 16 17 18 19 20 21 22 23 24

Misc 20 21 22 23 24 25 26 27 28 29

Note: Ships already contracted or currently in service are included in the averages. Excluded are ships known to be earmarked for decommissioning over the next several years. The forecast assumes no further orders are placed and Navy maintains its current level of fleet inventory. In effect, the data represent the aging process which will occur if the Navy orders no further ships.

Source: International Maritime Associates, Inc.. U.S. Navy Shipbuilding in a Period of Uncertainty, February 1989.

EXHIBIT 2—ASSESSMENT OF FUTURE U.S.

CURRENT SITUATION ten year build-up completed—480 to 580 ships big impact on industry—addictive, many companies now Navy dependent problems have accumulated—technical shortfalls, cost over- runs, procurement scandal stalemate exists—major decisions on program direction await- ing next administration

FUTURE PROGRAM DRIVERS goals for fleet size and composition depend on Navy's percep- tion of its defense role aging ships, technology advances create basic replacement needs

DOD's priorities for allocating financial resources sets Navy's funding limit future international developments impact Navy require- ments—foreign base closures, conventional arms reduction agreements current problems could erode political support for key Navy programs—particualry DDG 51, SSN 21 shift in congressional positions may impact support for Navy programs in Congress

SUBMARINES

SSN 688 funding may end earlier than planned—now overlaps with SSN 21 start-up

SSN 21 continues to be controversial—expensive, slow

Trident building goal depends on missile treaty negotiations new roles proposed for submarines—anti-air, battle surveil- lance

DARPA/Navy submarine R&D could produce major changes in sub design

AN/BSY 2 combat system problems could be big issue

SURFACE COMBATANTS

DDG 51 program could be expanded beyond 29 ships

Aegis system shortfalls,ship cost overruns casting shadow over

DDG 51 program major effort initiated to develop revolutionary designs for sur- face ships frigate modernization program being considered electric drive designated as propulsion system for future ships

CARRIERS 12, 13 or 15 carrier groups—big issue affecting future surface force requirements new carrier orders and CV modernizations in 1990's depend on carrier force objectives

TENDERS very old inventory possible AR program to enhance forward repair capability

NAVY SHIP CONSTRUCTION REQUIREMENTS

AMPHIBIOUS SHIPS next several years include LSD 49 and LHD orders

LPH and/or LPD replacement program to begin mid-1990's

LCAC orders to reach 90 units

COMBAT LOGISTICS SHIPS fleet capability gap said to exist—despite AOE, TAO procure- ments

AE building program—technical issues still to be resolved

PATROL COMBATANTS

PXM program planned for early 1990's

MINE WARFARE

MHC, MCM programs continue to have technical problems new designs under review—including air cushion vehicle for minehunting

OCEAN SURVEY AND SURVEILLANCE more TAGOS surveillance ships to be ordered

SWATH "A" bigger than TAGOS 19 oceanographic ships—some SWATH designs

SEALIFT SHIPS

Army wants more sealift capability

Navy studying procurement of new fast sealift ship additional crane ships—must be funded by DOT replenishment tankers—build/charter program to replace

Sealift tankers

SERVICE CRAFT

Inventory approaching block obsolescence creative procurement methods likely

MPLICATIONS FOR INDUSTRY technolgoy push developments getting greater attention in

Navy fewer ships, increasingly expensive, complex—business will support fewer players technology changes will open new opportunities—fibre optics, composite armor, stealth concepts, ship survivability, etc. ships will be designed for minimizing M&R toll

DEVELOPMENTS TO WATCH fewer dollars, rapidly growing unit costs will produce internal clash for available funds overruns/claims to cause procurement shake-up, contracting rules to change sustained attack of Aegis technology threatens pace of DDG 51 program

Navy under pressure to study and introduce new concepts— not simply buy more of the same

Source: International Maritime Associates, Inc., U.S. Navy Shipbuilding in a Period of Uncertainty, February 1989 32 (continued) ty. Trident construction will likely end at 20 units. Sixteen are now in service or under contract. Future construction will probably continue at the rate of one per year through 1992.

Attack submarines—Con- struction of six to eight additional

SSN-688s and 20 to 25 SSN-21s has been planned over the next 10 years.

However, budget pressures are like- ly to cause cancellation of some of the remaining SSN-688s.

The SSN-21 program could prove very controversial due to program cost. The Navy projects SSN-21 fol- low ships will be about 20 percent more costly than the SSN-688. This seems very optimistic—considering the SSN-21 is far more complicated and one third larger than the SSN- 688. The SSN-21 cost estimate is going to be a major target for criti- cism over the next few years.

The Navy is now studying new roles for attack submarines—in- cluding antiair capability—which may lead to major changes in sub- marine design. The Defense Ad- vanced Research Projects Agency (DARPA) has been assigned respon- sibility for assessing promising con- cepts which could lead to major breakthroughs in submarine tech- nology. Funding of $95 million has been provided this year for the

DARPA program. The Navy and

DARPA work in this area could pro- vide many new business opportuni- ties.

CARRIERS

The goal of 15 operational car- riers is very controversial. Aircraft carriers are enormously expensive to build, deploy and maintain. The four CVNs now under contract are to offset retirements of three older

CVs. But five instead of three

CVs—and possibly the USS Enter- prise (CVN-65)—may be retired in the 1990s for budget-cutting rea- sons.

It's possible that the next admin- istration could stretch spending on

CVN-75—maybe even CVN-74.

However, the contract for both ships has been awarded and a major cancellation cost would be incurred should there be a change of plans.

Cancellation would be unlikely.

CRUISERS/DESTROYERS

The Navy's goal to build 29 DDG- 51s may be pushed higher. There is again talk of a 60-ship force require- ment—which would provide a five to six per year construction program through the 1990s. The higher fig- ure is in line with the number of

DDGs originally planned in the ear- ly 1980s.

However, future requirements for

DDGs largely depend on the num- ber of carriers and battleships in service. Each carrier group and sur- face action group roughly requires three missile destroyers for protec- tion. Any cut in major ships in ser- vice (carriers or battleships) will re- duce DDG force requirements.

Budget constraints will also play a major role in limiting expansion of the DDG building program. These ships must compete with attack

29

29

31

31