Page 41: of Maritime Reporter Magazine (June 1998)

Read this page in Pdf, Flash or Html5 edition of June 1998 Maritime Reporter Magazine

and Aframax on the latter. The vessels can also benefit from strong Aframax rates which may encourage owners to "double up" cargoes. In recent years, West

African crudes have started to move into Asia meeting refiners' requirements there, although this trade is also often occupied by

VLCCs. The resumption of Iraqi exports has also been beneficial to this market. In the last two years demand growth has been impres- sive — 3.4 percent in 1997 and 4.6 percent in 1996.

With a very modest level of

Suezmax deliveries being made through 1995-97 (16 vessels in all) and deletions running ahead (22 vessels), the market has clearly tightened. However although rates doubled in 1996 from 1994 levels, in 1997 they generally underwent a period of consolida- tion, perhaps reflecting the nascent surplus of tonnage.

Delivery levels in 1998 and 1999 are scheduled at twice the demoli-

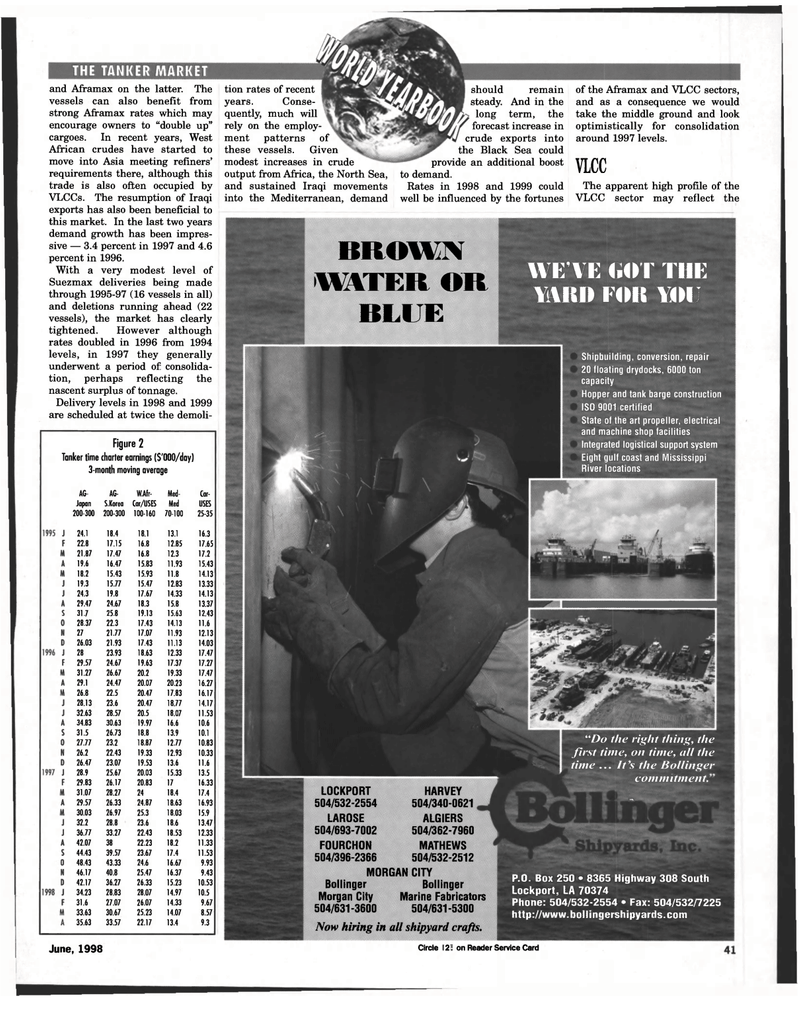

Figure 2

Tanker time charter earnings ($'000/day) 3-month moving average

AG- AG- W.Afr- Med- Car-

Japan S.Korea Car/USES Med USES 200-300 200-300 100-160 70-100 25-35 24.1 18.4 18.1 13.1 16.3 22.8 17.15 16.8 12.85 17.65 21.87 17.47 16.8 12.3 17.2 19.6 16.47 15.83 11.93 15.43 18.2 15.43 15.93 11.8 14.13 19.3 15.77 15.47 12.83 13.33 24.3 19.8 17.67 14.33 14.13 29.47 24.67 18.3 15.8 13.37 31.7 25.8 19.13 15.63 12.43 28.37 22.3 17.43 14.13 11.6 27 21.77 17.07 11.93 12.13 26.03 21.93 17.43 11.13 14.03 28 23.93 18.63 12.33 17.47 29.57 24.67 19.63 17.37 17.27 31.27 26.67 20.2 19.33 17.47 29.1 24.47 20.07 20.23 16.27 26.8 22.5 20.47 17.83 16.17 28.13 23.6 20.47 18.77 14.17 32.63 28.57 20.5 18.07 11.53 34.83 30.63 19.97 16.6 10.6 31.5 26.73 18.8 13.9 10.1 27.77 23.2 18.87 12.77 10.83 26.2 22.43 19.33 12.93 10.33 26.47 23.07 19.53 13.6 11.6 28.9 25.67 20.03 15.33 13.5 29.83 26.17 20.83 17 16.33 31.07 28.27 24 18.4 17.4 29.57 26.33 24.87 18.63 16.93 30.03 26.97 25.3 18.03 15.9 32.2 28.8 23.6 18.6 13.47 36.77 33.27 22.43 18.53 12.33 42.07 38 22.23 18.2 11.33 44.43 39.57 23.67 17.4 11.53 48.43 43.33 24.6 16.67 9.93 46.17 40.8 25.47 16.37 9.43 42.17 36.27 26.33 15.23 10.53 34.23 28.83 28.07 14.97 10.5 31.6 27.07 26.07 14.33 9.67 33.63 30.67 25.23 14.07 8.57 35.63 33.57 22.17 13.4 9.3

June, 1998 "Do the right thing, the first time, on time, all the time ... It's the Bollinger

WE'VE I.OI THE

YARD FOR YOU

P.O. Box 250 • 8365 Highway 308 South

Lockport, LA 70374

Phone: 504/532-2554 • Fax: 504/532/7225 http://www.bollingershipyards.com

BROWN

WATER OR

BLUE

LOCKPORT 504/532-2554

LAROSE 504/693-7002

F0URCH0N 504/396-2366

HARVEY 504/340-0621

ALGIERS 504/362-7960

MATHEWS 504/532-2512

MORGAN CITY

Bollinger Bollinger

Morgan City Marine Fabricators 504/631-3600 504/631-5300

Now hiring in all shipyard crafts.

Circle 240 on Reader Service Card 43

Shipbuilding, conversion, repair 20 floating drydocks, 6000 ton capacity

Hopper and tank barge construction

ISO 9001 certified

State of the art propeller, electrical and machine shop facilities

Integrated logistical support system

Eight gulf coast and Mississippi

River locations commitment. - tion rates of recent years. Conse- quently, much will rely on the employ- ment patterns of these vessels. Given modest increases in crude output from Africa, the North Sea, and sustained Iraqi movements into the Mediterranean, demand should remain steady. And in the long term, the forecast increase in crude exports into the Black Sea could provide an additional boost to demand.

Rates in 1998 and 1999 could well be influenced by the fortunes of the Aframax and VLCC sectors, and as a consequence we would take the middle ground and look optimistically for consolidation around 1997 levels.

VLCC

The apparent high profile of the

VLCC sector may reflect the

40

40

42

42