Page 8: of Maritime Reporter Magazine (November 1997)

Read this page in Pdf, Flash or Html5 edition of November 1997 Maritime Reporter Magazine

MARINE FINANCE — MARKET REPORT

Outlook For Construction Of U.S. Coastal Tankors by James R. McCaul, president International Maritime Associates, Inc.

Building tankers for the domestic trade has tradi-tionally been a profitable market niche for U.S. shipbuilders.

The market is limited to U.S. builders and prices have not been driven down by low cost competi- tion.

Construction of tankers for Jones

Act trade has remained profitable in an international market where prices have fallen 20 percent over the past several years. The follow- ing is a brief forecast of construc- tion requirements in this market niche for the next five to ten years.

Crude Carriers

The major oil producers in Alaska have long claimed that output of the Alaskan fields has been in an irreversible long term period of decline since peaking at 2.0 mbpd in 1988. To some extent this is true, as production in 1996 was 1.42 mbpd — down from 1.49 mbpd in 1995, 1.56 mbpd in 1994, 1.58 in 1993 and 1.71 mbpd in 1992.

Recent analyses have suggested a "renaissance" is underway in

Alaska that will stabilize produc- tion in the foreseeable future. For example, Arco expects to stabilize its production at 350,000 bpd over the next five years, whereas last year the company forecast its

Alaska production would fall below 300,000 bpd in 1999. Reflecting this upbeat outlook, Arco plans to invest $1.7 billion and BP plans to invest $3.5 billion in Alaskan fields over the next five years.

A number of factors are driving field production stabilization.

Perhaps most important has been traditional underestimating of field potential by major producers to pressure the State on royalty payments. There have also been significant improvements in reduc- ing costs for field development.

According to Arco, lease and sup- port costs in Alaska have been cut from $2.29/bbl in 1991 to $1.54/bbl in 1996. Development costs have been cut from an average of $3 mil- lion to $2 million per well and facil- ity hook-up costs have been cut from $1.5 million to $0.6 million per well over this period. In addi- tion, there have been a number of recent discoveries of small to mid- size oil accumulations on the North

Slope.

The stabilization of Alaskan crude production has coincided with OPA 90 regulations that are cutting into the number of ships available to transport crude to

California and elsewhere. This has produced a need for replace- ment tankers.

There are currently 34 tankers operating in the Alaskan trade, with total capacity of 4.1 million dwt. Taking into account OPA phase-outs and the addition of two

Arco tankers, which are now firm orders at Avondale, 20 tankers with 2.5 million dwt will be avail- able for the trade in 2002. The number will decline to seven tankers with one million dwt in 2007.

In other words, 61 percent of today's capacity will be available in 2002, and 24 percent of today's capacity will be available in 2007.

These figures will be 67 and 29 percent respectively if S/R

Mediterranean is permitted to return to the Alaskan trade.

The question: Will this much lower capacity be adequate to accommodate the transport requirement? While remaining capacity may be adequate for 2002, it will likely be lower than needed in 2007, assuming new fields and improved techniques continue to stem the downturn of production in Alaska well into the next decade. The capacity problem will be particularly severe in the years following 2007, as only S/R

Baytown and the two Arco ships now on order will remain after 2010.

To meet future requirements,

International Maritime Associates envisages Arco exercising its option for three ships at Avondale and BP/Exxon ordering four to six tankers through an intermediary.

Assuming these ships are deliv- ered over the next five years, capacity in 2002 would be 83 to 88 percent of the current level and 46 to 51 percent of the current level in 2007.

If these orders occurred and S/R

Mediterranean reentered the trade, the percentages would be five to six percent higher.

