Page 32: of Maritime Reporter Magazine (April 2000)

Read this page in Pdf, Flash or Html5 edition of April 2000 Maritime Reporter Magazine

Offshore Market

Projections center on When, not If

As the per barrel price of oil continued to soar through new stratospheres, offshore oil drilling companies and key marine industry suppliers alike wonder when the next offshore boom will ignite.

The cyclical nature of the offshore exploration and production beast is leg- endary in financial circles, riding boom and bust waves for years at a time.

While industry analysts and insiders alike had forecast a pick-up in activity no sooner than mid-year 2000. the col- lective industry is "itching" to get back to the business of building, repairing and supplying the myriad of rigs, boats and otherjausiness opportunities that abound and recover resources in deeper waters more efficiently seemingly made the industry bulletproof.

Enter OPEC.

At a meeting in Jakarta, Indonesia in

November 1997, OPEC leaders decided to raise production quotas in an effort to cash in on the high-flying market.

While this action alone cannot be blamed for the staggering collapse of oil pricing in 1998 and 1999, it — cora- lous financial crisis and tion lost during the low cost period.

Exploration for oil outside of OPEC picked up in the late 1970s in order to counter dependence on the cartel's oil following oil price shocks in 1973 and 1979. Currently, the world depends on this group's production to meet about two-thirds of the current 75 million bpd of crude oil demand.

Although oil demand growing and crude oil prices have topped $33 a bar- rel, analysts say upstream spending sti natural that sustained high prices would sooner than later drive a resurgence of the moribund offshore business, a host of factors — chief among them the very nature of today's corporate consolidated oil industry and the political powerplays by the OPEC nations — have conspired to delay the inevitable upswing in the

Gulf of Mexico.

A potential positive can be seen in the

Offshore Safety Article, which begins on page 36. In discussing Schlumberger's "safety and training program Bruce

Adams, the QHSE manager, admits the high level of hiring in 1Q 2000 has created "high" demand for safety and . . . ""Ww training sessions. "Ghost of Jakarta," industry consolidation, political issues and questionable numbers current drivers in world oil markets

Following repeated cries from around the globe, OPEC finally cut daily pro- uctjo^in aft effojJ to prop* the lagging continue to approach upstream spending cautiously, choosing instead to reduce debt, buy back shares, and explore for natural gas." of oil. That action taken last spring fiaH resulted in a more than tripling of the price of oil, which barreled through the $30 level in reccPtmonths. The pro- duction output has effectively squeezed supply worldwide, as demand has increased during the drawdown. ? froja Inter- sex JHHEBKfeound will be delayed a •••JionSr* fPPffWcy (IEAT; "the onger than originally anticiplfra ^"ffilmbers show marjcets^afe tight and i Ahead

Respite the logic run resuli

The, supply and demand curve will be permanendy skewered by the fact that so few hold such a tight grip on the major- ity of the world's oil supply.

It was late in 1997 when the offshore oilfield markets were enjoyini ting tighter." " "ip

The recent oil-price crisis set back non-OPEC output growth for at least year, a recent repor

Significant Growth on the Horizon?

From 2000 to 2003, Deutsche Banc "Alex. Bray.n estimates tfiat "worldwide deYnand should grow some 6.5 million- bpd. or 1.625 million bpd annually, On the supply side, after five years of growth during which non-OPEC pro- duction rose by an average of around 770,000 bpd annually, 199? saw output outside the cartel stay flat. This year^ expectations are for a large gain, but not from new projects but from those put on hold last year. Other analysts' predic- tions are significantly more skeptical, with some predicting a jump of 200,000 to 300,000 for 2000, with no quantifi- jneasure until 3Q 2000. to toufS^lgh^lls'c^'Oil- as an indi- _tor that production in other, non- tie$«testart soon, many con- labor to fulfill refurbish rig and vessel orders. The off- shore oil sector was a Wall Street dar- ' ^planting technology and ector in I biotechs for which to invest. exploratic with oil prices - for every oriP when crude prices are below the cost of 1?6; eVdlving fechnol- ,production, it takes three months of high around the world (see cl producers to discover prices to regain the volume of produc- spark activity in U.S. yards. While a (continued on page 35) fPPv.

