Page 14: of Maritime Reporter Magazine (March 1993)

Read this page in Pdf, Flash or Html5 edition of March 1993 Maritime Reporter Magazine

By

James R. McCaul, president, IMA Associates, Inc. I

MA has just completed a de- tailed analysis of the impact of fleet downsizing on the

U.S. ship repair business.

The 200+ page report exam- examines the size and composition of the future fleet, projects demand and supply of available ship mainte- nance capacity, examines downsizing and closure options, and proposes a strategy for rationaliz- ing the ship repair industry. This article highlights some of the report's findings and conclusions.

KEY ISSUES

Defense planners are faced with the difficult task of downsizing and/ or closing Navy ship repair facili- ties. This issue is highly politicized.

The local shipyard which employs several thousand workers generates lots of political support, and Con- gress can be expected to play a ma- jor role in shaping closure and downsizing decisions. However, if not properly handled, the entire in- dustrial base available for ship re- pair could be irrevocably damaged by a badly designed downsizing strategy. Failure to take proper action can result in significantly higher costs to maintain the Navy fleet. Even more important, a poorly designed strategy which attempts to ration work, rather than close facilities, could irrevocably damage the entire industrial base.

Among the key questions which need to be addressed by policymakers are: 1) As submarine and surface ship repair work available to shipyards shrinks over the next 10 years, should the available work be chan- neled to an increasingly smaller number of repair yards in order to maintain a critical mass of activity in each remaining yard? 2) Would a government policy to distribute the increasingly smaller volume of work to all existing yards result in increased cost of naval ship repair and cause a long term decline in industry capability? 3) Since the major commercial yards build and repair both naval and commercial ships, while public yards are limited to naval ship re- pair only, would channeling an in- creasing percentage of available business to the commercial sector result in lowered cost and spur capi- tal expenditures in new processes and facilities? 4) Would a properly planned downsizing of the public shipyards provide an opportunity for redeploy- ment of government assets and per- sonnel to alternative uses?

These questions are difficult to answer. They require hard infor- mation about future maintenance workload, resulting facility usage and comparative costs under vari- ous downsizing options. Our report attempts to provide this hard infor- mation.

THE FUTURE BUSINESS

SITUATION

One thing is very clear—budget pressures and changed military re- quirements will result in a signifi- cant downsizing of the U.S. Navy's fleet over the next several years.

Plans being discussed would cut the

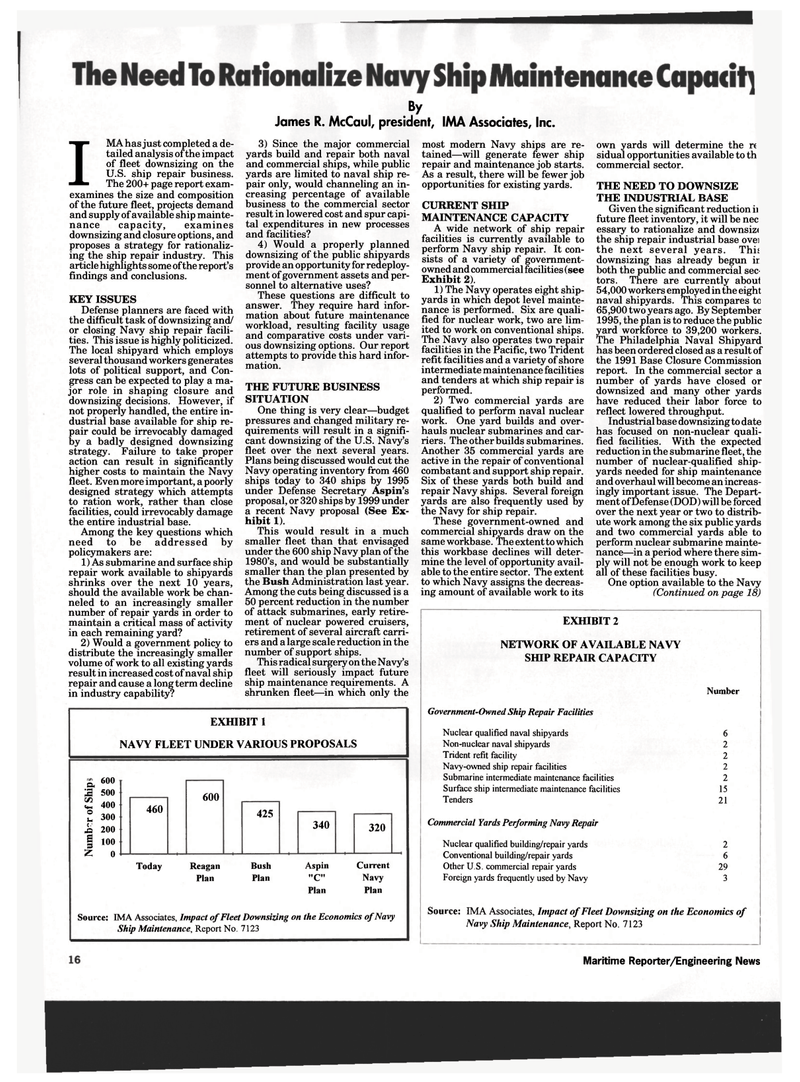

Navy operating inventory from 460 ships today to 340 ships by 1995 under Defense Secretary Aspin's proposal, or 320 ships by 1999 under a recent Navy proposal (See Ex- hibit 1).

