Page 21: of Maritime Reporter Magazine (June 1994)

Read this page in Pdf, Flash or Html5 edition of June 1994 Maritime Reporter Magazine

Status of U.S. Shipbuilding Assistance Programs by James R. McCaul, president

IMA Associates, Inc.

The U.S. has initiated a major effort to transition from a naval to a commercial shipbuilding base.

Here's a summary of key programs in existence or proposed to help

U.S. shipyards compete for ship- building orders, described and listed in approximate order of importance.

Ship Export Financing

Guarantees

Public Law 103-160 signed by

President Clinton on November 30,1993 created the National Ship- building and Shipyard Conversion

Act of 1993. The major provision in this act is creation of a facility to provide government financing guar- antees for ship export orders.

The general intent of PL 103-160 is to provide a financing facility similar to that available through

Eximbank. It is designed to pro- vide work to U.S. shipyards. The objective is to assist U.S. shipyards in developing a commercial workbase to offset the decline in military work.

Under the act, the Department of Transportation (DOT) is autho- rized to guarantee up to 87.5 per- cent of the ship's cost. This would be used for credit enhancement of a loan placed with a commercial bank.

It will allow a repayment period of up to 25 years at terms generally applicable to AAA rated borrowers.

Foreign as well as U.S. owners are eligible to apply for the financing guarantee. The ship can be regis- tered in the U.S. or in a foreign registry. It can be classed with ABS or another registry. The only major requirement is that the ship be built in the U.S.

A provision of the law enables the DOT to match more favorable financing terms available through foreign governments.

The government estimates that the value of ships to be built with financing guarantees will total $1.85 billion over the first two years of the program.

This program is already attract- ing considerable interest. It is un- derstood that there have been about a dozen applications already sub- mitted to the Maritime Administra- tion for guarantees on ship export contracts. In IMA's opinion, access to financing guarantees for export orders will be a major boon to U.S. shipyards.

Shipyard Modernization

Support

PL 103-160 also provides federal financing guarantees for shipyard modernization. A U.S. shipyard can submit an application requesting the

DOT to guarantee 87.5 percent of the cost of capital improvements and acquisition of modern shipbuilding technology. This guarantee will be used by the shipyard for credit en- hancement of a loan from a commer- cial bank.

This program is specifically de- signed for shipyards which other- wise would find difficulty obtaining financing for capital improvements.

It enables the shipyard to obtain financing at terms available to AAA rated companies.

Up to 12.5 percent of the total commitments made by the DOT for financing guarantees can be used for shipyard modernization support.

It is understood that one major shipyard has already submitted an application for a loan guarantee to- taling $22.7 million to finance a $27.7 million shipyard modernization project.

Cost Sharing Contracts

Under the TRP, shipyards as well as other U.S. firms are eligible to submit proposals to the Advanced

Research Projects Agency (ARPA) to cost share commercialization projects. ARPA will fund up to 50 percent of the cost of developing prod- ucts designed to transition military

Company Project # Participating

Organizations $ (mil)

Bath Iron Works Commercial Shipbuilding Focused

Development 5 $13.9

Westinghouse Electric Corp. Demonstration & Spin-Off of the Integral

Motor/Propeller Propulsion System 5 $9.8

Norfolk Shipbuilding & Drydock

Center for Advanced Ship Repair & Maintenance 4 $2.4

CYBO Robots, Inc. Portable Shipbuilding Robotics 13 $12.5

Westinghouse Electric Corp. Development of the Submerged Electric

Drive Cargo Pumping System 7 $4.9 to commercial activity. Five projects have already been awarded in the shipbuilding area (see chart this page).

A new round of cost-sharing awards is expected in the near fu- ture. These awards will be funded under the Maritech program—also managed by ARPA. About 40 pro- posals have been submitted to ARPA.

Many of the proposals involve de- veloping specific ship designs that will be marketed to international buyers. ARPA will pay for half of the cost to perform design and other work necessary to bring each project to the contract signing stage. To date, $30 million has been funded for Maritech, and another $40 mil- lion is planned for the fiscal year beginning October 1994. Total fund- ing of the five-year period is to be $220 million.

Series Transition Payment

Program

This proposed program calls for a construction subsidy of about $2 bil- lion over a 10-year period to pay half the cost of building ships in U.S. shipyards. The subsidy would be available for projects involving two or more ships. Over time, the sub- sidy percentage would decrease as

U.S. yards become more competi- tive.