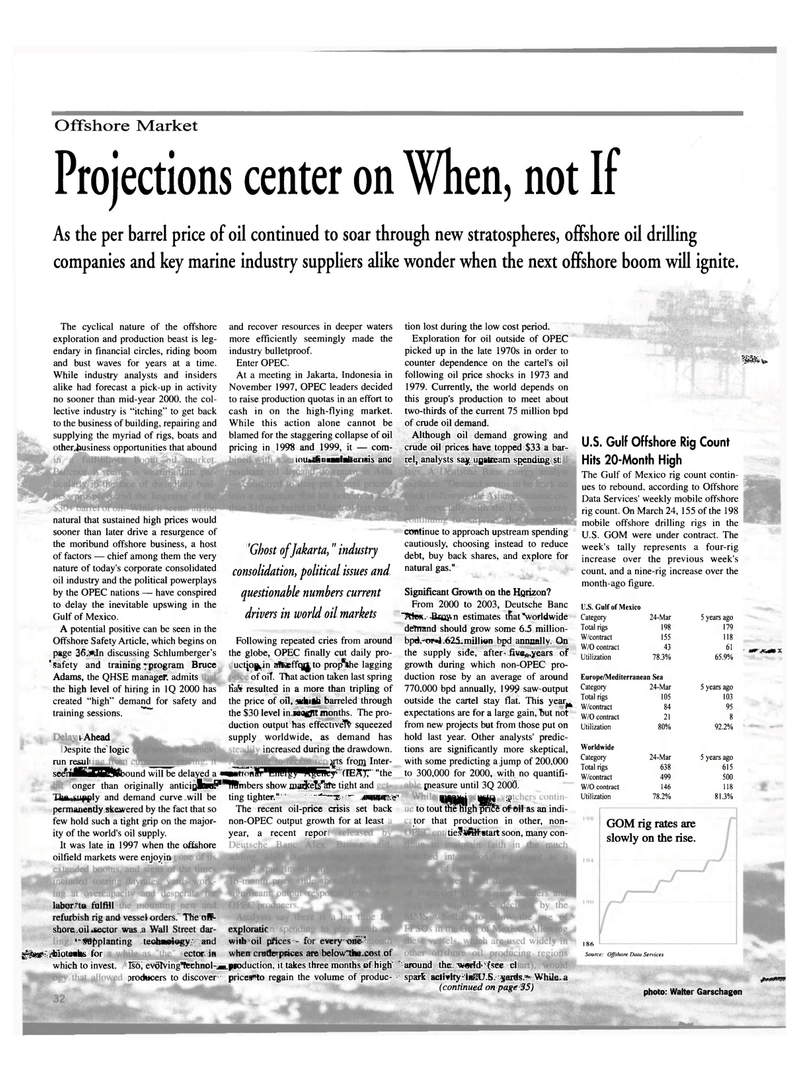

U.S. Gulf Offshore Rig Count

Hits 20-Month High

The Gulf of Mexico rig count contin- ues to rebound, according to Offshore

Data Services' weekly mobile offshore rig count. On March 24, 155 of the 198 mobile offshore drilling rigs in the

U.S. GOM were under contract. The week's tally represents a four-rig increase over the previous week's count, and a nine-rig increase over the month-ago figure.

U.S. Gulf of Mexico

Category

Total rigs

W/contract

W/0 contract

Utilization 24-Mar 198 155 43 78.3% 5 years ago 179 118 61 65.9% " •mr jft^mx.

Europe/Mediterranean Sea

Category 24-Mar

Total rigs 105

W/contract 84

W/0 contract 21

Utilization 80% 5 years ago 103 95 8 92.2%

Worldwide

Category

Total rigs

W/contract

W/O contract

Utilization 24-Mar 638 499 146 78.2% 5 years ago 615 500 118 81.3% 186

GOM rig rates are slowly on the rise.

Source: Offshore Data Services pifV'N*?^PS photo: Walter Garschagen

31

31

33

33