Page 14: of Maritime Reporter Magazine (September 1999)

Read this page in Pdf, Flash or Html5 edition of September 1999 Maritime Reporter Magazine

designed to ensure the long-term health of Teekay.

Enhanced operating mode

A very basic restructuring of Teekay's marine operations was dubbed "Project

Synergy." In short, the move entails the division of the fleet into smaller units, with all aspects managed by a cross- functional ship team, designed to opti- mize fleet operations and make the com- pany more responsive to customer needs. The ship teams support and are supported by standards and policy teams, which fulfill several critical func- tions including acting as a center of expertise to the ship teams; ensuring high, uniform standard of operation and driving continuous improvement.

More recently, Teekay has entered into the launch of an innovative marine pur- chasing cooperative known as MAR-

CAS. In partnership with two other major shipping entities, MARCAS seeks to leverage economies of scale in the purchase of products and services for ships, and in effect creates an entity that buys supplies for 250 ships. Vessel operating expenses totaled more than $84 million, including salaries — for the company in FY'99, and Teekay antici- pates that cost efficiencies through pro- grams such as MARCAS — particularly with a gradual increase of membership and a widening of the scope of services provided to the organization's members -— will help enhance the bottom line for years to come.

According to Bjorn Moller, Teekay's director president & CEO, the company expects the tanker market to remain dif- ficult in the near term, but is counting on

