Page 63: of Maritime Reporter Magazine (September 1997)

Read this page in Pdf, Flash or Html5 edition of September 1997 Maritime Reporter Magazine

MARINE PROPULSION TECHNOLOGY by David Tinsley, technical editor

The quickened pace of consoli- dation in the heavy engineering industry on one hand reflects aspi- rations towards business growth through acquisition of complemen- tary or rival enterprises. On the other hand, it is a factor of the enormous costs associated with product research and development (R&D) and investments in manu- facturing technology, set against persisting weak engine prices, par- ticularly in the shipbuilding domain.

Unremitting pressure to trim unit manufacturing costs, and to maintain a vibrant product devel- opment and refinement program with ever-shorter lead times, imposes considerable structural and strategic demands on the industry. The new scale and orga- nizational efficiency of certain players, achieved either organical- ly or through collaboration or takeover, would suggest that smaller firms will be increasingly hard-pressed from a competitive standpoint. The process of ratio- nalization and industrial restruc- ture has some way to go yet.

There will always be fear that the emergence of fewer, larger players will limit product and ser- vice choice available to the client, ultimately impelling prices upwards. However, evidence to date suggests that the creation of powerful new groupings will more efficiently safeguard the process of technological development, to the ultimate economic and competitive benefit of buyers and users.

In addition, there is little prospect of sustained, solid improvement in the shipbuilding capacity supply/demand scenario of an order that will allow the price of bought-in equipment to rise sub- stantially, all the time that there are competing suppliers. Only a combination of the kind proposed some years ago between Europe's two leading marques could materi- ally affect this situation. The lat- ter move, it will be recalled, was rejected by the anti-cartel authori- ties.

Moreover, the continuing devel-

September, 1997 opment of engine building capacity in the Orient, particularly South

Korea, will keep prices keen.

Growth in the global power gen- eration market continues to have a fundamental bearing on workloads and on product development strat- egy. Although a resurgence in shipbuilding activity has buoyed diesel engine factory output gener- ally, the longer term demand prog- nosis is more positive in the power sector.

Engine designers do not under- estimate the impact of environ- mental issues. IMO exhaust emis- sion limits, proposed for new machinery from 2000 onwards, have occupied the minds of engine makers to constructive and posi- tive effect. But the real test will be increasingly stringent local, regional and national require- ments.

Proponents of a new generation of gas turbines better suited to commercial marine requirements may yet have their day, while elec- tric propulsion systems can be expected to gain ground on perfor- mance, flexibility and environmen- tal merits.

The emergence of the powerful new European force, Wartsila NSD

Corporation, provides the market with a second full-line organiza- tion, like MAN B&W, offering a product range covering the gamut of propulsion, marine auxiliary and stationary power plant needs.

One of the first elements of the manufacturing strategy laid down since the melding of Metra's

Wartsila Diesel division with the

Fincantieri-owned New Sulzer

Diesel and Diesel Ricerche, has been the decision to concentrate output of the world's most power- ful medium-speed engine — the emerging Wartsila 64 — in Italy.

Offering an output of 2,010 kW (2,734 bhp) per cylinder at 333.3 rpm, commercial production has been assigned to Fincantieri's

Grandi Motori Trieste (GMT), in which Wartsila NSD has an initial 40 percent stake.

The move is in keeping with the

Wartsila philosophy of optimizing

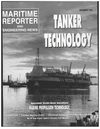

Pictured above is the Sulzer 11RTA96C, touted as the most powerful engine delivered to date, on a test bed at Diesel United's

Aiol works in Japan.

A Paxman 12VP185 high-speed engine is shown below, under assembly at the Colchester plant in the U.K.

62

62

64

64