Page 54: of Maritime Reporter Magazine (November 1998)

Read this page in Pdf, Flash or Html5 edition of November 1998 Maritime Reporter Magazine

WORKBOAT ANNUAL: Oil Prospects

Shifting Tides Continue To Produce Uncertainty

With the per barrel price of oil seemingly entrenched in the $12 to $14 range, the offshore exploration market continues to send mixed signals regarding the level and timing of off- shore exploration and production plans. As uncertainty, more often than not, equals fear, questions and speculation surrounding the future course of crude values has put a crimp in the near-term outlook for many of the compa- nies which build and supply workboats for the offshore markets.

According to a recent report from the Paris- based International Energy Agency (IEA), oil markets rallied in September, but the rally was apparently fueled by temporary factors, and

IEA reasoned that a sustained recovery is unlikely until a parallel Asian recovery takes place. The upward swing saw prices for West

Texas Intermediate and Brent jump by more than $2 per barrel, with WTI briefly jumping over the $16 mark and dated Brent approach- ing $15.

The real pressure created by the all-encom- passing Asian financial crisis, however, is best seen in the continuing downward projection for consumption in 1998 and beyond. In its

September report dated October 8, IEA once again reduced estimates of the region's demand in 1998 more than one million barrels per day lower than projected one year ago. Projections for 1999 are currently running 170 kb/d below initial estimates made two months ago, as diffi- culties in Malaysia, Indonesia, the Philippines,

Korea and Japan have reduced expectations for these countries, as well as created "downside sensitivity" for other countries in the region including China and India.

Mixed Messages

Despite the prolonged Asian financial crisis and consistently low per-barrel pricing, there is still a commitment to discovering and recover- ing resources from lucrative deepwater devel- opments, and new hot spots offshore Africa and in the Caspian Sea are garnering considerable attention. While E&P budgets have been decreased across the board, it is interesting to note that there has not been a wild stampede to eliminate this work altogether.

One major player, however, did issue the proverbial shot across the bow with an announcement of earnings disappointment last month. Global Industries, Ltd. announced that lower activity levels and inclement weather in the Gulf of Mexico and delayed activity in

Mexico negatively impacted second quarter earnings for fiscal 1999. For the quarter ended

September 30, 1998 earnings are expected to be down approximately 40% in comparison to fis- cal 1998 second quarter earnings.

As a result, Global's Chairman and CEO,

William J. Dore, said in a statement "We have already implemented various cost reduction ini- tiatives, including a worldwide salary reduction for most of our salaried staff and we have scaled back our planned capital expenditure budget because we believe that the continued weak- ness in oil prices and the current economic recession in many parts of the world may cause further contractions in the offshore marine con- struction sector."

While Global perhaps sees the oil barrel as half empty, another major, Rowan, sees it as half full. Rowan reported that it expects the market for drilling rigs to improve, after report- ing a 40 percent drop in net income in the third quarter. Net income fell to $32.5 million, or $0.38 per share, compared with analyst fore- casts of $0.33 according to First Call, from $54.3 million, or $0.61 per share a year ago.

Revenues declined to $183.5 million from $195.5 million as rig utilization fell to 84 per- cent of Rowan's fleet from 99 percent a year ago due to declining drilling activity as a result of low oil prices. While reporting the lower results, the company remained characteristical- ly upbeat, projecting that there will be an "inevitable improvement" in offshore drilling business.

Another positive is the relatively steady amount of ordering activity on the offshore front. While it does not resemble the bull rush of several month's back, the procurement of new equipment is still humming.

Friede Goldman Offshore recently won a con- tract from Houston-based R&B Falcon for the

Phoenix IV jackup rig. The Phoenix IV, a

Bethlehem design, 200 ft. (60.9 m), mat sup- ported cantilevered class rig, is scheduled to arrive at the shipyard later this week with a target departure date of mid November. Friede

Goldman is currently working on R&B Falcon's

Falcon 100 semisubmersible rig at the HAM

Marine shipyard in Pascagoula, Miss.

