Page 105: of Maritime Reporter Magazine (June 1992)

Read this page in Pdf, Flash or Html5 edition of June 1992 Maritime Reporter Magazine

U.S. SHIPBUILDING

Navy Construction Still Prime Source Of Contracts

Tanker; Cruise Ship Construction Pose New Opportunities

Despite budget cuts, most of the ship construction activity in the

United States centered around U.S.

Navy, military and government pro- grams— a market that will provide $30 billion in vessel building, re- pairing, converting and outfitting workfor Fiscal Year 1993. The Navy's shipbuilding and conversion budget totaled $7.37 billion for Fiscal Year 1991 (FY 91), $6.46 billion for FY 92 and $5.32 billion for FY 93. Fifty- two ships will be built or converted as a result of contracts from these three fiscal years.

Funding for Navy ship repair ex- ceeded was about $12 billion for the three fiscal years.

On the commercial side, the shal- low-draft vessel sector was the most active, with a number of hopper and tank barge deliveries and orders, passenger vessels—including the hot riverboat casino market—and various size workboats, including a number of towboats, tugs and crewboats. In all, accordingto MARI-

TIME REPORTER'S latest new ves- sel construction survey, 673 vessels were delivered in 1991, with orders at present for 615 more. For more details on the shallow-draft market, see the "Inland, Harbor & Coastal

Waterways" report in this issue.

Ship and boat repair activity has been rising over the last few years, mainly because of the competitive pricing available at U.S. yards, as well as the prevalence of older equip- ment in the U.S. fleet. For example,

NORSHIPCO, one of the leading ship repairers in the nation with $250 million in work annually, stemmed over 40 commercial vessels during 1991, with an excellent mix of bulk,

RO/RO, tanker and passenger ships.

NORSHIPCO also benefitted from ship activations for the Gulf War.

Southwest Marine, one of the larg- est repairers on the West Coast, completed the major conversion of the Viking Serenade for Royal Car- ibbean Cruise Lines (RCCL), worth more than $75 million.

In the shallow-draft repair mar- ket, the American Waterways Ship- yard Conference (AWSC), which rep- resents smaller and medium-sized yards around the country, reported that there were repairs performed on 22,028 power-driven vessels, 56,297 river barges and 7,629 off- shore barges in 1990.

Construction Opportunities

Although there were no major commercial oceangoing cargo-carry- ing ship contracts signed during the past 12 months, there are still a number of construction opportuni- ties in the U.S. A major driving fac- tor, not only in the U.S. but around the world, is the Oil Pollution Act of 1990 (OPA 90). Of the 313 ships in the U.S. tanker fleet, 262 are 11 years of age or older. Because OPA mandates that all tankers entering

U.S. waters must be fitted with double hulls by the year 2015, many of these ships will be phased out and either have to be replaced or retro- fitted with a midbody. Many U.S. owners are awaiting the outcome of the Coast Guard's final rules for double hulls, as well as any further developments in the wake of the coll apse of the recent OECD talks on the elimination of shipbuilding sub- sidies.

Another area of extreme interest among shipyards in the Navy's

Sealift Program. President Bush has proposed a National Sealift De- fense Fund (NSDF) which would be used to obtain further expand the

Ready Reserve Fleet (RRF) through the acquisition of used ships or, al- ternatively, charter, build and char- ter, and military-useful features in new commercial ships or a combina- tion of these programs. Initial capi- talization of the NSDF would be accomplished through the transfer of existing shipbuilding appropria- tions provided by the Congress for sealift totaling about $1.9 billion, as well as an additional $1.2 billion requested in the amended FY 1993

President's budget.

At present, design contracts have been awarded to nine shipyards, and construction contracts may be awarded as early as the spring of 1993 whether the NSDF is autho- rized or not.

U.S.-Flag Cruise Ships

Can Now Offer Gaming

Another area of major growth is

U.S.-flag cruise ship construction.

With the recent passage of the Flow- ers Banks National Marine Sanctu- ary Act, the prohibition on gambling aboard U.S.-flag cruise ships has been lifted. This will enable U.S.- flag operators to offer gaming aboard, not only for cruises with destinations, but for "cruises to no- where" as well.

Continental Coast Line Inc. of

California has already expressed in- terest inbuilding two U.S.-flag cruise ships for intra-California service.

The 2,500-passenger ships would cost $300 million to build and oper- ate between Los Angeles and San

Francisco.

McDermott Shipyard has signed a letter of intent for the construction of four 1,000-passenger 256-foot

SWATH cruise ships. The U.S.-flag ships would cost between $100 mil- lion to $200 million apiece.

In other cruise ship news, RCCL is reportedly thinking of adding more ships as a result of the completion of a $900 million expansion plan. The company is reportedly considering a 55,000-gtship. RCCL is in talks with

Newport News Shipbuilding about constructing the vessel, according to one industry source.

Matson Navigation

Boxship Launched

The only commercial oceangoing cargo-carrying ship under construc- tion in the United States, the 32,500- gross ton containership Pfeiffer was launched earlier this year at Na- tional Steel & Shipbuilding Co. (NASSCO) in San Diego for Matson

Navigation. The $129-million ship, which is designed to carry 24-foot equivalent unit (TFEU) containers, is due to be delivered this year.

