Page 34: of Maritime Reporter Magazine (December 1992)

Read this page in Pdf, Flash or Html5 edition of December 1992 Maritime Reporter Magazine

Marine Pollution And Safer Ships

Implications For The Tanker Industry

Despite a marked improvement in the overall safe handling of oil shipped by sea, major spills are still occurring. The cost of such inci- dents to oil companies and the ship- ping industry has been immense, not only in cash terms but also re- garding legislative regulation and consequential cost.

With rising ship casualties, the period 1990-92 has seen consider- able change inmaritime regulations relating to maritime safety and pol- lution. The upheaval truly began on

August 18, 1990, when President

George Bush signed the 1990 U.S.

Oil Pollution Act (OPA). Within nine months came the establishment of the first international framework for the introduction of double hulls on all new tankers and the gradual phasing-out of single hulls on exist- ing vessels. The changes, adopted at a session of the Marine Environ- ment Protection Committee in

March 1992, also added two extra regulations (13F and 13G) to the

MARPOL 73/78 document.

In order to achieve an improve- ment in tanker safety and marine pollution, it is vital that substan- dard tonnage is deleted from the world fleet quickly, that the existing fleet is made safe and that new- buildings are built to a very high specification. The IMO is placing a great deal of emphasis on making inspection procedures more rigor- ous in order to weed out poor ton- nage before it reaches compulsory retirement age. However, there are a number of serious flaws in the way inspections are currently carried out and certificates issued which sug- gest that at present a wholesale pruning of the tanker fleet is un- likely: • The present high number of clas- sification societies and the harshly competitive environment in which they operate is likely to ensure that the high proportion of substandard tonnage which is undoubtedly oper- ating is likely to receive certifica- tion from one society or another. • There are at present too many surveys and inspections, many of which duplicate each other. • There is a widespread feeling today that the historical confidence that classification societies will cer- tify only safe and seaworthy vessels is no longer universally accepted.

Whether substandard tankers are weeded out or not, the major prob- lem of crewing standards still re- mains largely untouched. As many as 90 percent of all marine disasters may be attributable to human error of one kind or another, yet this sub- ject continues to receive precious little attention. So bad is the prob- lem that a growing body of experts is claiming that working practices aboard vessels are becoming as sub- standard as the aging world tanker fleet. Only when all shipowners take, or are forced to take, the responsi- bility to ensure that their vessels are manned by a properly qualified crew will the situation improve.

Ship Design

The issue of which design offers the best protection in the event of an accident—the conventional narrow- span double hull or the Mitsubishi- sponsored "Double Sides, Mid-

Deck"— remains unresolved. The lack of non-contentious data makes for differing interpretations of test results. In a situation where neither design would appear to do both, is it better to have a system that pro- duces zero pollution for a large num- ber of small incidents or one that may produce a little pollution in the majority of incidents but is likely to prove more effective in the "Valdez"- type scenario which captures world media attention and focuses great attention on the tanker industry?

This basic problem is exacerbated by political and economic factors, most notably recent Japanese-U.S. economic squabbles. Nonetheless, it seemed harsh, to say the least, not to grant the Japanese-based mid-deck design equivalency under OPA '90 given the results of tests carried out in both Japan and the United States.

Fleet Development

Regardless of environmental leg- islation, the aging nature of the tanker fleet will dictate a major re- placement program towards the turn of the century. The likely extent to which this natural replacement pro- gram will be accelerated by increas- ingly stringent environmental leg- islation can be split into two distinct scenarios: (a) Main Case: Given the current flaws in inspection procedures, it seems unlikely that the natural re- placement program will be speeded up by the IMO's rulings. Unless ves- sels are prematurely retired by the classification societies, existing ves- sels can trade until a minimum of twenty-five years of age, above the average life expectancy of a tanker.

In fact, recent IMO legislation could have the opposite effect to that in- tended. Rather than ridding the world fleet of substandard tonnage, the decision to allow vessels to trade until they are 25 or 30 years of age could encourage owners of old, poorly maintained tonnage to "patch up" their vessels. (b) Lower Case: The lower case situation hypothesizes that a far more rigorous inspection program comes into being. Were such a sys- tem to emerge, the environmental legislators could have a significant effect on the development of the world tanker fleet in years to come, given reports of the level of inad- equate tonnage still presently trad- ing. BP, for instance, stated in March 1992 that it regarded 40 percent of the current VLCC fleet as unaccept- able for charter. Taking such a pro- portion out of the world fleet would have significant ramifications.

The true position is likely to be somewhere in the middle of the spec- trum. While it is unlikely that changes will occur overnight, it is possible that there will be a progres- sive schedule whereby tonnage is barred with increasing severity from the world tanker market as it gradu- ally becomes harder to obtain certi- fication.