Transocean Offshore Inc. reported that its fourth-generation semisubmersible Transocean

Richardson has received a five-well, minimum 190-day contract from Spirit Energy 76, Unocal

Corp.'s Lower 48 E&P unit. Revenues to be generated over the minimum 190-day contract period are $30.4 million. Transocean

Richardson is one of seven full or partially- owned fourth-generation semisubmersibles in the Transocean Offshore Inc. fleet, and one of nine units currently active in the company's fleet and capable of drilling operations in water depths exceeding 3,000 ft. (914 m). In 1997,

Transocean Richardson set the current world water depth drilling record for a moored semi- submersible in 5,297 ft. (1614.5 m).

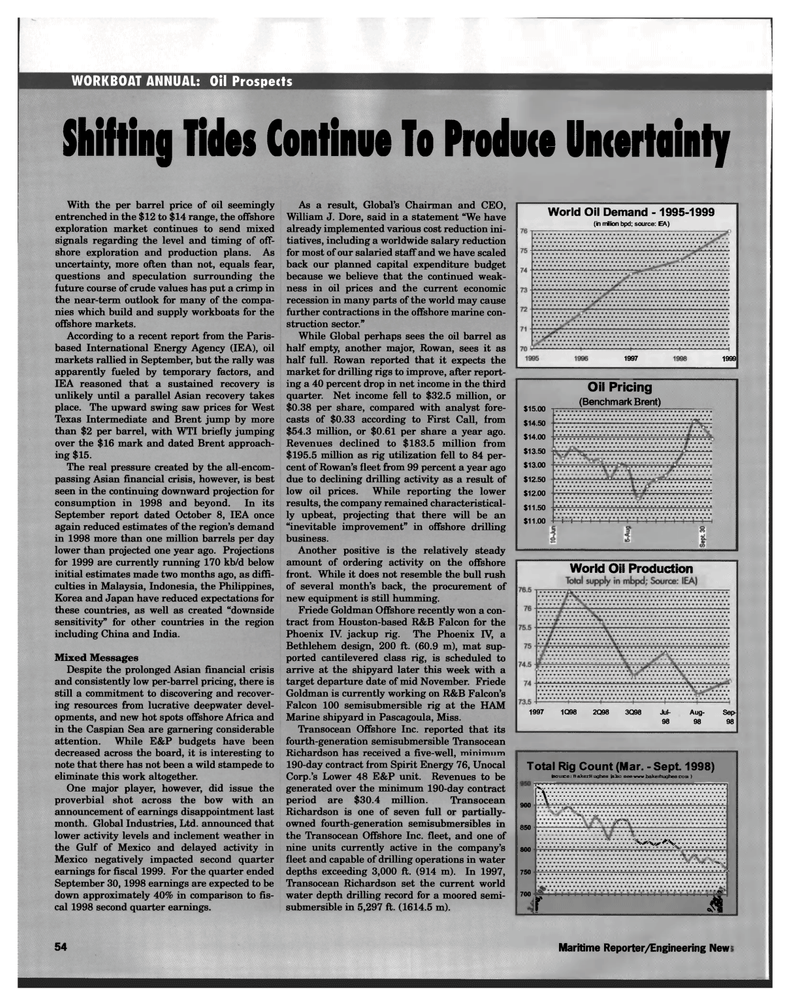

Total Rig Count (Mar. - Sept. 1998) feoiuce: B akerH ughes faio see www bakeihughes com ) 900 850

Wmmmm—m 800 ^Vv^-S^ 750 700 4 r i

World Oil Demand -1995-1999 (in million bpd; source: EA)

Oil Pricing (Benchmark Brent) $15.00 $14.50 $14.00 $13.50 $13.00 $12.50 $12.00 $11.50 $11.00 l l

World Oil Production 1997 1Q98 2Q98 3Q98 Jul- Aug- Sep- 98 98 98 1997 1999 54 Maritime Reporter/Engineering Newc

53

53

55

55