Page 8: of Maritime Reporter Magazine (March 1997)

Read this page in Pdf, Flash or Html5 edition of March 1997 Maritime Reporter Magazine

MARINE FINANCE

Shipping

Funds

Why they fail... and why they don't have to by Sydney P. Levine, Shipping Intelligence

Every so often, the idea of a "ship- ping fund" surfaces at the intersec- tion of the investment and shipping communities. In a few cases, ideas have gone beyond talk and actual investment vehicles have been cre- ated. But returns to investors have often been far less than predicted and the only lasting effect is that the reputation of shipping as a high- risk and low-return investment is enhanced.

Why is it that shipping can be a profitable business for individual shipowners and shipping compa- nies, but similar profitability eludes groups of investors organized to be in the same business?

I believe that the answer to that question is rooted in conflicts between the way that shipping funds are organized and the nature of the shipping and financial mar- kets.

These conflicts precipitate three economically harmful types of events. First, ships are bought when they should not be. Second, ships are not sold when they should be. And last, the investment man- ager develops a conflict of interest that adversely affects profitability as well as sours the relationship with investors.

To explain the logic behind these assertions, consider the history of a typical shipping fund.

Almost always, the impetus to start a shipping fund comes from the shipping rather than the invest- ment side of the transaction. The reasoning goes something like this:

Regardless of shipping's poor rep- utation as an investment, we know that it is possible to make money in shipping; we've done it. Why don't we interest a group of investors with some serious money, say $100 million, and assemble a fleet which we can then manage in the interna- tional charter market to the mutual benefit and profit of all? 8

Assuming for the moment that the capital has been raised — a difficult task under the best of circum- stances — an actual shipping com- pany is then formed, whose first task is to acquire a fleet which can begin trading.

At that point the reality of the markets — the ship resale, ship charter and financial markets — comes into conflict with the new shipping company's aims. Everyone in this venture would like to be fully invested, in ships, as soon as possi- ble. However, it is not always a good time to buy ships, and the most prudent course at any given time may be not to buy. This pru- dent course is a hard one for investors to accept; after all, their money was not invested to languish in certificates of deposit or treasury bills.

So, as time passes, pressure mounts on the fund manager to find ships to buy. This pressure is not only from the investors; the manag- er also wants to put the invested money to work. And eventually, ships are bought, with the purchas- es justified by incorrect logic. This kind of pressure to buy happens not only when a fleet is being initially assembled, but whenever there is excess unemployed capital, such as after a ship has been sold.

Consequences Of Buying In

Error

A ship should not be bought if the current and historic states of ship resale, charter and financial mar- kets and the interrelationships among them indicate that there is a high probability that the proposed purchase will not deliver the desired return. In other words, the markets alone indicate when to buy a ship. Of course one must be able to correctly interpret market data, (continued on page 22)

