Page 22: of Maritime Reporter Magazine (June 1999)

Read this page in Pdf, Flash or Html5 edition of June 1999 Maritime Reporter Magazine

Market Reports

The Tanker Market: Which Way Is Up? 22 "The Yearbook" Maritime Reporter/Engineering News

Carried out in a vacuum, the tanker market would be an easy one to predict and analyze. As tankers get older, qual- ity owners scrap technically inferior ton- nage in favor of new ships which offer operational benefits and savings. But real world scenarios, including severe economic crisis, naturally and political- ly controlled oil flow and pricing, and greed all enter into the decision of when, where and why new tankers are ordered and old ones sold. In its March 1999

Bulletin (No. 63/99), Intertanko ana- lyzes the undercurrents of tanker new- build and scrapping practices in an arti- cle entitled "Bubbles under the surface in the tanker industry, but few erup- tions." The article notes that shipowners operating 1970s built Suezmax and

VLCC tankers of good quality have enjoyed good profits, in fact equating the fleet of this description as "cash cows." The organization notes that 76 different owners in all (including oil companies and state owners) have their entire fleet comprised of vessels built in the 1970s. Interestingly, 41 percent of owners in the 120,000+ dwt segment has all 1970s built vessels. Most of these owners operate small fleets, comprised of one or two ships, but cumulatively they represent quite a bit of tonnage.

In fact, the Intertanko study found that only 10 of 198 owners in the 120,000+ dwt category operate what would be considered balanced fleets of new and older ships. Among the operators of new tonnage of this category are Front- line, with 23 ships, and many of the largest Japanese owners.

Old ships do not necessarily mean poor ships, however, as Intertanko notes that there has been a strong reduction in accidental and operational pollution from tankers. (For example: between 1970 and 1984, there was a total of 3,824,000 tons spilled; from 1984 to 1998, there was 1,535,000 tons, a 60 percent reduction). The organization in part credits mandates such as the intro- duction of the ISM Code, as well as revisions of STCW. 1998: Rates Well Maintained Despite The

Asian Crisis

The tanker market reached the peak of the cycle in the fall of 1997 and has since been showing a declining trend.

Despite the crisis in Asia, freight rates have, however, been relatively well maintained in 1998. This is quite in line with the main fundamentals: Oil pro- (Continued on page 29)

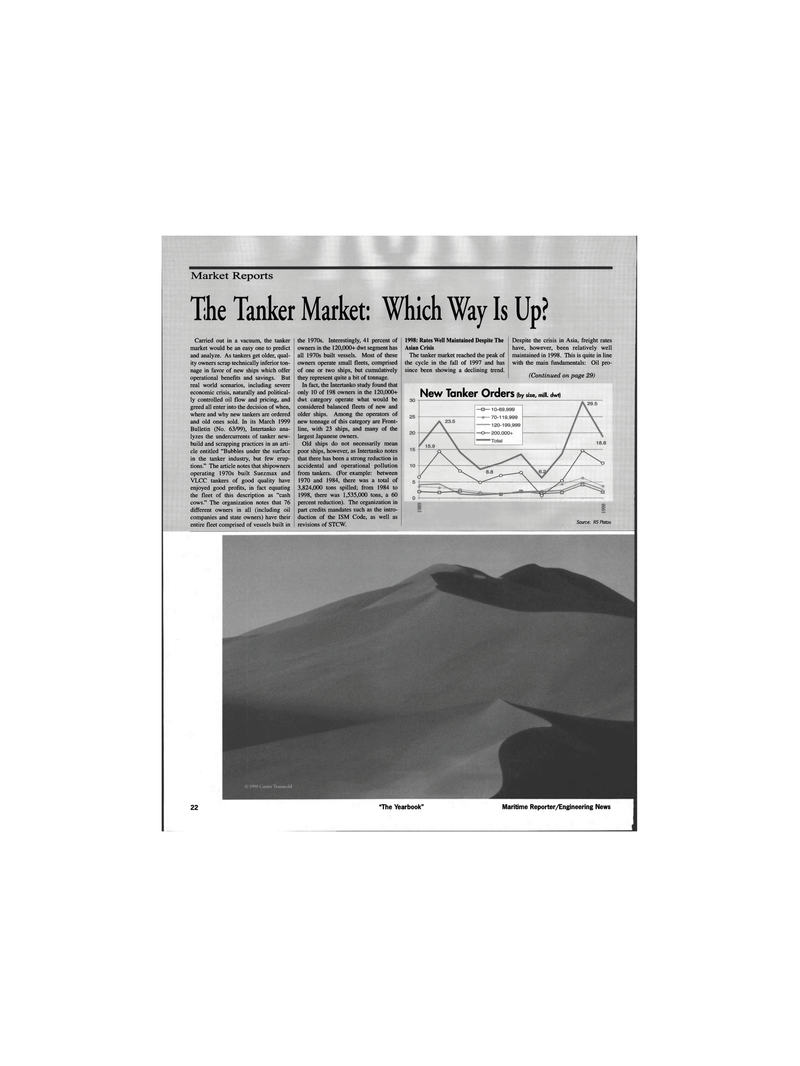

Source: RS Platou

New Tanker Orders (by size, mill, dwt)

21

21

23

23