Page 30: of Maritime Reporter Magazine (May 1992)

Read this page in Pdf, Flash or Html5 edition of May 1992 Maritime Reporter Magazine

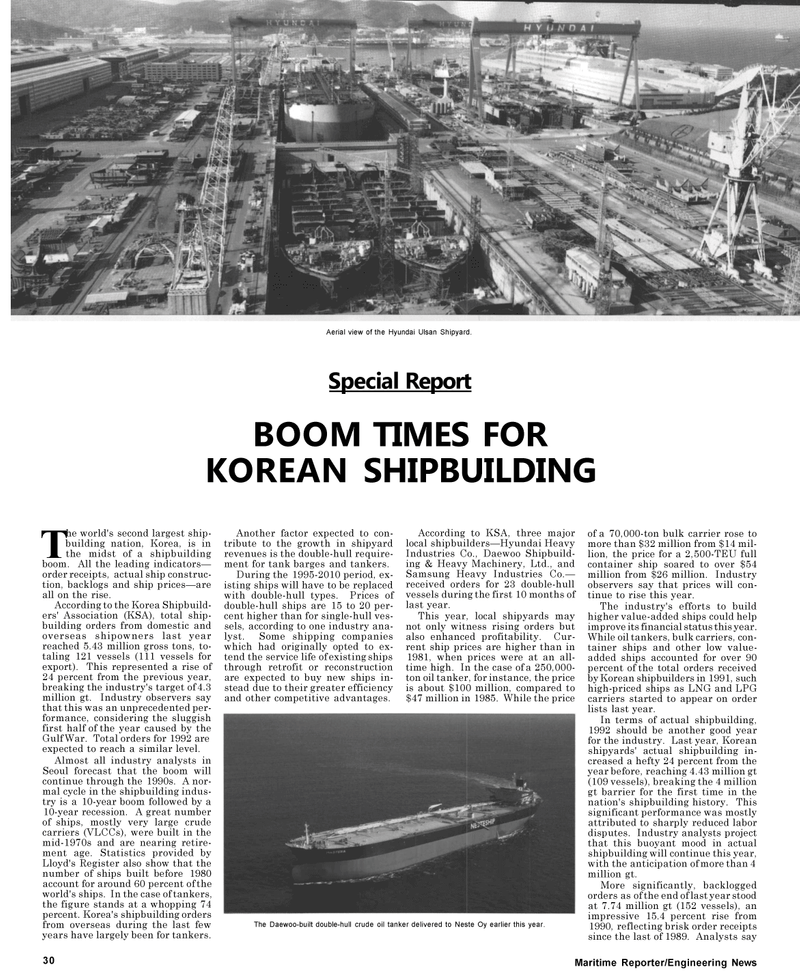

Aerial view of the Hyundai Ulsan Shipyard.

Special Report

BOOM TIMES FOR

KOREAN SHIPBUILDING

The world's second largest ship-building nation, Korea, is in the midst of a shipbuilding boom. All the leading indicators— order receipts, actual ship construc- tion, backlogs and ship prices—are all on the rise.

According to the Korea Shipbuild- ers' Association (KSA), total ship- building orders from domestic and overseas shipowners last year reached 5.43 million gross tons, to- taling 121 vessels (111 vessels for export). This represented a rise of 24 percent from the previous year, breaking the industry's target of 4.3 million gt. Industry observers say that this was an unprecedented per- formance, considering the sluggish first half of the year caused by the

Gulf War. Total orders for 1992 are expected to reach a similar level.

Almost all industry analysts in

Seoul forecast that the boom will continue through the 1990s. A nor- mal cycle in the shipbuilding indus- try is a 10-year boom followed by a 10-year recession. A great number of ships, mostly very large crude carriers (VLCCs), were built in the mid-1970s and are nearing retire- ment age. Statistics provided by

Lloyd's Register also show that the number of ships built before 1980 account for around 60 percent of the world's ships. In the case of tankers, the figure stands at a whopping 74 percent. Korea's shipbuilding orders from overseas during the last few years have largely been for tankers. 30

Another factor expected to con- tribute to the growth in shipyard revenues is the double-hull require- ment for tank barges and tankers.

During the 1995-2010 period, ex- isting ships will have to be replaced with double-hull types. Prices of double-hull ships are 15 to 20 per- cent higher than for single-hull ves- sels, according to one industry ana- lyst. Some shipping companies which had originally opted to ex- tend the service life of existing ships through retrofit or reconstruction are expected to buy new ships in- stead due to their greater efficiency and other competitive advantages.

According to KSA, three major local shipbuilders—Hyundai Heavy

Industries Co., Daewoo Shipbuild- ing & Heavy Machinery, Ltd., and

Samsung Heavy Industries Co.— received orders for 23 double-hull vessels during the first 10 months of last year.

This year, local shipyards may not only witness rising orders but also enhanced profitability. Cur- rent ship prices are higher than in 1981, when prices were at an all- time high. In the case of a 250,000- ton oil tanker, for instance, the price is about $100 million, compared to $47 million in 1985. While the price

The Daewoo-built double-hull crude oil tanker delivered to Neste Oy earlier this year. of a 70,000-ton bulk carrier rose to more than $32 million from $14 mil- lion, the price for a 2,500-TEU full container ship soared to over $54 million from $26 million. Industry observers say that prices will con- tinue to rise this year.

The industry's efforts to build higher value-added ships could help improve its financial status this year.

While oil tankers, bulk carriers, con- tainer ships and other low value- added ships accounted for over 90 percent of the total orders received by Korean shipbuilders in 1991, such high-priced ships as LNG and LPG carriers started to appear on order lists last year.

In terms of actual shipbuilding, 1992 should be another good year for the industry. Last year, Korean shipyards' actual shipbuilding in- creased a hefty 24 percent from the year before, reaching 4.43 million gt (109 vessels), breaking the 4 million gt barrier for the first time in the nation's shipbuilding history. This significant performance was mostly attributed to sharply reduced labor disputes. Industry analysts project that this buoyant mood in actual shipbuilding will continue this year, with the anticipation of more than 4 million gt.

More significantly, backlogged orders as of the end of last year stood at 7.74 million gt (152 vessels), an impressive 15.4 percent rise from 1990, reflecting brisk order receipts since the last of 1989. Analysts say

Maritime Reporter/Engineering News

29

29

31

31