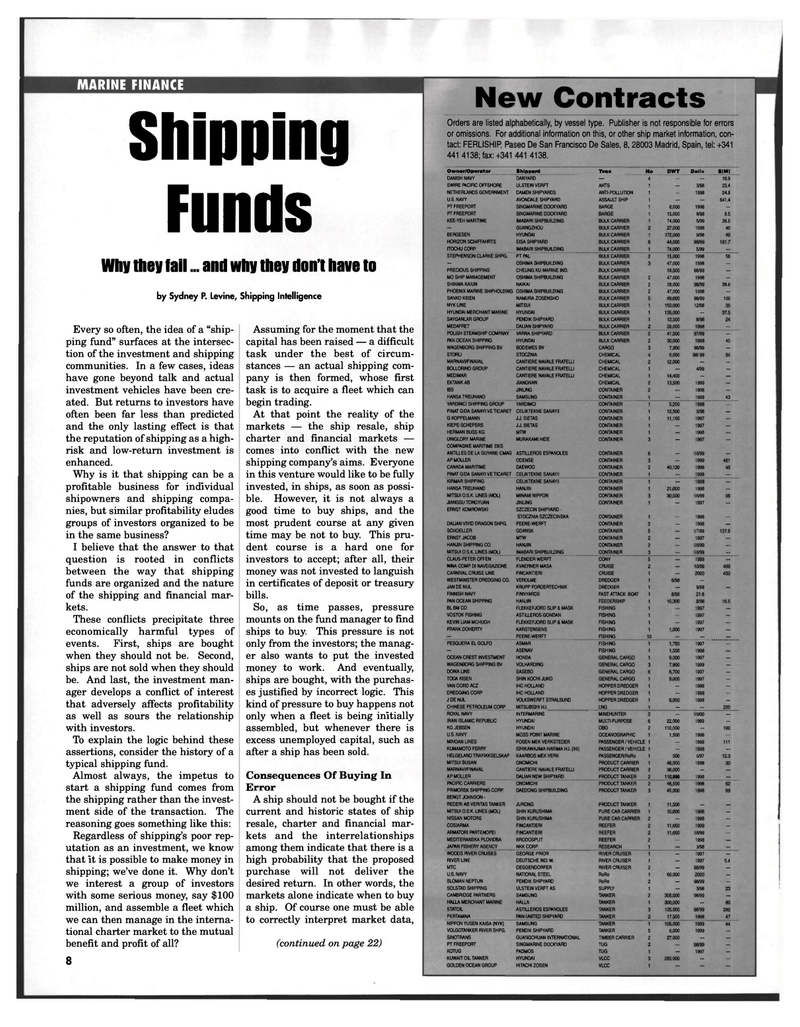

New Contracts

Orders are listed alphabetically, by vessel type. Publisher is not responsible for errors or omissions. For additional information on this, or other ship market information, con- tact: FERLISHIP, Paseo De San Francisco De Sales, 8,28003 Madrid, Spain, tel: +341 441 4138; fax: +341 441 4138.

O wner/Oporator Shipyard Typ. No DWT Deliv S(M)

DANISH NAVY DANYARD — 4 — 16.9

SWIRE PACIFIC OFFSHORE ULSTEIN VERFT AHTS 1 — 3/98 23.4

NETHERLANDS GOVERNMENT DAMEN SHIPYARDS ANTI-POLLUTION 1 f 1998 24.8

U.S. NAVY AVONBALE SHIPYARD ASSAULT SHIP 1 — — 641.4

PT FREEPORT SINGMARINE DOCKYARD BARGE 1 8,000 1998 —

PT FREEPORT SINGMARINE DOCKYARD BARGE 1 15,000 8/98 8.5

KEE-YEH MARITIME IMABARI SHIPBUILDING BULK CARRIER t 74,000 5/99 26.5 — GUANGZHOU BULK CARRIER 2 27,000 1998 40

BERGESEN HYUNDAI BULK CARRIER 1 172,000 9/98 49

HORIZON SCHIFFAHRTS EISA SHIPYARD BULK CARRIER 6 44,000 98/99 161.7 rrocHucoRP. IMABARI SHIPBUILDING BULK CARRIER 1 74,000 5/99 -

