Page 72: of Maritime Reporter Magazine (April 1992)

Read this page in Pdf, Flash or Html5 edition of April 1992 Maritime Reporter Magazine

Special Report

COMMERCIAL SHIPBUILDING—DIVERSIFICATION

AND GROWTH OPPORTUNITIES FOR NAVY SUPPLIERS

By James R. McCaul, President

IMA Associates, Inc

Changing military requirements have highlighted the need for traditional Navy suppliers to diver- sify by developing a growing sales presence in the commercial marine sector. While naval shipbuilding in this country will continue to provide major new business opportunities, there clearly is a need for market diversification to offset the downsizing of naval ship construc- tion over the next few years.

Market Overview

The composition of work avail- able to the U.S. marine sector will dramatically change over the near future. Industry in the U.S. will focus less on naval ship construc- tion—an activity which drove much of the marine business in the 1980s.

In its place will be an increasing flow of orders for product tankers, offshore equipment, cruise ship refurbishments, small passenger vessels, megayachts, river barge con- struction, etc. Importantly, the future workbase will gradually shift from military specification to com- mercial standard construction. This will provide a wealth of diversifica- tion opportunities for manufactur- ers traditionally selling to the naval ship market. A number of these op- portunities are described below.

Cruise Ships

There are currently 95 cruise ships servicing the North American cruise trade. Market projections call for a tripling of cruise passenger travel during the coming decade.

One industry analyst recently pre- dicted that 150,000 to 200,000 new cruise ship berths will be required during the 1990s to satisfy increas- ing demand. Construction of these new ships—costing up to $320 mil- lion each—will provide a number of interesting shipbuilding contracts.

Currently, contracts are flowing to shipbuilders in Finland, Italy,

France, Germany and Japan. There is no reason why U.S. builders could not participate in this market. Ad- ditionally, U.S. builders are well- positioned for maintenance and con- version work. In IMA's recent analy- sis of this sector, it identified 16 cruise ships which appear to be re- furbishment prospects over the next five years. This refurbishment work alone represents a potential market of $800 million to $1.2 billion.

Coastal Tankers

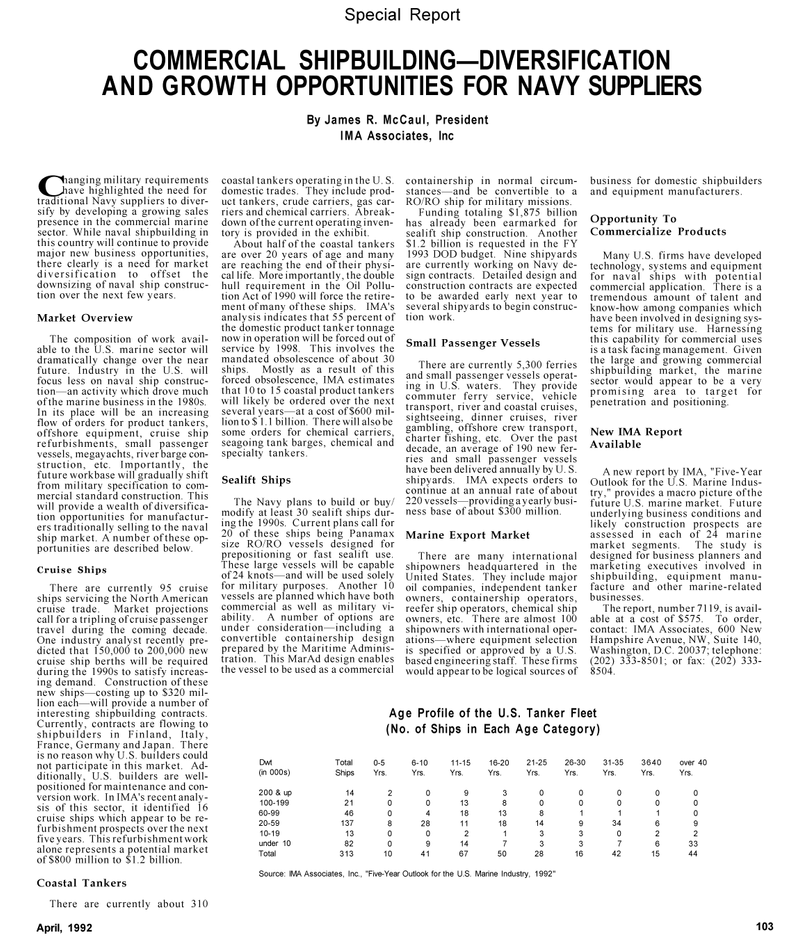

There are currently about 310 coastal tankers operating in the U. S. domestic trades. They include prod- uct tankers, crude carriers, gas car- riers and chemical carriers. Abreak- down of the current operating inven- tory is provided in the exhibit.

