Page 53: of Maritime Reporter Magazine (June 2003)

Read this page in Pdf, Flash or Html5 edition of June 2003 Maritime Reporter Magazine

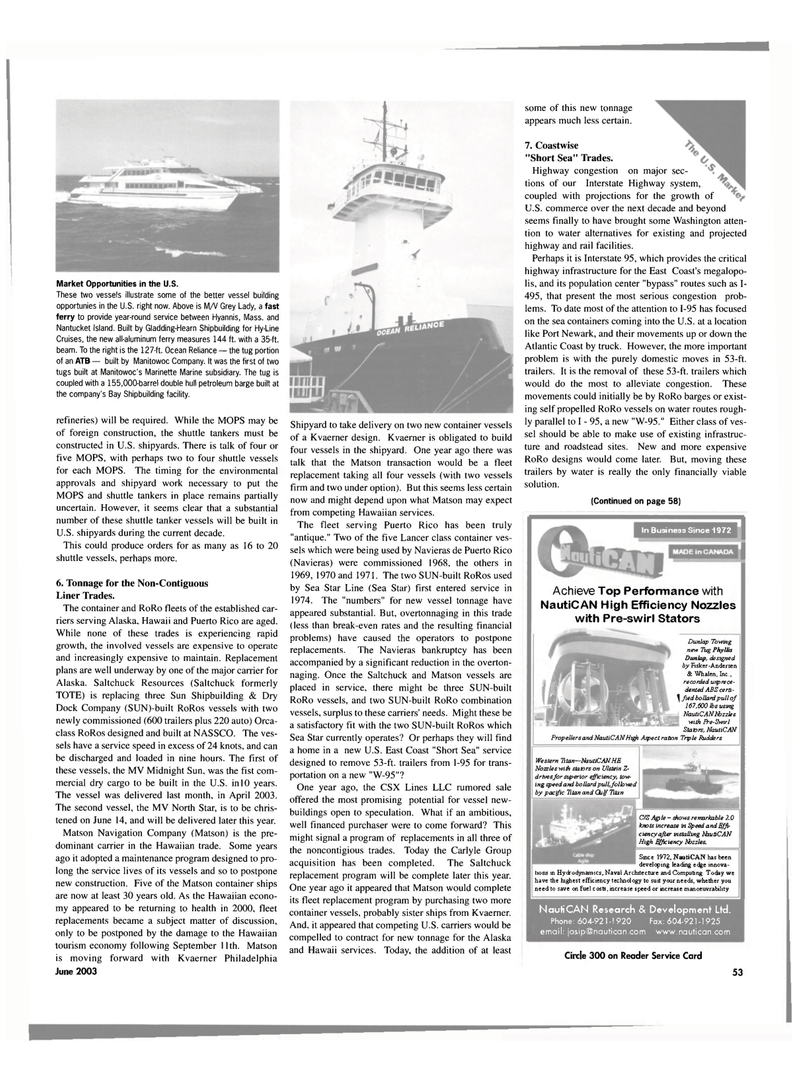

Market Opportunities in the U.S.

These two vessels illustrate some of the better vessel building opportunies in the U.S. right now. Above is M/V Grey Lady, a fast ferry to provide year-round service between Hyannis, Mass. and

Nantucket Island. Built by Gladding-Hearn Shipbuilding for Hy-Line

Cruises, the new all-aluminum ferry measures 144 ft. with a 35-ft. beam. To the right is the 127-ft. Ocean Reliance —the tug portion of an ATB — built by Manitowoc Company. It was the first of two tugs built at Manitowoc's Marinette Marine subsidiary. The tug is coupled with a 155,000-barrel double hull petroleum barge built at the company's Bay Shipbuilding facility. refineries) will be required. While the MOPS may be of foreign construction, the shuttle tankers must be constructed in U.S. shipyards. There is talk of four or five MOPS, with perhaps two to four shuttle vessels for each MOPS. The timing for the environmental approvals and shipyard work necessary to put the

MOPS and shuttle tankers in place remains partially uncertain. However, it seems clear that a substantial number of these shuttle tanker vessels will be built in

U.S. shipyards during the current decade.

This could produce orders for as many as 16 to 20 shuttle vessels, perhaps more. 6. Tonnage for the Non-Contiguous

Liner Trades.

The container and RoRo fleets of the established car- riers serving Alaska, Hawaii and Puerto Rico are aged.

While none of these trades is experiencing rapid growth, the involved vessels are expensive to operate and increasingly expensive to maintain. Replacement plans are well underway by one of the major carrier for

Alaska. Saltchuck Resources (Saltchuck formerly

TOTE) is replacing three Sun Shipbuilding & Dry

Dock Company (SUN)-built RoRos vessels with two newly commissioned (600 trailers plus 220 auto) Orca- class RoRos designed and built at NASSCO. The ves- sels have a service speed in excess of 24 knots, and can be discharged and loaded in nine hours. The first of these vessels, the MV Midnight Sun, was the fist com- mercial dry cargo to be built in the U.S. in 10 years.

