Page 82: of Maritime Reporter Magazine (June 1992)

Read this page in Pdf, Flash or Html5 edition of June 1992 Maritime Reporter Magazine

percent per annum;

Operating cost (60 percent) will increase at 5 percent per annum;

Current time charter earnings range from $15-$27 PDWT month with weighted average of $18.64 in 1991.

On this basis we can establish just how much new capital is re- quired fro this fleet to be replaced.

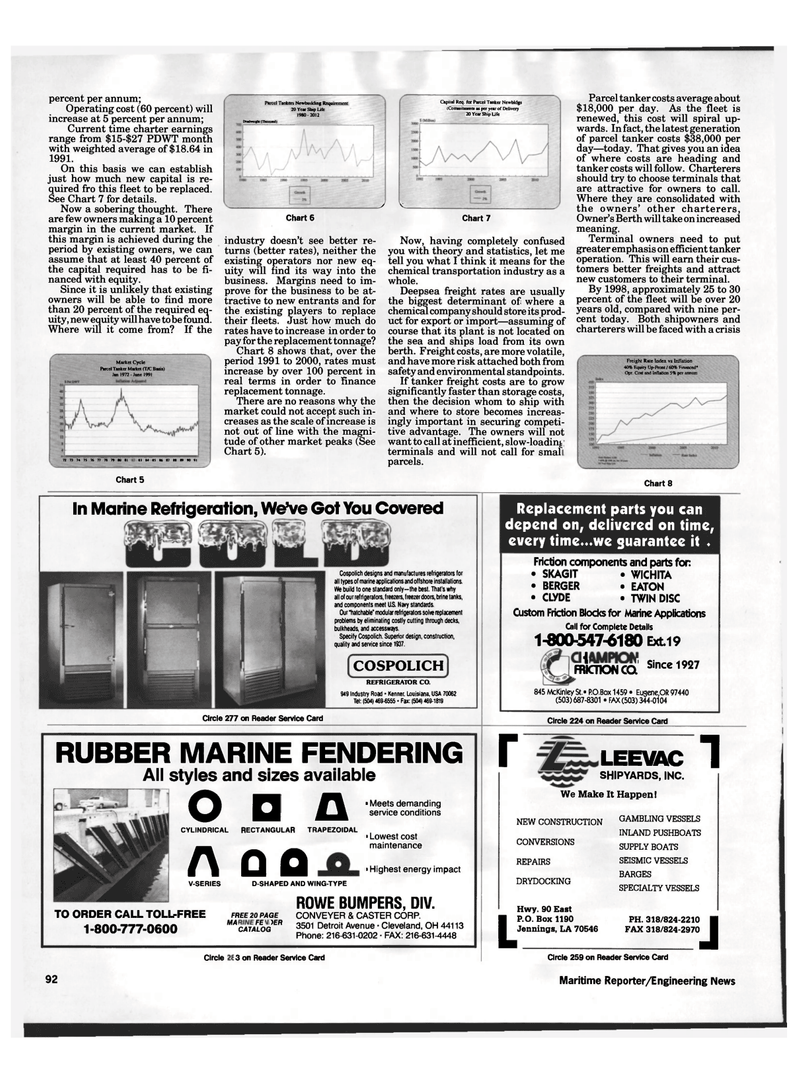

See Chart 7 for details.

Now a sobering thought. There are few owners making a 10 percent margin in the current market. If this margin is achieved during the period by existing owners, we can assume that at least 40 percent of the capital required has to be fi- nanced with equity.

Since it is unlikely that existing owners will be able to find more than 20 percent of the required eq- uity, new equity will have to be found.

Where will it come from? If the

Market Cycle

Parcel Tanker Market (T/C Basis)

Jan 1972-June 1991

Parcel Tankers Newbuilding Requirement 20 Year Ship Life 1980 - 2012 l^idweighl fn»ui3nd|

Capital Req. for Parcel Tanker Newbldgs (Commitments as per year of Delivery 20 Year Ship Ufe 72 73 74 7S 76 77 71 79 10 II II 84 IS 86 S7 81 S9 TO 71

Chart 6 industry doesn't see better re- turns (better rates), neither the existing operators nor new eq- uity will find its way into the business. Margins need to im- prove for the business to be at- tractive to new entrants and for the existing players to replace their fleets. Just how much do rates have to increase in order to pay for the replacement tonnage?

