Page 82: of Maritime Reporter Magazine (April 1997)

Read this page in Pdf, Flash or Html5 edition of April 1997 Maritime Reporter Magazine

c

E R

M

A

N 1

E

V # £ W

I he German maritime industry is a microcosm displaying the changes that arc sweeping the maritime scene in

Europe, and . •/ fact, the world.

Com pet i t ion /01 newhuild, repair and equipment supply dollars grows expo- nentially each year, i here's alti'/tys a new low-cost builder; />r, duct and/or service provider lurking ar< nnr! the corner; looking to steal marki ' share.

Cienuau companies luive not ''ecu spitted this trend, ttnd several n/oi >en- tous events — including the dtttQufo'/ <>l Bremer 1 ulkau and the purchase o/

Krnpp Malv by ( atcrpillar — have taken place in recent months. Just \ recently, //'<• Wall Stivci Journal tvits

Wticd K,upp AGHocsdA m mwisL

W AG. Wkih it mm

Honed to prosper in this new environ-

MvtB^nmlfftviI/ plWictably proritfflm stiff com petition for all challengers

Rcuotrned /or technological excel'ei/cc and innovation, (icrtuau com/' tines have earnctl it strong rcputat on as designers, builders and suppliers of top r/uality ships and etp ipment.

I he ens a i ng pages p wide updates on key German ship aids and equip- ment suppliers. A so, an editorial contribution fro u U Hfried Brune, managing dir dor of I l)MA, high- lights some of his member companies recent successes and future prospects.

A Driving Force In Technology

And Cost Efficiency

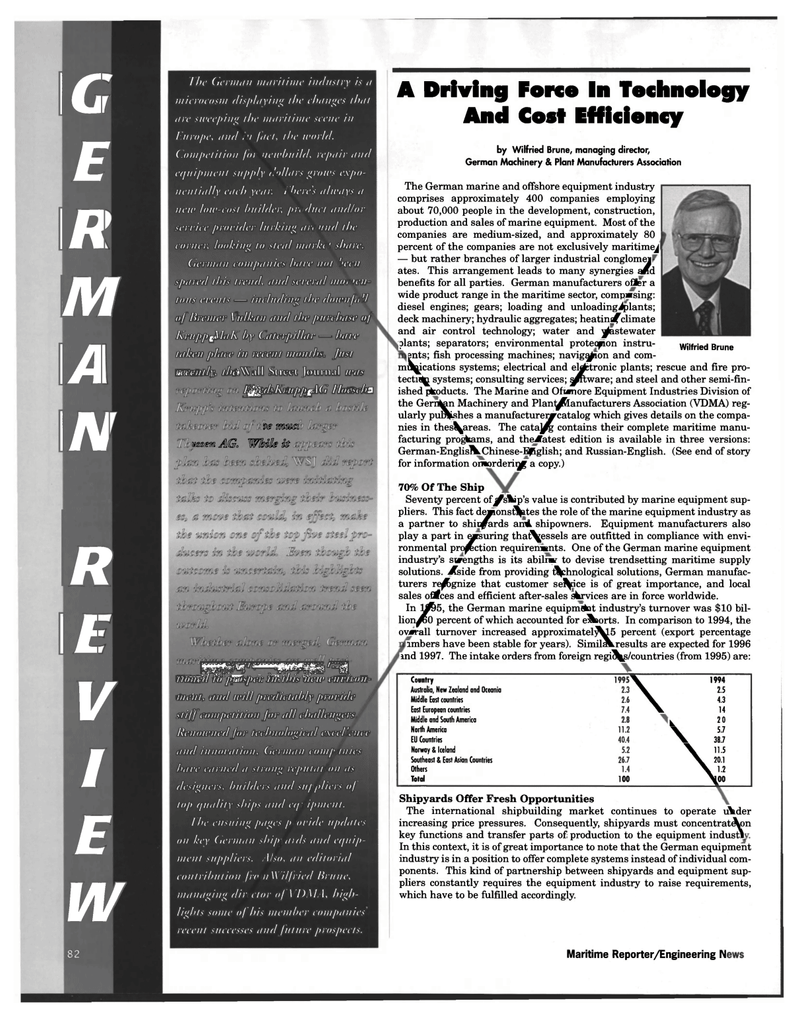

Wilfried Brune by Wilfried Brune, managing director,

German Machinery & Plant Manufacturers Association

The German marine and offshore equipment industry comprises approximately 400 companies employing about 70,000 people in the development, construction, production and sales of marine equipment. Most of the companies are medium-sized, and approximately 80 percent of the companies are not exclusively maritime^ — but rather branches of larger industrial conglomej ates. This arrangement leads to many synergies aMd benefits for all parties. German manufacturers offer a wide product range in the maritime sector, composing: diesel engines; gears; loading and unloadingiplants; deck machinery; hydraulic aggregates; heatindfclimate and air control technology; water and Wastewater plants; separators; environmental proteopon instru- cts; fish processing machines; navig^non and com- mideations systems; electrical and electronic plants; rescue and fire pro- tecting systems; consulting services; ^tware; and steel and other semi-fin- ished pkoducts. The Marine and Ofwiore Equipment Industries Division of the Gern^n Machinery and Plani^lanufacturers Association (VDMA) reg- ularly pul^Ushes a manufactureiycatalog which gives details on the compa- nies in thes^areas. The cata^j contains their complete maritime manu- facturing progteims, and the^atest edition is available in three versions:

German-EnglisXChinese-Bpglish; and Russian-English. (See end of story for information oimyrderiijf a copy.) 70% Of The Ship

Seventy percent of^sVp's value is contributed by marine equipment sup- pliers. This fact demonstrates the role of the marine equipment industry as a partner to shipyards amL shipowners. Equipment manufacturers also play a part in ysuring that^essels are outfitted in compliance with envi- ronmental promotion requirenmnts. One of the German marine equipment industry's swengths is its abiliw to devise trendsetting maritime supply solutions. Xside from providing technological solutions, German manufac- turers re^gnize that customer sendee is of great importance, and local sales oflfces and efficient after-sales services are in force worldwide.

In 1^5, the German marine equipmabt industry's turnover was $10 bil- lion^O percent of which accounted for eXorts. In comparison to 1994, the owm:al\ turnover increased approximate!^^5 percent (export percentage imbers have been stable for years). SimilXresults are expected for 1996 md 1997. The intake orders from foreign regies/countries (from 1995) are:

Country 199SV 1994

Australia, New Zealand and Oceania 2.3 X 2.5

Middle East countries 2.6 X 4.3

East European countries 7.4 X 14

Middle and South America k. 20

North America 11.2 X 57

EU Countries 40.4 X 387

Norway & Iceland 5.2 X 11.5

Southeast & East Asian Countries 26.7 X 20.1

Others 1.4 X 1.2

Total 100 \oo

Shipyards Offer Fresh Opportunities

The international shipbuilding market continues to operate uYder increasing price pressures. Consequently, shipyards must concentration key functions and transfer parts of production to the equipment industl

In this context, it is of great importance to note that the German equipment industry is in a position to offer complete systems instead of individual com- ponents. This kind of partnership between shipyards and equipment sup- pliers constantly requires the equipment industry to raise requirements, which have to be fulfilled accordingly. 84 Maritime Reporter/Engineering Nd

81

81

83

83