Should environmental restric- tions on developing the wildlife

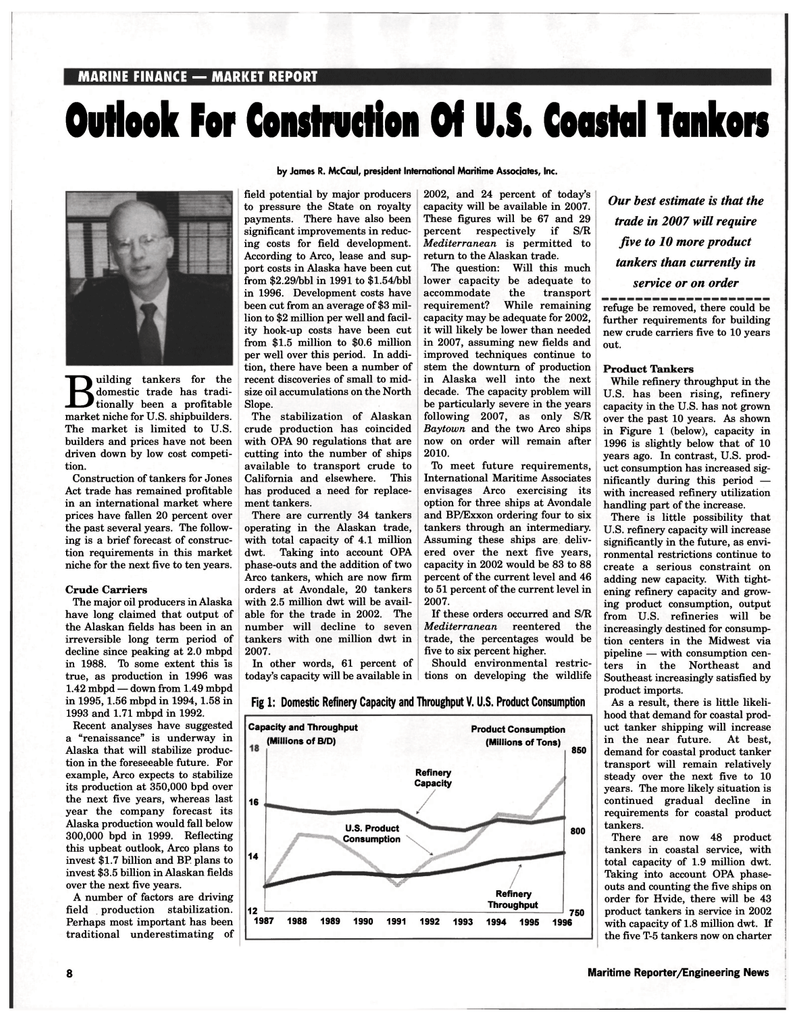

Fig 1: Domestic Refinery Capacity and Throughput V. U.S. Product Consumption

Capacity and Throughput (Millions of B/D)

Product Consumption (Millions of Tons) 16 14 12

Refinery

Capacity

U.S. Product

Consumption

Refinery

Throughput 850 800 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 750

Our best estimate is that the trade in 2007 will require five to 10 more product tankers than currently in service or on order refuge be removed, there could be further requirements for building new crude carriers five to 10 years out.

Product Tankers

While refinery throughput in the

U.S. has been rising, refinery capacity in the U.S. has not grown over the past 10 years. As shown in Figure 1 (below), capacity in 1996 is slightly below that of 10 years ago. In contrast, U.S. prod- uct consumption has increased sig- nificantly during this period — with increased refinery utilization handling part of the increase.

There is little possibility that

U.S. refinery capacity will increase significantly in the future, as envi- ronmental restrictions continue to create a serious constraint on adding new capacity. With tight- ening refinery capacity and grow- ing product consumption, output from U.S. refineries will be increasingly destined for consump- tion centers in the Midwest via pipeline — with consumption cen- ters in the Northeast and

Southeast increasingly satisfied by product imports.

As a result, there is little likeli- hood that demand for coastal prod- uct tanker shipping will increase in the near future. At best, demand for coastal product tanker transport will remain relatively steady over the next five to 10 years. The more likely situation is continued gradual decline in requirements for coastal product tankers.

There are now 48 product tankers in coastal service, with total capacity of 1.9 million dwt.

Taking into account OPA phase- outs and counting the five ships on order for Hvide, there will be 43 product tankers in service in 2002 with capacity of 1.8 million dwt. If the five T-5 tankers now on charter 8 Maritime Reporter/Engineering News

7

7

9

9