Page 36: of Maritime Reporter Magazine (June 1992)

Read this page in Pdf, Flash or Html5 edition of June 1992 Maritime Reporter Magazine

CANADIAN SHIPBUILDING

Poised For A Rebound

J.Y. Clarke, President

Canadian Maritime Industries Association

J.Y. Clarke

Toward the end of 1991, some sec-tors of Canadian industry were noting that the recessionary slump had bottomed-out, and that their respective outlooks were positive, indicating a turn-around. The Ca- nadian shipbuilding industry can- not say the same thing—not yet.

Indeed, 1991 could be considered, on balance, to be a repeat of 1990.

The Canadian order book, vessels over 100 gross tons under construc- tion or on order, totaled some 61,800 gt, down from 64,300 gt a year ear- lier, for a reduction of 3.9 percent.

On the other hand, new orders dur- ing 1991 comprised small vessels totaling 7,400 gt an increase of 11.5 percent. Eight vessels totaling 9,905 gt were delivered during the year, representing an increase of 128 per- cent over 1990.

In round figures, however, 52,000 gt of the'91 order book total of 61,800 gt are to the account of the Canadian

Government. A commercial order book share of 16 percent, an increase over 8 percent a year earlier, is en- couraging as it indicates a doubling of commercial content in the order book. If this fact is the start of a trend which grows in the next few years, then we will be able to say that the decline in new construction of ships in Canada has bottomed- out and is heading for recovery.

Repairs and conversions in Cana- dian shipyards totaled $263.1 mil- lion in value, which is a 13.6 percent increase during 1991. It is a miscon- ception that the vast majority of this is due to the update and moderniza- tion of the Canadian Navy's Tribal

Class destroyers. However, this view does not take into account the grow- ing maintenance and refit activity of cruise liners on the West Coast, of the extensive tug-and-barge fleets, and the fishery and ferry mainte- nance programs on both coasts.

The total value of shipyard pro- duction during '91, at $C1.13 bil- lion, is the highest its been for the last four years. Employment in

CMIA member shipyards averaged 8,969 during the year and stood at some 9,047 at year's end, slightly above 1990.

CMIA also noted a reduction in the importation of foreign vessels into Canada from previous years due, perhaps, to the economic state of fleet owners. Also, on a more posi- tive note, Canada's labor costs in the manufacturing sector have dropped to 11 th place among the "free world's" top 20 countries. It is at least pos- sible that in the next few years, a resurgence — not massive, but clearly noticeable—will character- ize Canadian shipyard activity.

Finally, it is interesting to note that the Canadian trade balance on ship parts, i.e.—equipment and components, remains strong with exports minus imports being over $C61 million. This bodes well for the future health of many of our marine suppliers.

CMIA's review of future prospects starts with government needs. Last

September, Defense Minister Masse announced that four of six planned security and sovereignty enforce- ment vessels (corvettes), as well as three of six planned conventional submarines would be acquired within the next 15 years. CMIA has recommended, in strong terms, that these projects be initiated immedi- ately and all 12 vessels be contracted to Canadian shipyards in an appro- priately phased program.

Another major prospect relates to

Canadian-owned commercial fleets.

These fleets are comprised, for the most part, of old vessels requiring replacement sooner rather than later.

Future requirements for tankers with double bottoms, double hulls or an alternative horizontal deck ar- rangement will probably appear on the scene in the not-too-distant fu- ture. These needs could involve ret- rofitting of some existing vessels, as well as new construction. Again, fi- nancing will be a problem. In this regard, CMIA agrees that in addi- tion to the financing, funds for this important purpose should be pro- vided by increasing the levy of the

Ship-Source Oil Pollution Fund.

Also, one would assume that some funding could be made available from Canada's multibillion dollar

Green Plan.

Finally, CMIA believes that refit, repair and conversion activity will remain strong in Canadian ship- yards. Indeed, with marine trans- portation continuing to grow on a global basis, it seems logical that vessel maintenance demands will also increase. As Canadian yards are reasonably competitive in this sector, gradual increases of refit and repair orders should occur.

