Page 56: of Maritime Reporter Magazine (November 1998)

Read this page in Pdf, Flash or Html5 edition of November 1998 Maritime Reporter Magazine

WORKBOATANNUAL have come to that. The sons worked on a strictly volunteer basis, but with the division, are now employed by the new compa- ny, and are envisioned, along with

Brian's nephew, A.J., vice-presi- dent of sales, as being the fifth generation of McAllisters to oper- ate the company.

And such guidance is certainly needed, with the added pressure of

Moran Transportation Company's recent acquisition of Turecamo

Maritime, Inc. Competitors since the 1860s, Moran and McAllister have engaged in some intense price wars over the past 10 years.

Moran's purchase results in the company having a far larger fleet now than McAllister. "[The purchase] was really a disappointment to me," says Brian. "McAllister had the reserves to buy

Turecamo, but we couldn't resolve

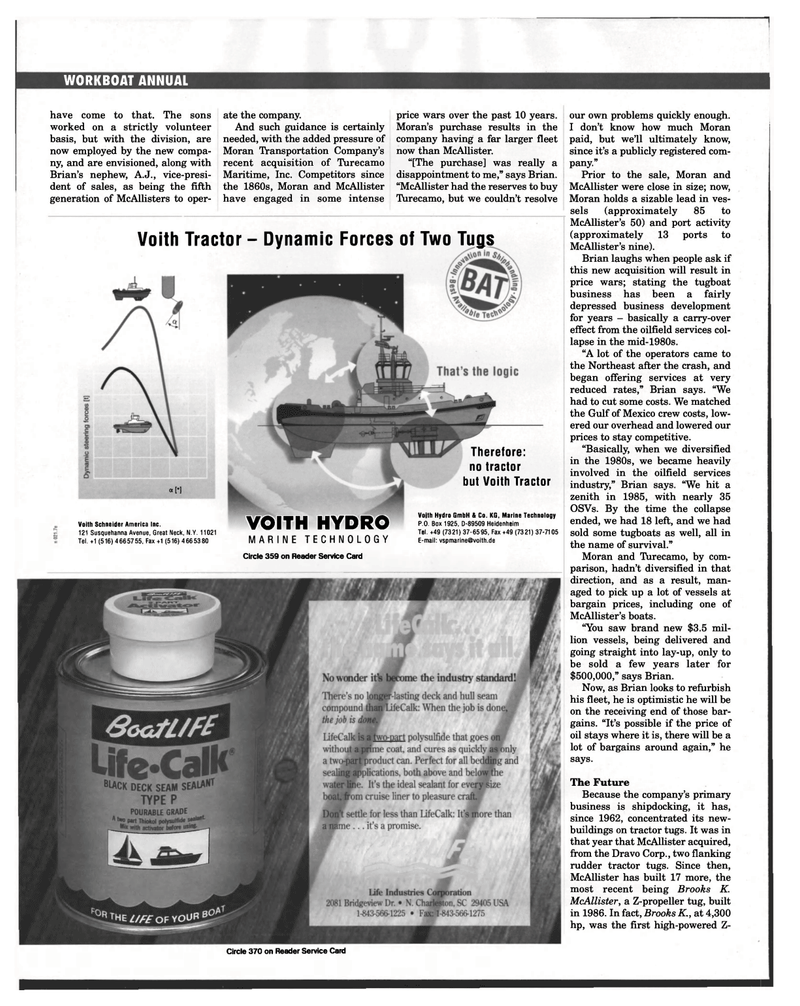

Voith Tractor - Dynamic Forces of Two Tugs an

Voith Schneider America Inc. 121 Susquehanna Avenue, Great Neck, N.Y. 11021

Tel. +1 (516) 4 66 57 55, Fax +1 (516) 4 66 53 80

Therefore: no tractor but Voith Tractor

VOITH HYDRO

MARINE TECHNOLOGY

Circle 359 on Reader Service Card

Voith Hydro GmbH & Co. KG, Marine Technology

P.O. Box 1925, D-89509 Heidenheim

Tel. +49 (7321) 37-6595, Fax +49 (7321) 37-7105

E-mail: [email protected] our own problems quickly enough.

I don't know how much Moran paid, but we'll ultimately know, since it's a publicly registered com- pany."

Prior to the sale, Moran and

McAllister were close in size; now,

Moran holds a sizable lead in ves- sels (approximately 85 to

McAllister's 50) and port activity (approximately 13 ports to

McAllister's nine).

Brian laughs when people ask if this new acquisition will result in price wars; stating the tugboat business has been a fairly depressed business development for years - basically a carry-over effect from the oilfield services col- lapse in the mid-1980s. "A lot of the operators came to the Northeast after the crash, and began offering services at very reduced rates," Brian says. "We had to cut some costs. We matched the Gulf of Mexico crew costs, low- ered our overhead and lowered our prices to stay competitive. "Basically, when we diversified in the 1980s, we became heavily involved in the oilfield services industry," Brian says. "We hit a zenith in 1985, with nearly 35

OSVs. By the time the collapse ended, we had 18 left, and we had sold some tugboats as well, all in the name of survival."

Moran and Turecamo, by com- parison, hadn't diversified in that direction, and as a result, man- aged to pick up a lot of vessels at bargain prices, including one of

McAllister's boats. "You saw brand new $3.5 mil- lion vessels, being delivered and going straight into lay-up, only to be sold a few years later for $500,000," says Brian.

Now, as Brian looks to refurbish his fleet, he is optimistic he will be on the receiving end of those bar- gains. "It's possible if the price of oil stays where it is, there will be a lot of bargains around again," he says.

The Future

Because the company's primary business is shipdocking, it has, since 1962, concentrated its new- buildings on tractor tugs. It was in that year that McAllister acquired, from the Dravo Corp., two flanking rudder tractor tugs. Since then,

McAllister has built 17 more, the most recent being Brooks K.

McAllister, a Z-propeller tug, built in 1986. In fact, Brooks K., at 4,300 hp, was the first high-powered Z-

Circle 370 on Reader Service Card

55

55

57

57