STEPHENSON CLARKE SHPG. PTFW. BULK CARRIER 2 15,000 1998 56 — OSHIMA SHIPBUILDING BULK CARRIER 3 47,000 1998 —

PRECIOUS SHIPPING CHEUNG KU MARINE IND. BULK CARRIER 18,500 98/99 . . —

MO SHIP MANAGEMENT OSHIMA SHIPBUILDING BULK CARRIER 2 47,000 1998 —

SHINWA KAIUN NAIKAI BULK CARRIER 2 28,000 98/99 38.6

PHOENIX MARINE SHIPHOLDING OSHIMA SHIPBUILDING BULK CARRIER 2 47,000 1998 —

SANKO KISEN NAMURAZOSENSHO BULK CARRIER 5 49,000 98/99 100

NYKUNE MITSUI BULK CARRIER 1 150,000 12/98 35

HYUNDAI MERCHANT MARINE HYUNDAI BULK CARRIER 1 135,000 — 37.5

SAYGANLAR GROUP PENDIK SHIPYARD BULK CARRIER 1 12,500 8/98 24

MEDAFRET DALIAN SHIPYARD BULK CARRIER 2 28,000 1998 —

POUSH STEAMSHIP COMPANY VARNA SHIPYARD BULK CARRIER 2 41,500 97/99 —

F*N OCEAN SHIPPING HYUNDAI BULK CARRIER 2 30,000 1998 45

WAGENBORG SHIPPING BV BODEWES BV CARGO 3 7,900 98/99 —

STOfiU STOCZNIA CHEMICAL 4 6,000 98/99 84

MARNAV1/FINAVAL CANTIERE NAVALE FRATELL! CHEMICAL 2 12,000 — —

BOLLORINO GROUP CANTIERE NAVALE FRATELL! CHEMICAL 1 _ 4/99 —

MEDIMAR CANTIERE NAVALE FRATELU CHEMICAL 1 14,400 — —

EKTANKAB JIANGNAN CHEMICAL 2 13,500 1999 _

IBS JINUNG CONTAINER i — 1998 -

HANSATREUHAND SAMSUNG CONTAINER 1 — 1998 43

YARDIMCI SHIPPING GROUP YARDIMCI CONTAINER Jj|i} 5,200 1998

PINAT GIDA SANAYIVE TICARET CELIKTEKNE SANAYII CONTAINER i 12,500 8/98 —

G KOPPELMANN JJ.SETAS CONTAINER 1 11,150 1997 —

KIEPE-SCHEPERS J.J. SIETAS CONTAINER i — 1997 —

HERMAN BUSS KG MTV/ CONTAINER i _ 1998 —

UNIGLORY MARINE MURAKAMI HIDE CONTAINER 3 — 1997 —

COMPAGNIE MARITIME DES

ANTILLES DE LA GUYANE CMAG ASTILLEROS ESRANOLES CONTAINER 6 — 98/99 —

APMOLLER ODENSE CONTAINER 3 — 1999 481

CANADA MARITIME DAEWOO CONTAINER 2 40,120 1998 45

PINAT GIDA SANAYI VE TICARET CEUKTEKNE SANAYII CONTAINER 1 — 1998 —

KIRMAR SHIPPING CELIKTEKNE SANAYII CONTAINER 1 — 1998 —

HANSATREUHAND HANJIN CONTAINER t 21,000 1998 —

Mrrsui O.S.K. LINES (MOL) MINAMI NIPPON CONTAINER 3 30,000 98/99 96

JIANGSUTONGYUAN JINUNG CONTAINER 1 ; — 1997 —

ERNST KOMROWSKI SZCZECIN SHIPYARD -

STOCZNIA SZCZECINSKA CONTAINER 1 1998

DALIAN VIVID DRAGON SHPG. PEENE-WERFT CONTAINER 2 : — 1998 —

SCHOELLER GDANSK CONTAINER 5 — 97/98 137.5

ERNST JACOB MTW CONTAINER 2 — 1997 —

HANJIN SHIPPING CO. HANJIN CONTAINER 2 — 98/99 —

MITSUI O.S.K. LINES (MOL) IMABARI SHIPBUILDING CONTAINER 3 — 98/99 --

CLAUS-PETER OFFEN FLENDER WERFT CONY 5 — 1999 —

NINA COMP. Dl NAVEGAZIONE KVAERAJER MASA CRUISE 2 — 1CV99 400

CARNIVAL CRUISE LINE F1NCANTIERI CRUISE 1 — 2000 430

WESTMINSTER DREDGING CO. VEROLME DREDGER 1 6/98 —

JAN DE NUL KRUPP FORDERTECHNIK DREDGER 1 ; : — 9/98 —

FINNISH NAVY FINNYARDS FAST ATTACK BOAT 1 8/98 21.6

RAN OCEAN SHIPPING HANJIN FEEDERSHIP 1 10,300 8/98 16.5

BLBMCO FLEKKEFJORD SLIP S MASK FISHING 1 — 1997 —

VOSTOK RSHING ASTILLEROS GONDAN FISHING 1 1997 -

KEVIN UAM MCHUGH FLEKKEFJORD SLIP S MASK FISHING 1 — 1997 —;

