Page 34: of Maritime Reporter Magazine (June 1991)

Read this page in Pdf, Flash or Html5 edition of June 1991 Maritime Reporter Magazine

U.S. SHIPBUILDING

Navy Ship Projects, Workboat Sector

Primary Sources Of Vessel Construction

New Construction May Be Spurred By OPA, Sealift Program

Texaco Order

On Horizon?

Although the U.S. Navy and

Government remain the primary customers of U.S. shipyards, there are signs emerging that a signifi- cant boost might be on its way from the commercial sector propelled by the Oil Pollution Act of 1990.

Texaco Inc. is reportedly engaged in talks with a number of domestic yards for the construction of as many as five 40,000-deadweight double- hull tankers.

According to Jim Liebertz, man- ager of economics and planning at

Texaco's marine department, the new tankers would replace 26,000- to 40,000-dwt ships nearing the end of their service lives in the com- pany's current fleet.

Mr. Liebertz said that Texaco has put the order out for public bid and is talking with a number of U.S. yards. Prices for the tankers could range between $60 million to $50 million per vessel in series produc- tion.

Navy Primary

Source Of

New Construction

Navy work remains the primary source of new construction contracts for large ships in the United States.

The Navy has asked for $8.6 billion to build 12 ships in fiscal year 1992 and $8.3 billion for 11 ships in fiscal year 1993.

The program calls for one SSN-21

Seawolf Class submarine in each year. General Dynamics-Electric

Boat Division of Groton, Conn., is currently building the lead ship of this new class of attack submarines.

A second contract awarded to the yard has been blocked temporarily by a judge following a lawsuit by

Newport News Shipbuilding, which was also bidding on the contract.

As of April 1st of this year, one dozen U.S. shipyards held new con- struction contracts for 100 naval vessels, 11 of which were ordered in 1991 and eight in 1990. In addition, five fleet oilers were under contract at Avondale Shipyards for jumboiza- tion.

Billion Dollar

Navy Sealift

Program In Works

The current Navy budget has $1,275 billion available to begin the sealift program, which might mean the construction of several Roll-On/

Roll-Off ships to commercially vi- able designs at U.S. yards. Other plans are under discussion for the possible acquisition of existing RO/

ROs and their subsequent conver- sion. An additional $1.2 billion has been allocated for sealift over the next five years, with further fund- ing possible in the future. Work under this program, as well as the impact of OPA could provide U.S. yards with a significant order book in the near future.

Significant

Commercial Orders

Although no new construction commercial oceangoing ships were delivered by U.S. shipyards in 1990, there were several orders placed during the year.

In January 1990, National Steel and Shipbuilding Co. (NASSCO) of

San Diego, Calif., received the first oceangoing commercial ship order placed with a U.S. shipyard since 1984. The 713-foot, 23,314-dwt, diesel-powered containership, de- signed to carry 1,650, twenty-four containers, was ordered by Matson

Navigation Co. for delivery in June 1992.

In February 1990, Edison Chou- est Offshore Inc. of Galliano, La., was awarded a contract to provide an icebreaking research and sup- port vessel to serve the National

Science Foundation operations in

Antarctica. Under this contract,

Edison Chouest will construct, char- ter, and operate the vessel, which is scheduled for completion in Febru- ary 1992. Construction is under way at North American Shipbuild- ing in Larose, La.

In September of 1990, Eastern

Shipyards, Inc., of Panama City,

Fla., was awarded a contract worth about $30 million for the construc- tion of two 400-foot molten sulfur tankers for Freeport-McMoRan, Inc.

The first tanker is scheduled for delivery late this year and the sec- ond in the first quarter of 1992. $75 Million

Cruise Ship Conversion

In the last quarter of 1990, South- west Marine, Inc., San Diego, Calif., was awarded a $75 million contract for the conversion of the Viking

Serenade for Royal Caribbean

Cruise Line.

The award of this contract repre- sents the largest cruise ship conver- sion to be undertaken in a U.S. yard and has significant international implications for Southwest Marine and the U.S. ship repair industry.

High Activity

In Shallow-Draft Market

In the shallow-draft sector, where there seems to be a significant rise in activity, several noteworthy con- tracts were landed by U.S. yards.

Avondale Boat Division secured a contract to build three 6,800-hp towboats for Viking Maritec, Inc.,

Pittsburgh, Pa. The vessels will reportedly be the first large inland towboats constructed in the U.S. since 1982.

Each vessel will be 168 feet long with a beam of 45 feet, and draft of about three feet, which will allow them to operate on the lower Missis- sippi, as well as the upper Missis- sippi River and Ohio River.

The Trinity Marine Group was one of the first U.S. builders to re- ceive orders for the construction of offshore supply boats. Trinity Ma- rine received the contract from

Kilgore Offshore, Inc. of Houston,

Texas, for one 202-foot, all-steel supply boat, with an option for three more vessels. Delivery of the vessel is scheduled for September 1991.

New Gambling Laws

Spur Orders

Spurred by new Iowa gambling laws which will allow gambling on the Mississippi River, several new construction and conversion con- tracts were awarded to small yards for casino and riverboat gambling vessels. Among those yards receiv- ing contracts were Patti Shipyards,

Atlantic Marine, Leevac Shipyards,

Service Marine Industries, and

Bender Shipbuilding.

