Page 27: of Maritime Reporter Magazine (September 1992)

Read this page in Pdf, Flash or Html5 edition of September 1992 Maritime Reporter Magazine

Government-controlled Bazan also has repair and conversion ca- pacity. For medium-size ships, the firm has a Syncrolift at its disposal at its facility in Cartagena.

There is a high level of ship re- pair activity at the Union Naval de

Levante Barcelona shipyard.

Largest FSU

Under Construction

The Spanish shipbuilding indus- try is also active in the offshore sector. Astano, which belongs to the

Astilleros Espanoles Group, is fin- ishing the Production Testing and

Storage Unit PTS-850-C for deliv- ery to the Norwegian companies

Ocean Production and Smedvig.

This unit will be the biggest of its type with a storage capacity of86,500 cubic meters.

At the same time Astano has been contracted for the building of a Float- ing Storage Unit (FSU) by Chevron.

The unit will be almost 250 meters long and have a capacity of the equivalent of 850,000 barrels of oil.

This unit, now under construction, will be equipped to function under adverse seas and low temperatures through the use of a dynamic posi- tioning system.

Spanish Diesel

Manufacturers

Within the subsector of major suppliers of ship equipment, the

Spanish shipbuilding industry is a remarkable force in the building of propulsion and auxiliary engines, enjoying a notable range of slow-, medium- and high-speed engines.

In the range of slow-speed diesel engines, Astilleros Espanoles

Factoria de Manises, located in

Valencia, is dedicated to the manu- facture of two-stroke diesel engines for ships, as well as for electrical power plants, producing a complete top range of AESA-Sulzer and

AESA-Man B&W models. The

Manises factory's annual capacity on the test bench is 400,000 bhp.

Manises is the only producer in

Spain of two-stroke diesel engines and one of the most important in

Europe.

There are three producers of me- dium- and high-speed four-stroke engines, with greater than 500 bhp.

They are Bazan-Cartagena,

Echevarria-Wartsila, and Guascor.

The modern facilities of Bazan-

Cartagena specialize in the manu- facture of medium- and high-speed diesel engines, the medium-speed range being Bazan-MAN B&W en- gines and the high-speed range

Bazan-MTU. Bazan-Cartagena is one of the many parts of the govern- ment-run Bazan shipbuilding com- pany.

Echevarria-Wartsila, a privately held company, is principally involved in the assembly of parts coming from Wartsila. Within the wide spectrum of four-stroke engines, the company covers the market range for high power engines.

Finally, Guascor, also privately held, must be mentioned not only for its lead in the number of engines produced in 1991, but also for being the only one of the three enterprises that entirely produces its own en- gines using its own design and tech- nology. It produces engines rang- ing in power from less than 200 bhp to a maximum of 1,350 bhp.

Since 1984, Guascor has had a technology transfer agreement with the American company WED (Waukesha Engine Division) of the

Dresser Group. This license agree- ment allows for the transfer of tech- nology permitting the manufacture and distribution of Guascor's Series

F diesel engines in the United States.

The remaining suppliers, apart from steel, which is mainly pro- duced and supplied by Ensidesa, are spread over a wide range of activities. Whether they are doing business with their own patents or acting under license, this sector is experiencing an acute crisis as it tries to adapt itself to the present demand and the opening to direct competition of the new European market.