The House of Representatives has passed a bill authorizing the pro- gram. However, the program is opposed by the Administration and funding has not yet been provided.

Gibbons/Breaux Bills

A proposed bill introduced in the

House of Representatives by Rep.

Gibbons calls for penalties on ships calling in U.S. ports that have been built with foreign subsidy support.

A similar bill has been introduced in the Senate by Sen. Breaux. The objective of both bills is to cause other governments to elimi nate their support of shipbuilding ir order to "level the playingfield"forU.S. ship- yards. This legislation is heatedly opposed by the cruise industry. It has until now not gained the sup- port of the previous or present ad- ministration. The Clinton Admin- istration has been attacking the trade policies of other countries and this legislation may end up passing in some fashion. Chances of pas- sage will increase if U.S. yards do not obtain some orders within the near future as a result of the new ship export financing program. ___—— „

Jones Act.. las been a traditional pro- tection for U.S. shipyards. The law requires that cargo ships trading between U.S. porfiTbe builtlh" do- mestic shipyards^ S~strrllar law requires that passenger ships oper- ating between U.S. ports be U.S.- built. Legislation introduced in the

House would permit the u se of for- eign-built ships in the domestic cruise trade. As a condition, the operator would need to ccmmit to buy a replacement vessel in a U.S. shipyard within a two-yea:" period.

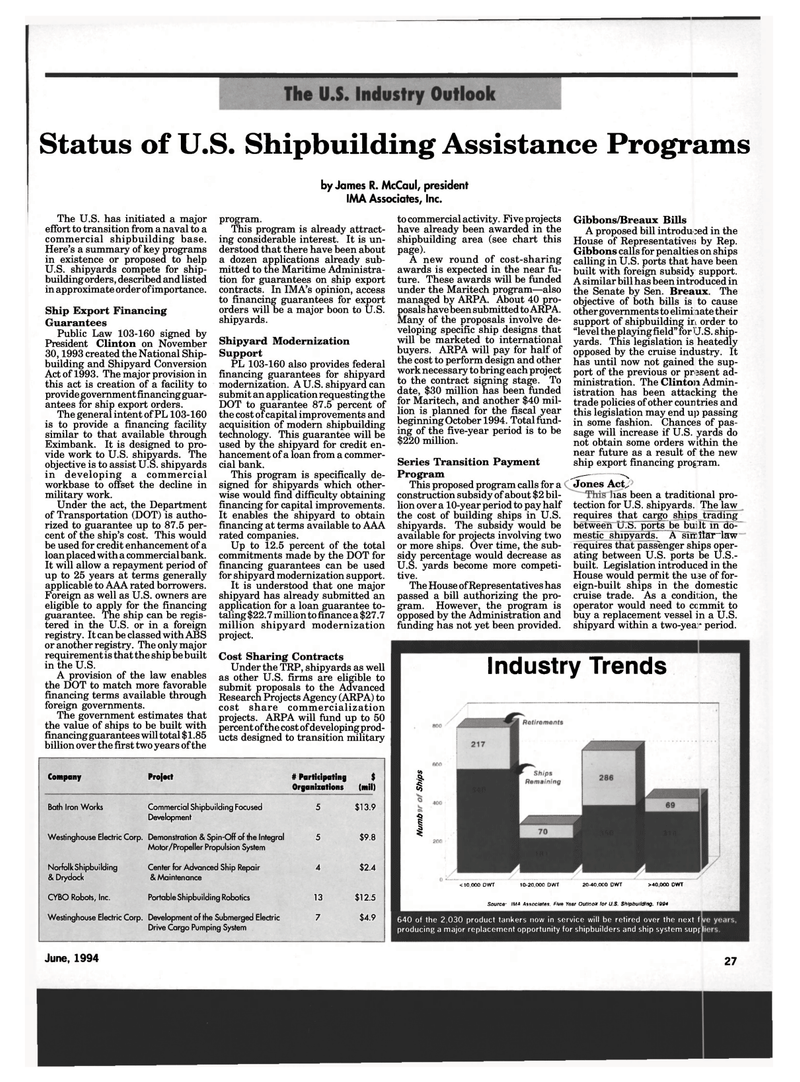

Industry Trends

I

I <10,000 DWT 10-20.000 DWT 20-40.000 DWT >40,000 DWT

Source• IMA Associates. Five Ymr Outlook for U.S. Shipbuilding. 1994 640 of the 2,030 product tankers now in service will be retired over the next f producing a major replacement opportunity for shipbuilders and ship system supf

June, 1994 27

20

20

22

22