Chart 8 shows that, over the period 1991 to 2000, rates must increase by over 100 percent in real terms in order to finance replacement tonnage.

There are no reasons why the market could not accept such in- creases as the scale of increase is not out of line with the magni- tude of other market peaks (See

Chart 5). y v

Chart 7

Now, having completely confused you with theory and statistics, let me tell you what I think it means for the chemical transportation industry as a whole.

Deepsea freight rates are usually the biggest determinant of where a chemical company should store its prod- uct for export or import—assuming of course that its plant is not located on the sea and ships load from its own berth. Freight costs, are more volatile, and have more risk attached both from safety and environmental standpoints.

If tanker freight costs are to grow significantly faster than storage costs, then the decision whom to ship with and where to store becomes increas- ingly important in securing competi- tive advantage. The owners will not want to call at inefficient, slow-loading terminals and will not call for smal parcels.

Parcel tanker costs average about $18,000 per day. As the fleet is renewed, this cost will spiral up- wards. In fact, the latest generation of parcel tanker costs $38,000 per day—today. That gives you an idea of where costs are heading and tanker costs will follow. Charterers should try to choose terminals that are attractive for owners to call.

Where they are consolidated with the owners' other charterers,

Owner's Berth will take on increased meaning.

Terminal owners need to put greater emphasis on efficient tanker operation. This will earn their cus- tomers better freights and attract new customers to their terminal.

By 1998, approximately 25 to 30 percent of the fleet will be over 20 years old, compared with nine per- cent today. Both shipowners and charterers will be faced with a crisis

Freight Rate Index vs Inflation 40% Equity Up-Front / 60% Financed*

Opr. Cost and Inflation 5% per annum

Chart 5 Chart 8

Circle 277 on Reader Service Card

Replacement parts you can depend on, delivered on time, every time««.we guarantee it *

Friction components and parts for: • SKAGIT • WICHITA • BERGER • EATON • CLYDE • TWIN DISC

Custom Friction Blocks for Marine Applications

Call for Complete Details 1-800-547-6180 Ext 19 fficnoNca Since1927 845 McKinley St.« P.O.Box 1459 • Eusene,OR 97440 (503)687-8301 • FAX (503) 344-0104

Circle 224 on Reader Service Card

RUBBER MARINE FENDERING

All styles and sizes available o • n • Meets demanding service conditions

CYLINDRICAL RECTANGULAR TRAPEZOIDAL

A DD • Lowest cost maintenance > Highest energy impact

V-SERIES D-SHAPED AND WING-TYPE

TO ORDER CALL TOLL-FREE 1-800-777-0600

R0WE BUMPERS, DIV.

FREE 20 PAGE CONVEYER & CASTER CORP.

MACATALOG ER 3501 Detroit Avenue • Cleveland, OH 44113

Phone: 216-631-0202 • FAX: 216-631-4448 r LEEVAC

SHIPYARDS, INC.

We Make It Happen! 1

NEW CONSTRUCTION

CONVERSIONS

REPAIRS

DRYDOCKING

GAMBLING VESSELS

INLAND PUSHBOATS

SUPPLY BOATS

SEISMIC VESSELS

BARGES

SPECIALTY VESSELS t

Hwy. 90 East

P.O. Box 1190

Jennings, LA 70546

PH. 318/824-2210

FAX 318/824-2970 J

Circle 349 on Reader Service Card 92

Circle 259 on Reader Service Card

Maritime Reporter/Engineering News

COSPOLICH

In Marine Refrigeration, WeVe Got You Covered

Cospolich designs and manufactures refrigerators for all types of marine applications and offshore installations.

We build to one standard only—the best. That's why all of our refrigerators, freezers, freezer doors, brine tanks, and components meet US. Navy standards.

Our "hatchable" modular refrigerators solve replacement problems by eliminating costly cutting through decks, bulkheads, and accessways.

Specify Cospolich. Superior design, construction, quality and service since 1937.

REFRIGERATOR CO. 949 Industry Road • Kenner, Louisiana, USA 70062

Tel: (504) 469-6555 • Fax: (504) 469-1819

81

81

83

83