Page 20: of Maritime Reporter Magazine (June 1992)

Read this page in Pdf, Flash or Html5 edition of June 1992 Maritime Reporter Magazine

Production At AESA's

Manises Engine Plant

Surpasses 1991 Levels

Spanish shipyard Astilleros

Espanoles's (AESA) engine plant of

Manises, in Valencia, is set to de- liver 10 engines totaling 194,000 hp this year, which is slightly in excess of 199 l's delivery performance level of 9 engine units of 190,640 hp.

Although AESA holds a Sulzer license, all of the 1992 deliveries are

MAN B&W two-stroke engines.

Included in the '92 engine pro- duction output are two of the largest diesels ever ordered from Manises.

Both diesels are 70,000-hp 12-cylin- der K90MC-S engines that will gen- erate 100 MW in a barge-mounted power plant to be located at

Mindanao, the Philippines.

While not on order this year,

Manises produced two Sulzer nine- cylinder RTA76 engines for

Mauritius and Lanzarote last year for stationary power applications.

Manises has an overall produc- tion capacity of300,000 hp per year, with this year's engine output ex- pected to make 1992 the second con- secutive year of growth since comple- tions fell from 220,200 hp (17 en- gines) in 1989 to 173,800 hp (10 units) the following year.

Next year will see the continued reorganization and robotisation of welding lines, according to Manises.

Nassco Optimistic

Regarding Future

Commercial Work

San Diego-based National Steel and Shipbuilding Company (NASSCO) continues to be the only

United States shipyard to have re- ceived a commercial order for a deepsea merchant vessel since 1984.

The R. J. Pfeiffer, a containership ordered by Matson Navigation, San

Francisco, is the last commercial vessel on order from Nassco. The $129 million vessel, named after

Matson's chairman, is currently con- ducting sea trials and will be deliv- ered in June.

The containership was ordered by Matson to satisfy the Jones Act requirements for its service between the U.S. West Coast and Hawaii, which left the company with no other choice than to order the new ship from a U.S. shipyard.

Nassco also built the Exxon Medi- terranean (ex-Exxon Valdez) and its sistership the Exxon Long Beach, which along with three Sea-Land containerships delivered by Bay

Shipbuilding, of Wisconsin, in 1987, were the last vessels built in U.S. shipyards with government aid.

Being one of only two U.S. ship- yards having recent commercial shipbuilding experience, Nassco be- lieves it will be at an advantage when it comes to securing future work.

A strong Navy orderbook helped

Nassco to fill the gap after the deliv- 22 ery of the Exxon Long Beach in 1987.

Today the yard is building three replenishment tankers for the Navy, with another on order and negotia- tions underway for an additional vessel.

As well as the assistance that the

Jones Act has provided the yard,

Nassco is also looking towards the

Oil Pollution Act of 1990 (OPA90) for help in winning future commer- cial orders.

With the International Maritime

Organization's (IMO) decision to support double-hull tanker construc- tion, OPA90 is having a significant influence on world shipbuilding.

A design for a 40,000-dwt double- hull product tanker is being mar- keted by Nassco to win some of the new tanker construction business.

According to Nassco, because the design is intended for serious pro- duction it would incorporate cost- saving features.

The shipyard's president, Rich- ard Vortmann, was quoted recently as predicting that 20 to 25 new tank- ers would be ordered from U.S. ship- yards between now and 1997.

Once European Community sub- sidies are eliminated, Nassco will be able to compete equally with north- ern European shipyards, according to Mr. Vortmann.

For free literature about the ship- yard facilities and'services offered by Nassco,

Circle 75 on Reader Service Card

Maritime Reporter/Engineering News

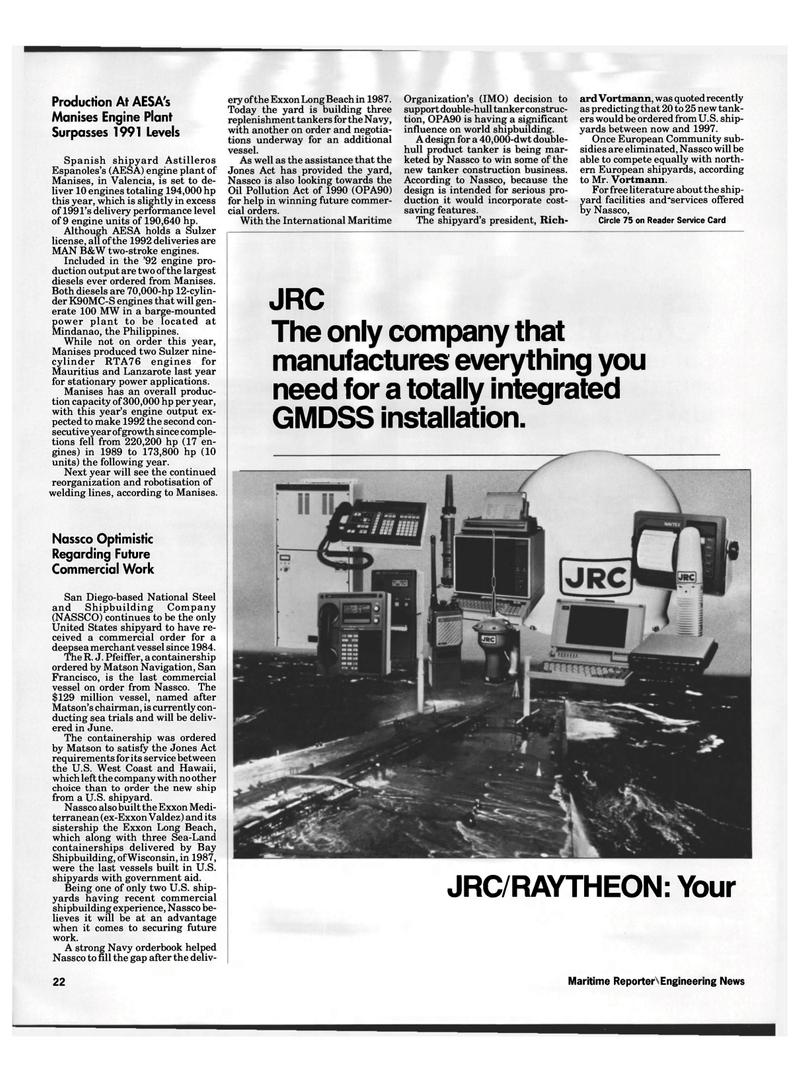

JRC

The only company that manufactures everything you need for a totally integrated

GMDSS installation.

JRC/RAYTHEON: Your

19

19

21

21