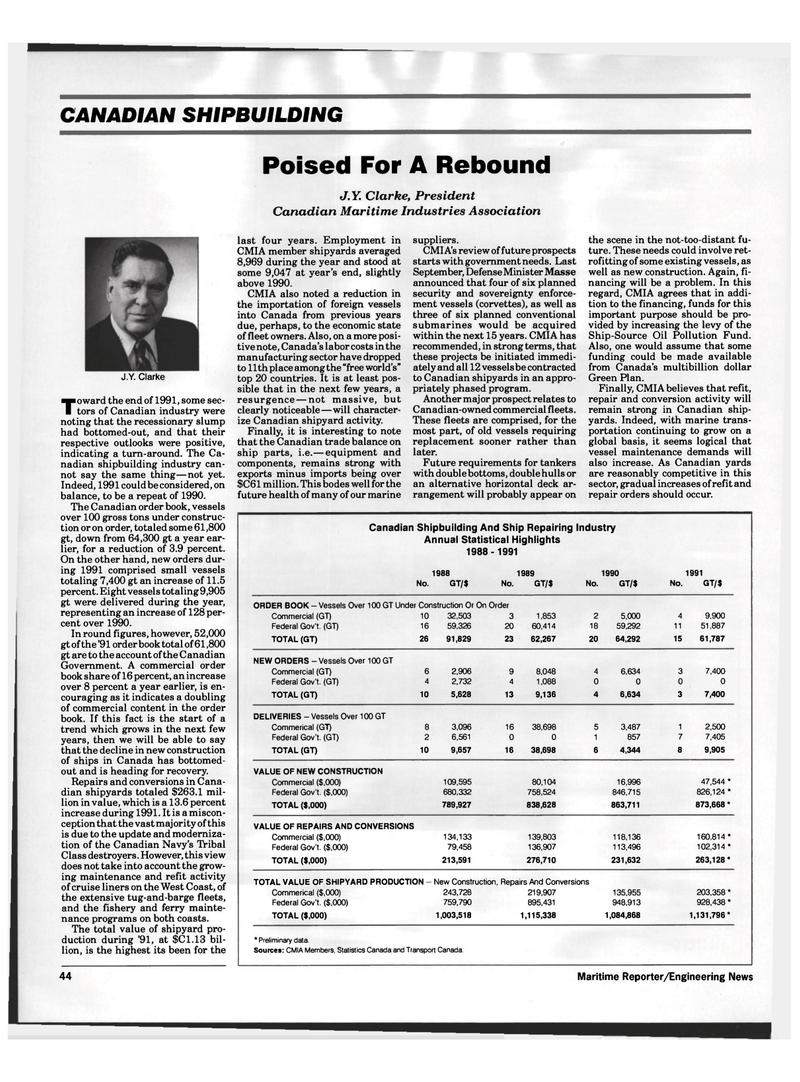

Canadian Shipbuilding And Ship Repairing Industry

Annual Statistical Highlights 1988- 1991 1988 1989 1990 1991

No. GT/$ No. GT/$ No. GT/$ No. GT/$

ORDER BOOK - Vessels Over 100 GT Under Construction Or On Order

Commercial (GT) 10 32,503 3 1,853 2 5,000 4 9,900

Federal Gov't. (GT) 16 59,326 20 60,414 18 59,292 11 51,887

TOTAL (GT) 26 91,829 23 62,267 20 64,292 15 61,787

NEW ORDERS - Vessels Over 100 GT

Commercial (GT) 6 2,906 9 8,048 4 6,634 3 7,400

Federal Gov't. (GT) 4 2,732 4 1,088 0 0 0 0

TOTAL (GT) 10 5,628 13 9,136 4 6,634 3 7,400

DELIVERIES - Vessels Over 100 GT

Commerical (GT) 8 3,096 16 38,698 5 3,487 1 2,500

Federal Gov't. (GT) 2 6,561 0 0 1 857 7 7,405

TOTAL (GT) 10 9,657 16 38,698 6 4,344 8 9,905

VALUE OF NEW CONSTRUCTION

Commercial ($,000) 109,595 80,104 16,996 47,544 *

Federal Gov't. ($,000) 680,332 758,524 846,715 826,124*

TOTAL ($,000) 789,927 838,628 863,711 873,668 *

VALUE OF REPAIRS AND CONVERSIONS

Commercial ($,000) 134,133 139,803 118,136 160,814*

Federal Gov't. ($,000) 79,458 136,907 113,496 102,314*

TOTAL ($,000) 213,591 276,710 231,632 263,128*

TOTAL VALUE OF SHIPYARD PRODUCTION

Commerical ($,000)

Federal Gov't. ($,000)

TOTAL ($,000)

New Construction, Repairs And Conversions 243,728 219,907 759,790 895,431 1,003,518 1,115,338 135,955 948,913 1,084,868 203,358 * 928,438 * 1,131,796* * Preliminary data.

Sources: CMIA Members, Statistics Canada and Transport Canada. 44 Maritime Reporter/Engineering News

35

35

37

37