The largest of the gambling ves- sels was the $12-million 387-foot

Dubuque Casino Belle delivered by

Patti Shipyards, Pensacola, Fla., to

Roberts River Rides of Dubuque,

Iowa.

Annual Vessel

Construction Survey

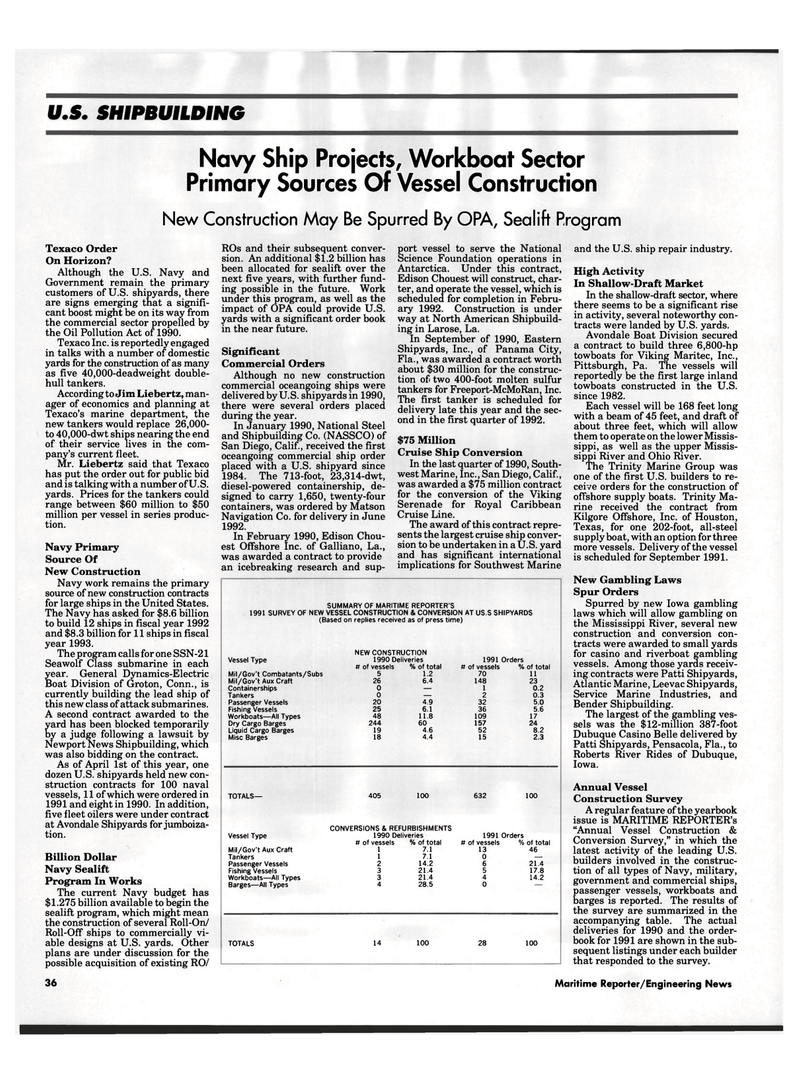

A regular feature of the yearbook issue is MARITIME REPORTER'S "Annual Vessel Construction &

Conversion Survey," in which the latest activity of the leading U.S. builders involved in the construc- tion of all types of Navy, military, government and commercial ships, passenger vessels, workboats and barges is reported. The results of the survey are summarized in the accompanying table. The actual deliveries for 1990 and the order- book for 1991 are shown in the sub- sequent listings under each builder that responded to the survey.

SUMMARY OF MARITIME REPORTER'S 1991 SURVEY OF NEW VESSEL CONSTRUCTION & CONVERSION AT US.S SHIPYARDS (Based on replies received as of press time)

NEW CONSTRUCTION

Vessel Type 1990 Deliveries 1991 Orders # of vessels % of total # of vessels % of total

Mil/Gov't Combatants/Subs 5 1.2 70 11

Mil/Gov't Aux Craft 26 6.4 148 23

Containerships 0 — 1 0.2

Tankers 0 — 2 0.3

Passenger Vessels 20 4.9 32 5.0

Fishing Vessels 25 6.1 36 5.6

Workboats—All Types 48 11.8 109 17

Dry Cargo Barges 244 60 157 24

Liquid Cargo Barges 19 4.6 52 8.2

Misc Barges 18 4.4 15 2.3

TOTALS— 405 100 632 100

CONVERSIONS & REFURBISHMENTS

Vessel Type 1990 Deliveries 1991 Orders # of vessels % of total # of vessels % of total

Mil/Gov't Aux Craft 1 7.1 13 46

Tankers 1 7.1 0 —

Passenger Vessels 2 14.2 6 21.4

Fishing Vessels 3 21.4 5 17.8

Workboats—All Types 3 21.4 4 14.2

Barges—All Types 4 28.5 0

TOTALS 14 100 28 100 36 Maritime Reporter/Engineering News

33

33

35

35