This would result in a much smaller fleet than that envisaged under the 600 ship Navy plan of the 1980's, and would be substantially smaller than the plan presented by the Bush Administration last year.

Among the cuts being discussed is a 50 percent reduction in the number of attack submarines, early retire- ment of nuclear powered cruisers, retirement of several aircraft carri- ers and a large scale reduction in the number of support ships.

This radical surgery on the Navy's fleet will seriously impact future ship maintenance requirements. A shrunken fleet—in which only the

EXHIBIT 1

NAVY FLEET UNDER VARIOUS PROPOSALS

Q, 600 2 500 ^ 400

Z 300 ja 200

I 100

Z 0 460 600 425 340 320

Today Reagan

Plan

Bush

Plan

Aspin "C"

Plan

Current

Navy

Plan

Source: IMA Associates, Impact of Fleet Downsizing on the Economics of Navy

Ship Maintenance, Report No. 7123 most modern Navy ships are re- tained—will generate fewer ship repair and maintenance job starts.

As a result, there will be fewer job opportunities for existing yards.

CURRENT SHIP

MAINTENANCE CAPACITY

A wide network of ship repair facilities is currently available to perform Navy ship repair. It con- sists of a variety of government- owned and commercial facilities (see

Exhibit 2). 1) The Navy operates eight ship- yards in which depot level mainte- nance is performed. Six are quali- fied for nuclear work, two are lim- ited to work on conventional ships.

The Navy also operates two repair facilities in the Pacific, two Trident refit facilities and a variety of shore intermediate maintenance facilities and tenders at which ship repair is performed. 2) Two commercial yards are qualified to perform naval nuclear work. One yard builds and over- hauls nuclear submarines and car- riers. The other builds submarines.

Another 35 commercial yards are active in the repair of conventional combatant and support ship repair.

Six of these yards both build and repair Navy ships. Several foreign yards are also frequently used by the Navy for ship repair.

These government-owned and commercial shipyards draw on the same workbase. The extent to which this workbase declines will deter- mine the level of opportunity avail- able to the entire sector. The extent to which Navy assigns the decreas- ing amount of available work to its own yards will determine the rf sidual opportunities available to th commercial sector.

THE NEED TO DOWNSIZE

THE INDUSTRIAL BASE

Given the significant reduction ii future fleet inventory, it will be nec essary to rationalize and downsizi the ship repair industrial base ovei the next several years. Thij downsizing has already begun ir both the public and commercial sec- tors. There are currently aboul 54,000 workers employed in the eight naval shipyards. This compares to 65,900 two years ago. By September 1995, the plan is to reduce the public yard workforce to 39,200 workers.

The Philadelphia Naval Shipyard has been ordered closed as a result of the 1991 Base Closure Commission report. In the commercial sector a number of yards have closed or downsized and many other yards have reduced their labor force to reflect lowered throughput.

Industrial base downsizing to date has focused on non-nuclear quali- fied facilities. With the expected reduction in the submarine fleet, the number of nuclear-qualified ship- yards needed for ship maintenance and overhaul will become an increas- ingly important issue. The Depart- ment of Defense (DOD) will be forced over the next year or two to distrib- ute work among the six public yards and two commercial yards able to perform nuclear submarine mainte- nance—in a period where there sim- ply will not be enough work to keep all of these facilities busy.

One option available to the Navy (Continued on page 18)

EXHIBIT 2

NETWORK OF AVAILABLE NAVY

SHIP REPAIR CAPACITY

Number

Government-Owned Ship Repair Facilities

Nuclear qualified naval shipyards 6

Non-nuclear naval shipyards 2

Trident refit facility 2

Navy-owned ship repair facilities 2

Submarine intermediate maintenance facilities 2

Surface ship intermediate maintenance facilities 15

Tenders 21

Commercial Yards Performing Navy Repair

Nuclear qualified building/repair yards 2

Conventional building/repair yards 6

Other U.S. commercial repair yards 29

Foreign yards frequently used by Navy 3

Source: IMA Associates, Impact of Fleet Downsizing on the Economics of

Navy Ship Maintenance, Report No. 7123 100

Maritime Reporter/Engineering News

13

13

15

15