Page 24: of Maritime Reporter Magazine (May 2003)

Read this page in Pdf, Flash or Html5 edition of May 2003 Maritime Reporter Magazine

NorShipping 2003

Farstad Shipping ASA is a valued Norwegian owner/oper ator of offshore supply vessels, well regarded for its inno- vative approach but reliance on conservative values in rela tion to safety of ships and crew.

The company, which has steadily built its fleet and reputation in the offshore sector since exiting the tanker business in 1973, has a decidedly neutral take on the future, though. "There is a lot of uncer- tainty right now, about how the industry will move forward," said Torstein L.

Stavseng, Farstad's CFO. "We are enter- ing a period where there is a lot of over- tonnage, which will require us to push into new fields. More than likely, some of the small players will disappear into the larger ones."

While the crystal ball may seem a bit cloudy, Farstad has proven in the past to be an astute evaluator of companies and markets in the past. It acquired the Seafourth fleet in 1989, just as the market was starting to pick up steam.

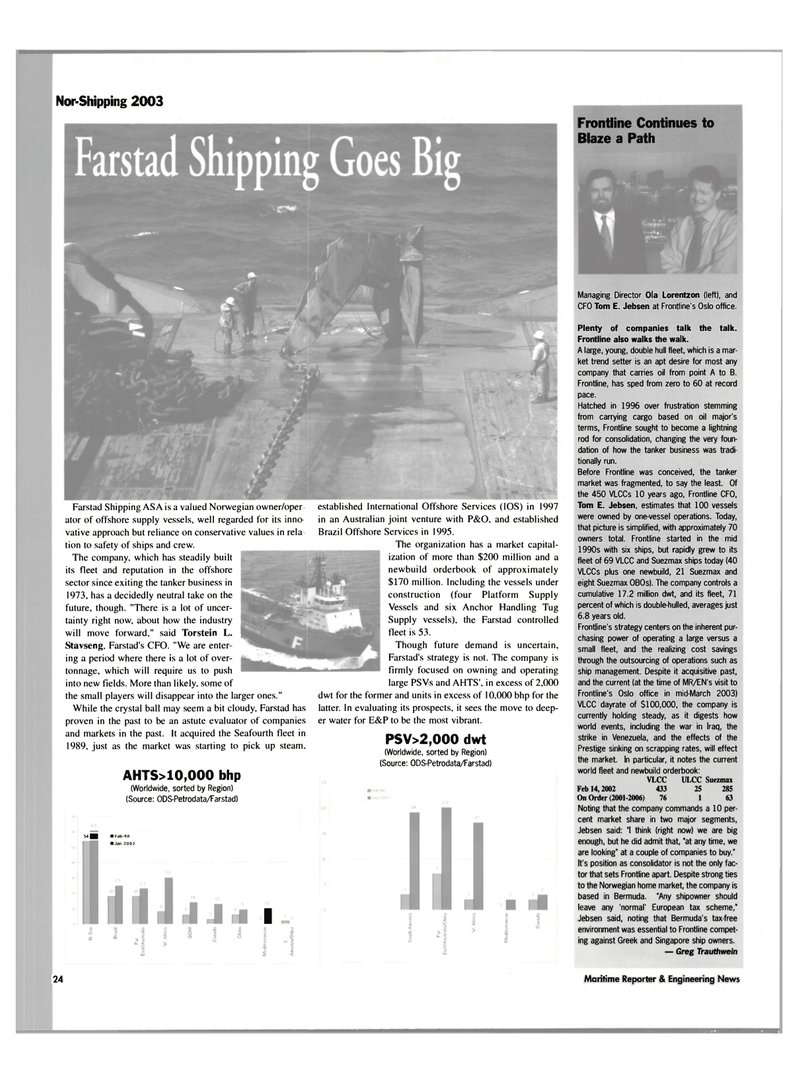

AHTS>10,000 bhp (Worldwide, sorted by Region) (Source: ODS-Petrodata/Farstad) established International Offshore Services (IOS) in 1997 in an Australian joint venture with P&O, and established

Brazil Offshore Services in 1995.

The organization has a market capital- ization of more than $200 million and a newbuild orderbook of approximately $170 million. Including the vessels under construction (four Platform Supply

Vessels and six Anchor Handling Tug

Supply vessels), the Farstad controlled fleet is 53.

Though future demand is uncertain,

Farstad's strategy is not. The company is firmly focused on owning and operating large PS Vs and AHTS', in excess of 2,000 dwt for the former and units in excess of 10,000 bhp for the latter. In evaluating its prospects, it sees the move to deep- er water for E&P to be the most vibrant.

PSV>2,000 dwt (Worldwide, sorted by Region) (Source: ODS-Petrodata/Farstad) 54 IB nFeb-98 • Jan.2003

I 24

Frontline Continues to

Blaze a Path

Managing Director Ola Lorentzon (left), and

CFO Tom E. Jebsen at Frontline's Oslo office.

Plenty of companies talk the talk.

Frontline also walks the walk.

A large, young, double hull fleet, which is a mar- ket trend setter is an apt desire for most any company that carries oil from point A to B.

Frontline, has sped from zero to 60 at record pace.

Hatched in 1996 over frustration stemming from carrying cargo based on oil major's terms, Frontline sought to become a lightning rod for consolidation, changing the very foun- dation of how the tanker business was tradi- tionally run.

Before Frontline was conceived, the tanker market was fragmented, to say the least. Of the 450 VLCCs 10 years ago, Frontline CFO,

Tom E. Jebsen, estimates that 100 vessels were owned by one-vessel operations. Today, that picture is simplified, with approximately 70 owners total. Frontline started in the mid 1990s with six ships, but rapidly grew to its fleet of 69 VLCC and Suezmax ships today (40

VLCCs plus one newbuild, 21 Suezmax and eight Suezmax OBOs). The company controls a cumulative 17.2 million dwt, and its fleet, 71 percent of which is double-hulled, averages just 6.8 years old.

Frontline's strategy centers on the inherent pur- chasing power of operating a large versus a small fleet, and the realizing cost savings through the outsourcing of operations such as ship management. Despite it acquisitive past, and the current (at the time of MR/EN's visit to

Frontline's Oslo office in mid-March 2003)

VLCC dayrate of $100,000, the company is currently holding steady, as it digests how world events, including the war in Iraq, the strike in Venezuela, and the effects of the

Prestige sinking on scrapping rates, will effect the market. In particular, it notes the current world fleet and newbuild orderbook:

VLCC ULCC Suezmax

Feb 14,2002 433 25 285

On Order (2001-2006) 76 1 63

Noting that the company commands a 10 per- cent market share in two major segments,

Jebsen said: "I think (right now) we are big enough, but he did admit that, "at any time, we are looking" at a couple of companies to buy."

It's position as consolidator is not the only fac- tor that sets Frontline apart. Despite strong ties to the Norwegian home market, the company is based in Bermuda. 'Any shipowner should leave any 'normal' European tax scheme,"

Jebsen said, noting that Bermuda's tax-free environment was essential to Frontline compet- ing against Greek and Singapore ship owners. — Greg Trauthwein

Maritime Reporter & Engineering News

23

23

25

25