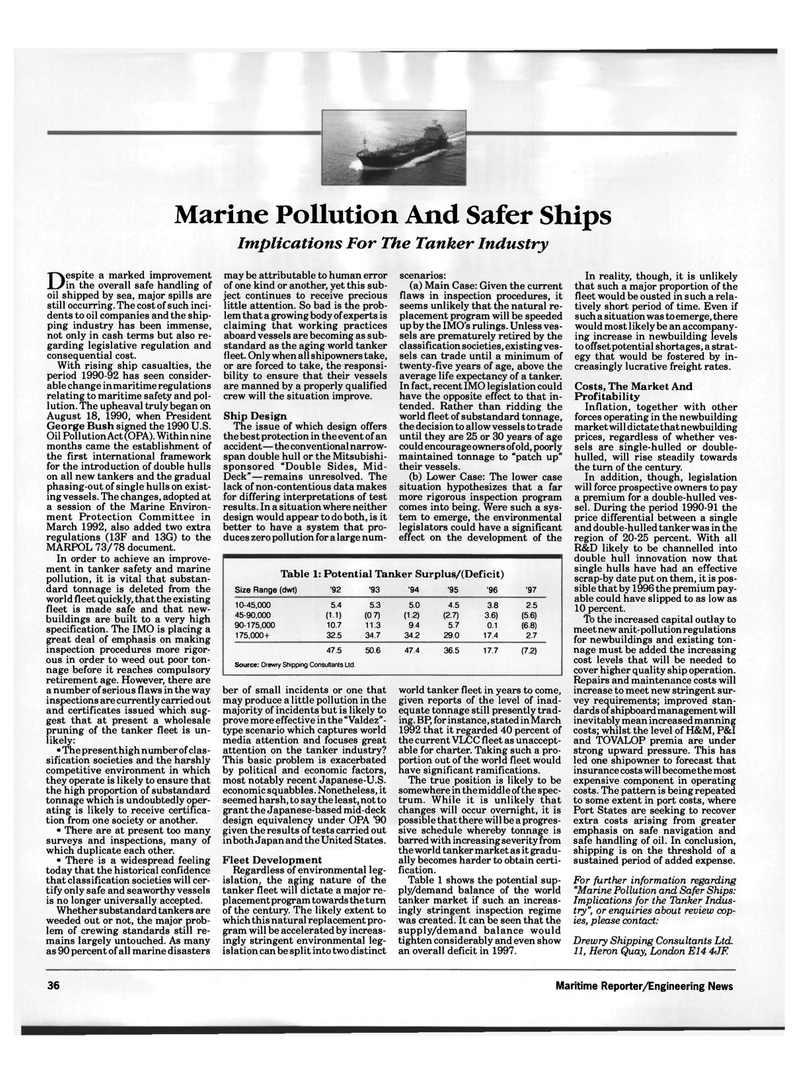

Table 1 shows the potential sup- ply/demand balance of the world tanker market if such an increas- ingly stringent inspection regime was created. It can be seen that the supply/demand balance would tighten considerably and even show an overall deficit in 1997.

In reality, though, it is unlikely that such a major proportion of the fleet would be ousted in such a rela- tively short period of time. Even if such a situation was to emerge, there would most likely be an accompany- ing increase in newbuilding levels to offset potential shortages, a strat- egy that would be fostered by in- creasingly lucrative freight rates.

Costs, The Market And

Profitability

Inflation, together with other forces operating in the newbuilding market will dictate that newbuilding prices, regardless of whether ves- sels are single-hulled or double- hulled, will rise steadily towards the turn of the century.

In addition, though, legislation will force prospective owners to pay a premium for a double-hulled ves- sel. During the period 1990-91 the price differential between a single and double-hulled tanker was in the region of 20-25 percent. With all

R&D likely to be channelled into double hull innovation now that single hulls have had an effective scrap-by date put on them, it is pos- sible that by 1996 the premium pay- able could have slipped to as low as 10_percent.

To the increased capital outlay to meetnew anit-pollutionregulations for newbuildings and existing ton- nage must be added the increasing cost levels that will be needed to cover higher quality ship operation.

Repairs and maintenance costs will increase to meet new stringent sur- vey requirements; improved stan- dards of shipboard management will inevitably mean increased manning costs; whilst the level of H&M, P&I and TOVALOP premia are under strong upward pressure. This has led one shipowner to forecast that insurance costs will become the most expensive component in operating costs. The pattern is being repeated to some extent in port costs, where

Port States are seeking to recover extra costs arising from greater emphasis on safe navigation and safe handling of oil. In conclusion, shipping is on the threshold of a sustained period of added expense.

For farther information regarding "Marine Pollution and Safer Ships:

Implications for the Tanker Indus- try", or enquiries about review cop- ies, please contact:

Drewry Shipping Consultants Ltd. 11, Heron Quay, London E14 4JF.

Table 1: Potential Tanker Surplus/fDeficit)

Size Range (dwt) '92 '93 '94 '95 '96 '97 10-45,000 5.4 5.3 5.0 4.5 3.8 2.5 45-90,000 (1.1) (07) (1.2) (2.7) 3.6) (5.6) 90-175,000 10.7 11.3 9.4 5.7 0.1 (6.8) 175,000+ 32.5 34.7 34.2 29.0 17.4 2.7 47.5 50.6 47.4 36.5 17.7 (7.2)

Source: Drewry Shipping Consultants Ltd. 36 Maritime Reporter/Engineering News

33

33

35

35