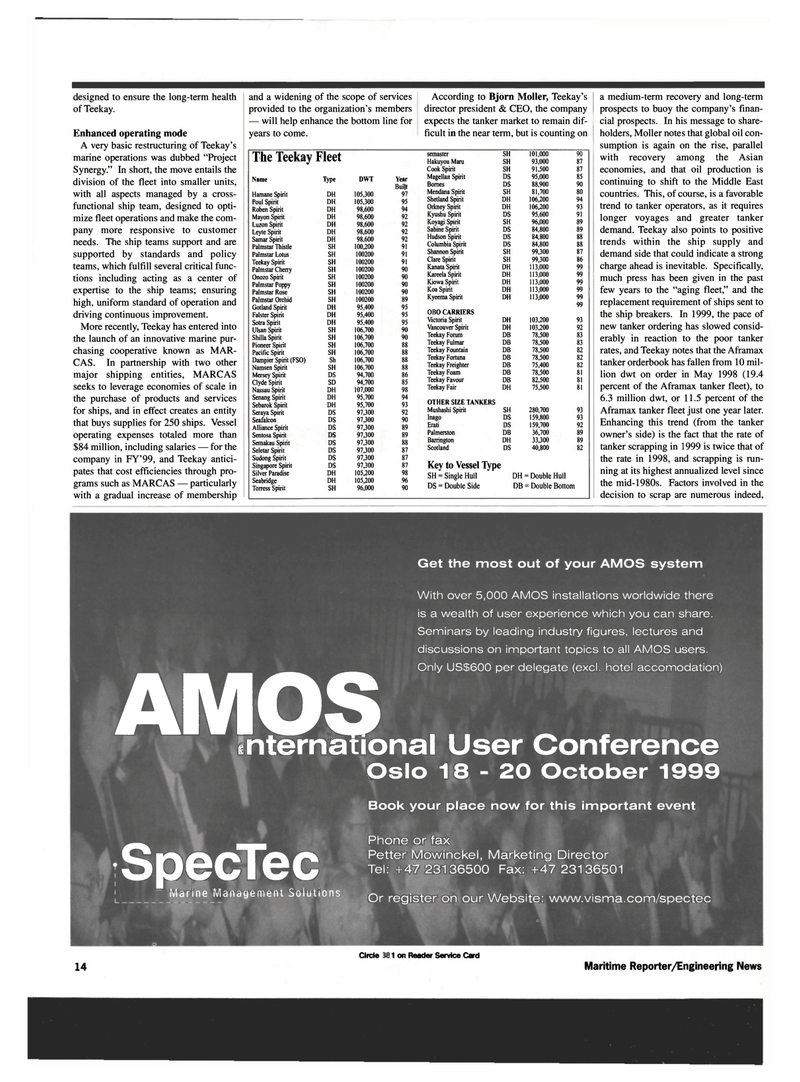

The Teekay Fleet

Name Type DWT Year

Built

Hamane Spirit DH 105,300 97

Poul Spirit DH 105,300 95

Roben Spirit DH 98,600 94

Mayon Spirit DH 98,600 92

Luzon Spirit DH 98,600 92

Leyte Spirit DH 98,600 92

Samar Spirit DH 98.600 92

Palmstar Thistle SH 100,200 91

Palmstar Lotus SH 100200 91

Teekay Spirit SH 100200 91

Palmstar Cheny SH 100200 90

Onozo Spirit SH 100200 90

Palmstar Poppy SH 100200 90

Palmstar Rose SH 100200 90

Palmstar Orchid SH 100200 89

Gotland Spirit DH 95,400 95

Falster Spirit DH 95,400 95

Sotra Spirit DH 95,400 95

Ulsan Spirit SH 106,700 90

Shilla Spirit SH 106,700 90

Pioneer Spirit SH 106,700 88

Pacific Spirit SH 106,700 88

Dampier Spirit (FS0) Sh 106,700 88

Namsen Spirit SH 106,700 88

Mersey Spirit DS 94,700 86

Clyde Spirit SD 94,700 85

Nassau Spirit DH 107,000 98

Senang Spirit DH 95,700 94

Sebarok Spirit DH 95,700 93

Seraya Spirit DS 97,300 92

Seafalcon DS 97,300 90

Alliance Spirit DS 97,300 89

Sentosa Spirit DS 97,300 89

Semakau Spirit DS 97,300 88

Seletar Spirit DS 97,300 87

Sudong Spirit DS 97,300 87

Singapore Spirit DS 97,300 87

Silver Paradise DH 105,200 98

Seabridge DH 105,200 96

ToiTess Spirit SH 96,000 90 semaster SH 101,000 90

Hakuyou Mani SH 93,000 87

Cook Spirit SH 91,500 87

Magellan Spirit DS 95,000 85

Bomes DS 88,900 90

Mendana Spirit SH 81,700 80

Shetland Spirit DH 106,200 94

Orkney Spirit DH 106,200 93

Kyushu Spirit DS 95,600 91

Koyagi Spirit SH 96,000 89

Sabine Spirit DS 84,800 89

Hudson Spirit DS 84,800 88

Columbia Spirit DS 84,800 88

Shannon Spirit SH 99,300 87

Clare Spirit SH 99,300 86

Kanata Spirit DH 113,000 99

Kareela Spirit DH 113,000 99

Kiowa Spirit DH 113,000 99

Koa Spirit DH 113,000 99

Kyeema Spirit DH 113,000 99 99

OBO CARRIERS

Victoria Spirit DH 103,200 93

Vancouver Spirit DH 103,200 92

Teekay Forum DB 78,500 83

Teekay Fulmar DB 78,500 83

Teekay Fountain DB 78,500 82

Teekay Fortuna DB 78,500 82

Teekay Freighter DB 75,400 82

Teekay Foam DB 78,500 81

Teekay Favour DB 82,500 81

Teekay Fair DH 75,500 81

OTHER SIZE TANKERS

Mushashi Spirit SH 280,700 93

Inago DS 159,800 93

Erati DS 159,700 92

Palmerston DB 36,700 89

Banington DH 33,300 89

Scotland DS 40,800 82

Key to Vessel Type

SH = Single Hull DH = Double Hull

DS = Double Side DB = Double Bottom a medium-term recovery and long-term prospects to buoy the company's finan- cial prospects. In his message to share- holders, Moller notes that global oil con- sumption is again on the rise, parallel with recovery among the Asian economies, and that oil production is continuing to shift to the Middle East countries. This, of course, is a favorable trend to tanker operators, as it requires longer voyages and greater tanker demand. Teekay also points to positive trends within the ship supply and demand side that could indicate a strong charge ahead is inevitable. Specifically, much press has been given in the past few years to the "aging fleet," and the replacement requirement of ships sent to the ship breakers. In 1999, the pace of new tanker ordering has slowed consid- erably in reaction to the poor tanker rates, and Teekay notes that the Aframax tanker orderbook has fallen from 10 mil- lion dwt on order in May 1998 (19.4 percent of the Aframax tanker fleet), to 6.3 million dwt, or 11.5 percent of the

Aframax tanker fleet just one year later.

Enhancing this trend (from the tanker owner's side) is the fact that the rate of tanker scrapping in 1999 is twice that of the rate in 1998, and scrapping is run- ning at its highest annualized level since the mid-1980s. Factors involved in the decision to scrap are numerous indeed,

AMOS Intematic

Get the most out of your AMOS system

With over 5,000 AMOS installations worldwide there is a wealth of user experience which you can share.

Seminars by leading industry figures, lectures and discussions on important topics to all AMOS users.

Only US$600 per delegate (excl. hotel accomodation)

SpecTec ™ a a _ . • i\ n i- r* I .. i.: Marine Management Solutions ional User Conference

Oslo 18-20 October 1999

Book your place now for this important event

Phone or fax

Petter Mowinckel, Marketing Director

Tel: + 47 23136500 Fax: +47 23136501

Or register on our Website: www.visma.com/spectec 14

Circle 271 on Reader Service Card

Maritime Reporter/Engineering News

13

13

15

15