About half of the coastal tankers are over 20 years of age and many are reaching the end of their physi- cal life. More importantly, the double hull requirement in the Oil Pollu- tion Act of 1990 will force the retire- ment of many of these ships. IMA's analysis indicates that 55 percent of the domestic product tanker tonnage now in operation will be forced out of service by 1998. This involves the mandated obsolescence of about 30 ships. Mostly as a result of this forced obsolescence, IMA estimates that 10 to 15 coastal product tankers will likely be ordered over the next several years—at a cost of $600 mil- lion to $ 1.1 billion. There will also be some orders for chemical carriers, seagoing tank barges, chemical and specialty tankers.

Sealift Ships

The Navy plans to build or buy/ modify at least 30 sealift ships dur- ing the 1990s. Current plans call for 20 of these ships being Panamax size RO/RO vessels designed for prepositioning or fast sealift use.

These large vessels will be capable of 24 knots—and will be used solely for military purposes. Another 10 vessels are planned which have both commercial as well as military vi- ability. A number of options are under consideration—including a convertible containership design prepared by the Maritime Adminis- tration. This MarAd design enables the vessel to be used as a commercial containership in normal circum- stances—and be convertible to a

RO/RO ship for military missions.

Funding totaling $1,875 billion has already been earmarked for sealift ship construction. Another $1.2 billion is requested in the FY 1993 DOD budget. Nine shipyards are currently working on Navy de- sign contracts. Detailed design and construction contracts are expected to be awarded early next year to several shipyards to begin construc- tion work.

Small Passenger Vessels

There are currently 5,300 ferries and small passenger vessels operat- ing in U.S. waters. They provide commuter ferry service, vehicle transport, river and coastal cruises, sightseeing, dinner cruises, river gambling, offshore crew transport, charter fishing, etc. Over the past decade, an average of 190 new fer- ries and small passenger vessels have been delivered annually by U. S. shipyards. IMA expects orders to continue at an annual rate of about 220 vessels—providing a yearly busi- ness base of about $300 million.

Marine Export Market

There are many international shipowners headquartered in the

United States. They include major oil companies, independent tanker owners, containership operators, reefer ship operators, chemical ship owners, etc. There are almost 100 shipowners with international oper- ations—where equipment selection is specified or approved by a U.S. based engineering staff. These firms would appear to be logical sources of business for domestic shipbuilders and equipment manufacturers.

Opportunity To

Commercialize Products

Many U.S. firms have developed technology, systems and equipment for naval ships with potential commercial application. There is a tremendous amount of talent and know-how among companies which have been involved in designing sys- tems for military use. Harnessing this capability for commercial uses is a task facing management. Given the large and growing commercial shipbuilding market, the marine sector would appear to be a very promising area to target for penetration and positioning.

New IMA Report

Available

A new report by IMA, "Five-Year

Outlook for the U.S. Marine Indus- try," provides a macro picture of the future U.S. marine market. Future underlying business conditions and likely construction prospects are assessed in each of 24 marine market segments. The study is designed for business planners and marketing executives involved in shipbuilding, equipment manu- facture and other marine-related businesses.

The report, number 7119, is avail- able at a cost of $575. To order, contact: IMA Associates, 600 New

Hampshire Avenue, NW, Suite 140,

Washington, D.C. 20037; telephone: (202) 333-8501; or fax: (202) 333- 8504.

Age Profile of the U.S. Tanker Fleet (No. of Ships in Each Age Category)

Dwt Total 0-5 6-10 11-15 16-20 21-25 26-30 31-35 3640 over 40 (in 000s) Ships Yrs. Yrs. Yrs. Yrs. Yrs. Yrs. Yrs. Yrs. Yrs. 200 & up 14 2 0 9 3 0 0 0 0 0 100-199 21 0 0 13 8 0 0 0 0 0 60-99 46 0 4 18 13 8 1 1 1 0 20-59 137 8 28 11 18 14 9 34 6 9 10-19 13 0 0 2 1 3 3 0 2 2 under 10 82 0 9 14 7 3 3 7 6 33

Total 313 10 41 67 50 28 16 42 15 44

Source: IMA Associates, Inc., "Five-Year Outlook for the U.S. Marine Industry, 1992"

April, 1992 103

71

71

73

73