FRANK DOHEKTY KARSTENSENS FISHING 1 1,000 1997 - — PEENE-WERFT RSHING 10 — — —

PESQUERA EL GOLFO ASMAR FISHING 1 : 1,750 1997 ............. — ASENAV FISHING 1 1,500 1998 —

OCEAN CREST INVESTMENT HONDA GENERAL CARGO 1 9,000 1997 —

WAGENBORG SHIPPING BV VOLHARDING GENERAL CARGO 3 7,900 1999 —

OOWAUNE SASEBO GENERAL CARGO 6 6,700 1997 —

TOOA KISEN SHIN KOCHIJUKO GENERAL CARGO 1 9,000 1997 —

VAN OORD ACZ IHC HOLLAND HOPPER DREDGER 1 — 1998 —

DREDGING CORP IHC HOLLAND HOPPER DREDGER 1 — 1998

JDENUL VOLKSWERFT STHALSUND HOPPER DREDGER 1 6,000 1998 —

CHINESE PETROLEUM CORP MITSUBISHI H.I. __ WG 1 — — 220

ROYAL NAVY INTERMARINE M1NEHUNTER 2 — 99/00 _

IRAN ISLAMIC REPUBLIC HYUNDAI MULTI-PURPOSE 6 22,000 1999 —

KG JEBSEN HYUNDAI OBO 2 110,000 — ioo

U.S. NAVY MOSS POINT MARINE OCEANOGRAPHIC 1 1,500 1998

MINOAN LINES FOSENMEKVERKSTEDER PASSENGER/ VEHICLE 1 — 1998 m

KUMAMOTO FERRY ISHIKAWAJIMA HARIMA H.I. (IHI) PASSENGER/VEHICLE 1 — 1998 —

HELGELAND TRAFIKKSELSKAP KAARBOS MEK VERK PASSENGER/RoRo 1 500 8/97 12.3

MITSUI BUSAN ONOMICHI PRODUCT CARRIER 1 46,000 1998 30

MARNAVI/FINAVAL CANTIERE NAVALE FRATELLI PRODUCT CARRIER 2 36,000 — —

APMOLLER DALIAN NEW SHIPYARD PRODUCT TANKER 2 110,000 1998 —

RACIF1C CARRIERS ONOMICHI PRODUCT TANKER 2 46,500 1998 62

PRIMORSK SHIPPING CORP. DAEDONG SHIPBUILDING PRODUCT TANKER 3 45,000 1998 99

BENGTJOHNSON -

REDERI AB VERITAS TANKER JURONG PRODUCT TANKER 1 11,500 — —

MITSUI O.S.K. LINES (MOL) SHIN KURUSHIMA PURE CAR CARRIER i - 10,000 1998 —

NISSAN MOTORS SHIN KURUSHIMA PURE CAR CARRIER 2 — 1998 —

COSIARMA FINCANTIERI REEFER 2 11,650 1999 —

ARMATORIRARTENOPEI FINCANTIERI REEFER 2 11,650 90/99

MEDtTERANSKA PLOVIDBA BRODOSPUT REEFER 2 1998 —

JAFSN FISHERY AGENCY NKKCORP. RESEARCH 1 — 3/98 -

WOODS RIVER CRUISES GEORGE PRIOR RIVER CRUISER 1 — 1997 —

RIVER LINE DEUTSCHE IND. W. RIVER CRUISER 1 _ 1997 5.4

MTC DEGGENDORFER RIVER CRUISER 2 — 98/99 —

U.S. NAVY NATIONAL STEEL RoRo i ; 60,000 2000 . —

SLOMANNEPTUN PENDIK SHIPYARD RoRo 2 — 98/99 —

SOLSTAD SHIPPING ULSTEIN VERFT AS SUPPLY 1 — 3/98 23

CAMBRIDGE FURTHERS SAMSUNG TANKER 2 308,000 98/99 —

HALLA MERCHANT MARINE HALLA TANKER 1 300,000 — 80

STATOIL ASTILLEROS ESRANOLES TANKER 3 125,000 98/99 260

PERTAMINA WN-UNITE0 SHIPYARD TANKER 2 17,500 1998 47

NIPPON YUSEN KAISA (NYK) SAMSUNG TANKER 1 105,000 1999 44

VOLGOTANKER RIVER SHPG. PENDIK SHIPYARD TANKER 5 6,000 1999 —

SINOTRANS GUANGCHUAN INTERNATIONAL TIMBER CARRIER 2 27,000 — —

PT FREEPORT SINGMARINE DOCKYARD TUG 2 — • 98/99 _

KOTUG PADMOS TUG t — 1997 —

KUWAIT OIL TANKER HYUNDAI VLCC 3 285,000 —

GOLDEN OCEAN GROUP HITACHI ZOSEN VLCC 1 — — —

7

7

9

9