As previously pointed out, the

Spanish economy as well as its in-

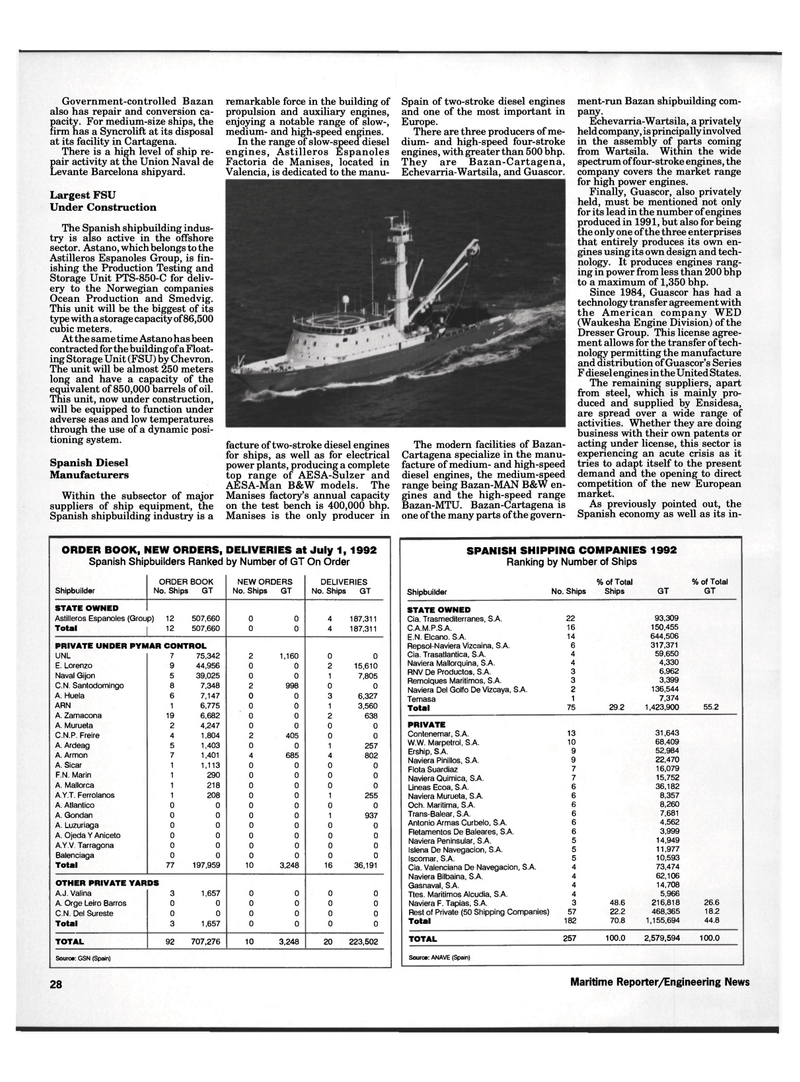

ORDER BOOK, NEW ORDERS, DELIVERIES at July 1, 1992

Spanish Shipbuilders Ranked by Number of GT On Order

ORDER BOOK NEW ORDERS DELIVERIES

Shipbuilder No. Ships GT No. Ships GT No. Ships GT

STATE OWNED

Astilleros Espanoles (Group) 12 507,660 0 0 4 187,311

Total 12 507,660 0 0 4 187,311

PRIVATE UNDER PYMAR CONTROL

UNL 7 75,342 2 1,160 0 0

E. Lorenzo 9 44,956 0 0 2 15,610

Naval Gijon 5 39,025 0 0 1 7,805

C.N. Santodomingo 8 7,348 2 998 0 0

A. Huela 6 7,147 0 0 3 6,327

ARN 1 6,775 0 0 1 3,560

A. Zamacona 19 6,682 0 0 2 638

A. Murueta 2 4,247 0 0 0 0

C.N.P. Freire 4 1,804 2 405 0 0

A. Ardeag 5 1,403 0 0 1 257

A. Armon 7 1,401 4 685 4 802

A. Sicar 1 1,113 0 0 0 0

F.N. Marin 1 290 0 0 0 0

A. Mallorca 1 218 0 0 0 0

A.Y.T. Ferrolanos 1 208 0 0 1 255

A. Atlantico 0 0 0 0 0 0

A. Gondan 0 0 0 0 1 937

A. Luzuriaga 0 0 0 0 0 0

A. Ojeda Y Aniceto 0 0 0 0 0 0

A.Y.V. Tarragona 0 0 0 0 0 0

Balenciaga 0 0 0 0 0 0

Total 77 197,959 10 3,248 16 36,191

OTHER PRIVATE YARDS

A.J. Valina 3 1,657 0 0 0 0

A. Orge Leiro Barros 0 0 0 0 0 0

C.N. Del Sureste 0 0 0 0 0 0

Total 3 1,657 0 0 0 0

TOTAL 92 707,276 10 3,248 20 223,502

Source: GSN (Spain)

SPANISH SHIPPING COMPANIES 1992

Ranking by Number of Ships % of Total % of Total

Shipbuilder No. Ships Ships GT GT

STATE OWNED

Cia. Trasmediterranes, S.A. 22 93,309

C.A.M.P.S.A. 16 150,455

E.N. Elcano. S.A. 14 644,506

Repsol-Naviera Vizcaina, S.A. 6 317,371

Cia. Trasatlantica, S.A. 4 59,650

Naviera Mallorquina, S.A. 4 4,330

RNV De Productos, S.A. 3 6,962

Remolques Maritimos, S.A. 3 3,399

Naviera Del Golfo De Vizcaya, S.A. 2 136,544

Temasa 1 7,374

Total 75 29.2 1,423,900 55.2

PRIVATE

Contenemar, S.A. 13 31,643

W.W. Marpetrol, S.A. 10 68,409

Ership, S.A. 9 52,984

Naviera Pinillos, S.A. 9 22,470

Flota Suardiaz 7 16,079

Naviera Quimica, S.A. 7 15,752

Lineas Ecoa, S.A. 6 36,182

Naviera Murueta, S.A. 6 8,357

Och. Maritima, S.A. 6 8,260

Trans-Balear, S.A. 6 7,681

Antonio Armas Curbelo, S.A. 6 4,562

Fletamentos De Baleares, S.A. 6 3,999

Naviera Peninsular, S.A. 5 14,949

Islena De Navegacion, S.A. 5 11,977

Iscomar, S.A. 5 10,593

Cia. Valenciana De Navegacion, S.A. 4 73,474

Naviera Bilbaina, S.A. 4 62,106

Gasnaval, S.A. 4 14,708

Ttes. Maritimos Alcudia, S.A. 4 5,966

Naviera F. Tapias, S.A. 3 48.6 216,818 26.6

Rest of Private (50 Shipping Companies) 57 22.2 468,365 18.2

Total 182 70.8 1,155,694 44.8

TOTAL 257 100.0 2,579,594 100.0

Source: ANAVE (Spain) 28 Maritime Reporter/Engineering News

26

26

28

28