Page 38: of Maritime Reporter Magazine (November 1999)

Read this page in Pdf, Flash or Html5 edition of November 1999 Maritime Reporter Magazine

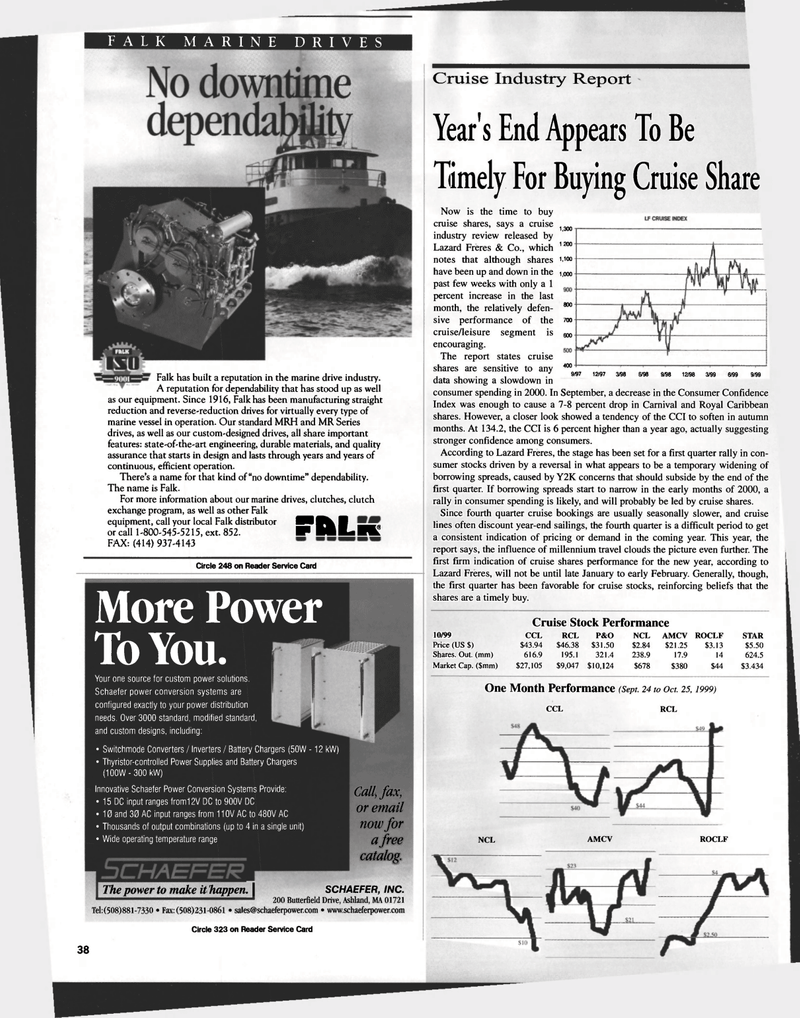

FALK MARINE DRIVES More Power Cruise Stock Performance 10/99 CCL RCL P&O NCL AMCV ROCLF STAR Price (US $) $43.94 $46.38 $31.50 $2.84 $21.25 $3.13 $5.50 Shares. Out. (mm) 616.9 195.1 321.4 238.9 17.9 14 624.5 Market Cap. ($mm) $27,105 $9,047 $10,124 $678 $380 $44 $3,434 Circle 248 on Reader Service Card Cruise Industry Report Falk has built a reputation in the marine drive industry. A reputation for dependability that has stood up as well as our equipment. Since 1916, Falk has been manufacturing straight reduction and reverse-reduction drives for virtually every type of marine vessel in operation. Our standard MRH and MR Series drives, as well as our custom-designed drives, all share important features: state-of-the-art engineering, durable materials, and quality assurance that starts in design and lasts through years and years of continuous, efficient operation. There's a name for that kind of "no downtime" dependability. The name is Falk. For more information about our marine drives, clutches, clutch exchange program, as well as other Falk equipment, call your local Falk distributor B or call 1-800-545-5215, ext. 852. W HLK FAX: (414) 937-4143 Year's End Appears To Be Timely For Buying Cruise Share Now is the time to buy cruise shares, says a cruise J 1,300 industry review released by Lazard Freres & Co., which 1200 notes that although shares '?10° have been up and down in the 1,000 past few weeks with only a 1 percent increase in the last month, the relatively defen- 800 sive performance of the TOO cruise/leisure segment is a*, encouraging. The report states cruise shares are sensitive to any 400 . 9/97 12/97 3/98 Kf98 9/98 12/98 3/99 6/99 9/99 data showing a slowdown in consumer spending in 2000. In September, a decrease in the Consumer Confidence Index was enough to cause a 7-8 percent drop in Carnival and Royal Caribbean shares. However, a closer look showed a tendency of the CCI to soften in autumn months. At 134.2, the CCI is 6 percent higher than a year ago, actually suggesting stronger confidence among consumers. According to Lazard Freres, the stage has been set for a first quarter rally in con-sumer stocks driven by a reversal in what appears to be a temporary widening of borrowing spreads, caused by Y2K concerns that should subside by the end of the first quarter. If borrowing spreads start to narrow in the early months of 2000, a rally in consumer spending is likely, and will probably be led by cruise shares. Since fourth quarter cruise bookings are usually seasonally slower, and cruise lines often discount year-end sailings, the fourth quarter is a difficult period to get a consistent indication of pricing or demand in the coming year. This year, the report says, the influence of millennium travel clouds the picture even further. The first firm indication of cruise shares performance for the new year, according to Lazard Freres, will not be until late January to early February. Generally, though, the first quarter has been favorable for cruise stocks, reinforcing beliefs that the shares are a timely buy. To You. Your one source for custom power solutions. Schaefer power conversion systems are configured exactly to your power distribution needs. Over 3000 standard, modified standard, and custom designs, including: ? Switchmode Converters / Inverters / Battery Chargers (50W -? Thyristor-controlled Power Supplies and Battery Chargers (100W - 300 kW) 12 kW) Innovative Schaefer Power Conversion Systems Provide: ? 15 DC input ranges from12V DC to 900V DC ? 10 and 30 AC input ranges from 110V AC to 480V AC ? Thousands of output combinations (up to 4 in a single unit) ? Wide operating temperature range Call, fax, or email now for a free catalog. SCHAEFER, INC. 200 Butterfleld Drive, Ashland, MA 01721 Tel:(508)881-7330 ? Fax: (508)231-0861 ? [email protected] ? www.schaeferpower.com The power to make it happen. \ Circle 323 on Reader Service Card One Month Performance (Sept. 24 to Oct. 25,1999) CCL RCL NCL AMCV ROCLF 38

37

37

39

39