Page 29: of Maritime Reporter Magazine (June 1993)

Read this page in Pdf, Flash or Html5 edition of June 1993 Maritime Reporter Magazine

Cruise

Shipping

Recent Orders Help To Buoy

Maritime Markets

In an attempt to prepare for the eight million passengers per year projected by the turn of the century, cruise ship owners have been plac- ing orders at a steady pace at the outset of 1993.

With rosy market potential esti- mates like the Cruise Line Interna- tional Association (CLIA) (New

York) recently released, it is no won- der owners are signing today for ships tomorrow.

Based on the association's best estimate, which takes into account factors such as total population by age, probability of that population taking a cruise, and cruise prices,

CLIA estimates that there is more than $50 billion in revenues to be made in the cruise market.

Another positive indicator is the ten-year trend of capacity increases and the projected continuance of this through 1997.

According to CLIA, in order to keep capacity in line with North

American (including Canada and the

U.S.) demand, average capacity rose at a rate of 8.2 percent from 1981 to 1992.

Based on current information, the association projects a 4.4 percent capacity increase through the year 1997.

While all of the facts, figures and projections are subjective to uncon- trollable forces such as the world economy, probably the best bottom- line indicator of the cruise ship mar- ket are recent orders and deliveries.

And the beginning of the year to date has seen the signing of some landmark deals.

For example, Carnival Cruise

Lines Inc. (CCL) of Miami signed a contract with Italian builder

Fincantieri Cantieri Navali Italiani

SPA for the construction of the larg- est passenger cruise ship ever, a 95,000-gt vessel with 1,300 cabins, for delivery in late 1996.

Additionally, Royal Caribbean

Cruise Line (RCCL) signed contracts with Chantiers de l'Atlantique of

France, for the construction of up to three ships with a potential value of approximately $1 billion.

Each vessel is scheduled to be 65,000-gt with the capacity to carry 1,800 passengers double occupancy.

The first ship is scheduled for delivery in April 1995, and the sec- ond and third, should the options be exercised, will be delivered in 1996 and 1997 respectively.

Chantiers has delivered four cruise ships to RCCL since 1987.

Finnish builder Kvaerner Masa-

Yards got into the act also, and was recently tapped by Japan's NYK Line to build the 50,000-gt Crystal Sym- phony, scheduled for delivery in the spring of 1995.

The vessel is planned to be nearly 778 feet long with a capacity for 960 passengers, and will be built at the company's Turku New Shipyard.

Rounding out the more recent ac- tion was an order placed by Celeb- rity Cruise Lines Inc. with

Germany's Meyerwerft for the con- struction of a 1,740-passenger, $317.5-million vessel.

In addition, CCLI has options for two sisterships at approximately the same price. All vessels will be for the Celebrity fleet, which serves the premium segment of the cruise mar- ket. The first ship is scheduled for delivery in late 1995.

Two award winning Celebrity ships, Horizon and Zenith, were built by Meyerwerft in 1990 and 1992 respectively.

Perhaps a portion of the reason- ing for the relative steady nature of cruise ship orders is the consumer's demand for more diversity. Over the past 10 years, according to the

CLIA survey, the industry has re-

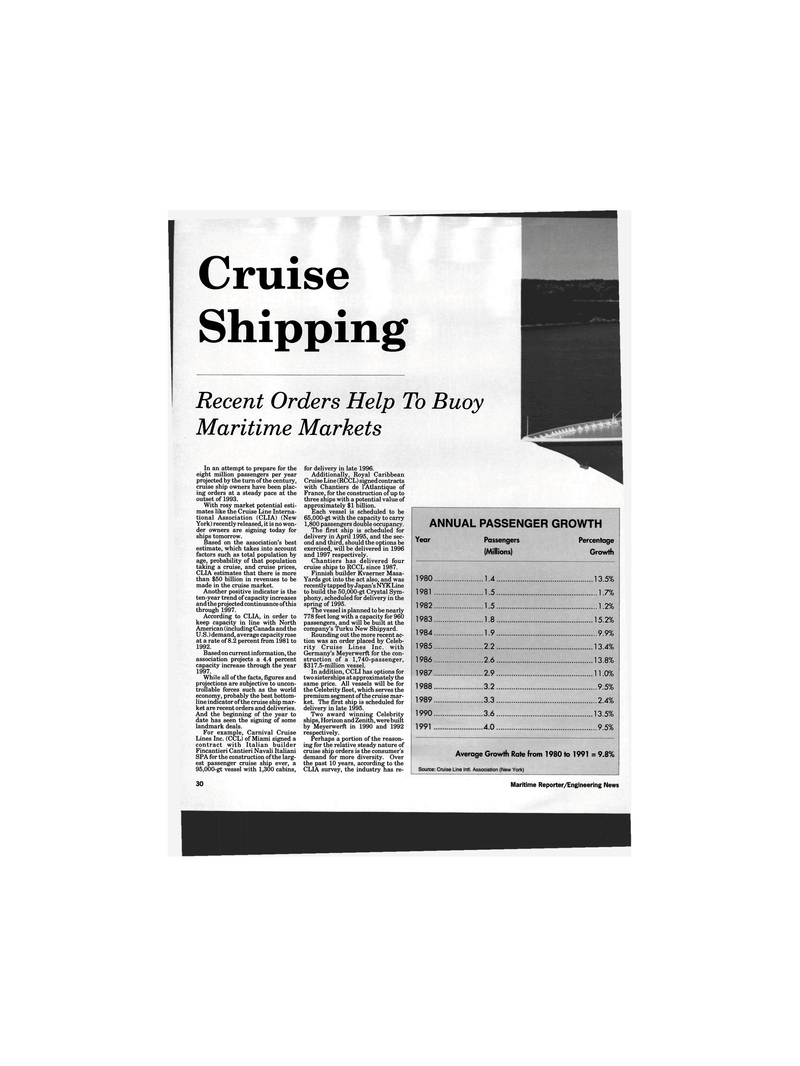

ANNUAL PASSENGER GROWTH

Year Passengers (Millions)

Percentage

Growth 198 0 1.4 198 1 1.5 198 2 1.5 198 3 1.8 198 4 1.9 198 5 2.2 198 6 2.6 198 7 2.9 198 8 3.2 198 9 3.3 199 0 3.6 199 1 4.0 13.5% ..1.7% ..1.2% 15.2% ..9.9% 13.4% 13.8% 11.0% ..9.5% ..2.4% 13.5% ..9.5%

Average Growth Rate from 1980 to 1991 = 9.8%

Source: Cruise Line Intl. Association (New York) 30 Maritime Reporter/Engineering News

28

28

30

30