The vessel was delivered last month, in April 2003.

The second vessel, the MV North Star, is to be chris- tened on June 14, and will be delivered later this year.

Matson Navigation Company (Matson) is the pre- dominant carrier in the Hawaiian trade. Some years ago it adopted a maintenance program designed to pro- long the service lives of its vessels and so to postpone new construction. Five of the Matson container ships are now at least 30 years old. As the Hawaiian econo- my appeared to be returning to health in 2000, fleet replacements became a subject matter of discussion, only to be postponed by the damage to the Hawaiian tourism economy following September 11th. Matson is moving forward with Kvaerner Philadelphia

June 2003

Shipyard to take delivery on two new container vessels of a Kvaerner design. Kvaerner is obligated to build four vessels in the shipyard. One year ago there was talk that the Matson transaction would be a fleet replacement taking all four vessels (with two vessels firm and two under option). But this seems less certain now and might depend upon what Matson may expect from competing Hawaiian services.

The fleet serving Puerto Rico has been truly "antique." Two of the five Lancer class container ves- sels which were being used by Navieras de Puerto Rico (Navieras) were commissioned 1968, the others in 1969, 1970 and 1971. The two SUN-built RoRos used by Sea Star Line (Sea Star) first entered service in 1974. The "numbers" for new vessel tonnage have appeared substantial. But, overtonnaging in this trade (less than break-even rates and the resulting financial problems) have caused the operators to postpone replacements. The Navieras bankruptcy has been accompanied by a significant reduction in the overton- naging. Once the Saltchuck and Matson vessels are placed in service, there might be three SUN-built

RoRo vessels, and two SUN-built RoRo combination vessels, surplus to these carriers' needs. Might these be a satisfactory fit with the two SUN-built RoRos which

Sea Star currently operates? Or perhaps they will find a home in a new U.S. East Coast "Short Sea" service designed to remove 53-ft. trailers from 1-95 for trans- portation on a new "W-95"?

One year ago, the CSX Lines LLC rumored sale offered the most promising potential for vessel new- buildings open to speculation. What if an ambitious, well financed purchaser were to come forward? This might signal a program of replacements in all three of the noncontigious trades. Today the Carlyle Group acquisition has been completed. The Saltchuck replacement program will be complete later this year.

One year ago it appeared that Matson would complete its fleet replacement program by purchasing two more container vessels, probably sister ships from Kvaerner.

And, it appeared that competing U.S. carriers would be compelled to contract for new tonnage for the Alaska and Hawaii services. Today, the addition of at least some of this new tonnage appears much less certain. 7. Coastwise "Short Sea" Trades.

Highway congestion on major sec- tions of our Interstate Highway system, coupled with projections for the growth of

U.S. commerce over the next decade and beyond seems finally to have brought some Washington atten- tion to water alternatives for existing and projected highway and rail facilities.

Perhaps it is Interstate 95, which provides the critical highway infrastructure for the East Coast's megalopo- lis, and its population center "bypass" routes such as I- 495, that present the most serious congestion prob- lems. To date most of the attention to 1-95 has focused on the sea containers coming into the U.S. at a location like Port Newark, and their movements up or down the

Atlantic Coast by truck. However, the more important problem is with the purely domestic moves in 53-ft. trailers. It is the removal of these 53-ft. trailers which would do the most to alleviate congestion. These movements could initially be by RoRo barges or exist- ing self propelled RoRo vessels on water routes rough- ly parallel to I - 95, a new "W-95." Either class of ves- sel should be able to make use of existing infrastruc- ture and roadstead sites. New and more expensive

RoRo designs would come later. But, moving these trailers by water is really the only financially viable solution. (Continued on page 58)

NaufiCAN Research & Development Ltd.

Phone: 604-921-1920 Fax: 604-921-1925 email: [email protected] www.naufican.com

Circle 300 on Reader Service Card 53

In Business Since 1972

Western Titan—NautiCAN HE

Nozsleswith ski tors on Ulstein Z- d rives for superior efficiency, tow- ing speed and bollardpull,folhwsd by pacific Titan and Qulf Titan

C/S Agile - shows remarkable 2.0 knots increase in Speed and Effi- ciency after installing NautiCAN

High Efficiency "thzzles.

Since 1972, NautiCAN has been developing leading edge innova- tions in Hydrodynamics, Naval Architecture and Computing Today we have the highest efficiency technology to suit your needs, whether you need to save on fuel costs, increase speed or increase manoeuvrability.

Achieve Top Performance with

NautiCAN High Efficiency Nozzles with Pre-swirl Stators

Dunlap Towing new Tug Phyllis

Dunlap, designed by Fisker-Andersen & Whalen, Inc., recorded unprece- dented ABS certi- ^ fied bollard pull of 167,600 lbs using

NautiCAN bbzzles with Pre-Swirl

Stators, NautiCAN

Propellers and NautiCAN High Aspect ration Triple Pudders

52

52

54

54