The Marine Spill Response Cor- poration (MSRC), Washington, D.C., awarded $188 million in construc- tion contracts to Gulfport, Missis- sippi-based Trinity Marine Group and Bender Shipbuilding & Repair

Co., Inc., Mobile, Ala. The Trinity

Marine Group, which consist of 11 shipyards located in Louisiana, Mis- sissippi, Texas and Pennsylvania, is building 12 of the 210-foot vessels, while Bender Shipbuilding is build- ing four of the same class. Bender has already launched the first two vessels, the Gu 1 f Re sponder and ther

Louisiana Responder. The sixteen

OSRVs will be stationed around the

U.S. at various sites to provide quick response in the event of a major oil spill.

In addition, the MSRC has put out

Request For Proposals (RFPs) for the construction of sixteen 40,000- bbl tank barges, which would be used as temporary storage for recov- ered oil.

Icebreaking Research Ship

Delivered To Chouest

One of the most notable deliveries during the past 12 months was the

Nathanial B. Palmer built by North

American Shipbuilding of Larose,

La. She is the nation's first commer- cial icebreaking research vessel.

Classed according to ABS Rules for strengthening for navigation in ice, the 308-foot, 6,500-long ship, owned by Edison Chouest Offshore of

Galliano, La., will be operated for the National Science Foundation supporting Antarctic research projects.

Also noteworthy among commer- cial deliveries was the 800-bed, 625- foot floating detention facility built and delivered by Avondale Shipyards

Division, Avondale Industries for the

City of New York.

Avondale's Boat Division also de- livered three new Viking Class 2000 towboats to New Orleans-based

National Marine. The three 6,800- hp Caterpillar-powered boats, the

Cindy Celeste, Elizabeth Dewey and the Karen K., represent a new gen- eration of towboat.

Maritime Reporter's Annual New

Vessel Construction Survey follows >"

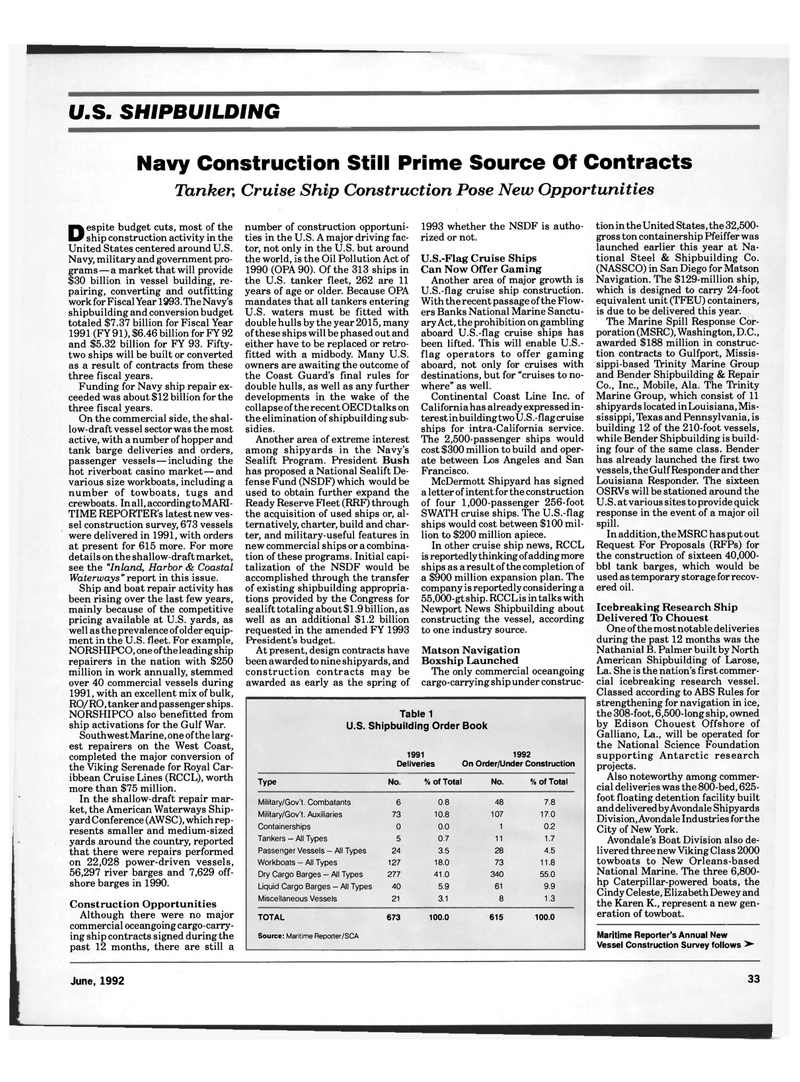

Table 1

U.S. Shipbuilding Order Book 1991 1992

Deliveries On Order/Under Construction

Type No. % of Total No. % of Total

Military/Gov't. Combatants 6 0.8 48 7.8

Military/Gov't. Auxiliaries 73 10.8 107 17.0

Containerships 0 0.0 1 0.2

Tankers - All Types 5 0.7 11 1.7

Passenger Vessels — All Types 24 3.5 28 4.5

Workboats - All Types 127 18.0 73 11.8

Dry Cargo Barges — All Types 277 41.0 340 55.0

Liquid Cargo Barges - All Types 40 5.9 61 9.9

Miscellaneous Vessels 21 3.1 8 1.3

TOTAL 673 100.0 615 100.0

Source: Maritime Reporter/SCA

June, 1992 33

104

104

106

106