Page 24: of Maritime Reporter Magazine (July 2003)

Read this page in Pdf, Flash or Html5 edition of July 2003 Maritime Reporter Magazine

Gulf of Mexico Report

Is More Drilling on the Way? "Deep" Gas in Shallow Water, Increased Deepwater Activities are Positive

Signs for Recovery

By Larry Pearson

There has been a steady stream of bad news recently in the marine press regarding the health of the oil and gas industry in the Gulf of Mexico.

Much of this bad "press" is fueled by boat operators who are trying to do a "Rope-a-dope" on their com- petitors.

That is by "talking the industry down" they are trying to convince competition that "better days" may be years out. hoping they may not be ready when the turn- around comes.

All indications are that the industry will indeed drill itself out of the current malaise - sooner than later. And the indicators for such a turnaround are right in front of your face if you know where to look.

In general, people who follow intensely the oil and gas industry all agree that a significant rebound is on the way.

CIBC World Markets is one such expert in oil and gas markets and they recently concluded, "During the past few months oil and gas operators seem to be get- ting a new degree of confidence in future natural gas prices.

As a result, we anticipate the 19 percent increase in drilling activity the oil field service industry has expe- rienced in the last 15 weeks could just be a precursor of things to come."

Paul H. Hilegeist. president of Quest Offshore

Resources, added. "An analysis of the North American

Gulf of Mexico market reveals a large upside potential for growth over the next six years despite weaker over- all market conditions in 2002."

Drilling for natural gas and oil drives the Gulf of

Mexico energy market. Here is an analysis of these two sectors and how development in both gas and oil impact the fleet of offshore vessels.

Natural Gas

A prime example of why a great increase in the drilling for natural gas is on the way is the action

Interior Secretary Gale Norton took recently when she proposed major new incentives to increase deep natu- ral gas production in the Gulf.

Under the proposal, the Interior Department's

Minerals Management Service would provide royalty suspension incentives when companies take the risk of exploring and developing deep gas deposits in shallow water areas already leased.

There are about 2.400 such leases targeted by the proposal. The royalty relief would be applicable for wells drilled beyond 15.000 ft. There is even a "dry hole" incentive built into this new program. If a dry hole 18.000 ft. or deeper is drilled, then a royalty relief of 5 billion cu. ft. of gas is given to the driller.

Most of those existing leases have been explored and wells drilled, but new technology makes it feasible to find gas at much greater depths than before.

The Energy Information Administration forecasts the demand for natural gas will increase by 30 percent in the next 15 years with supplies available to meet only 70 percent of this demand.

The immediate supply-demand equation for natural gas is tight at best. Natural gas prices have been run- ning about S6 per thousand cu. ft. .. .almost double that of a year ago.

Coupled with the price is that storage levels of the clean and odorless fuel are at a five year low after a colder than average winter. And even though rig count is up 44 percent since April 2002, storage is down almost 50 percent from just one year ago.

So the short term forecast for shallow water drilling mostly via jackups is very promising indeed.

Bob Alerio. president of the Marine Offshore

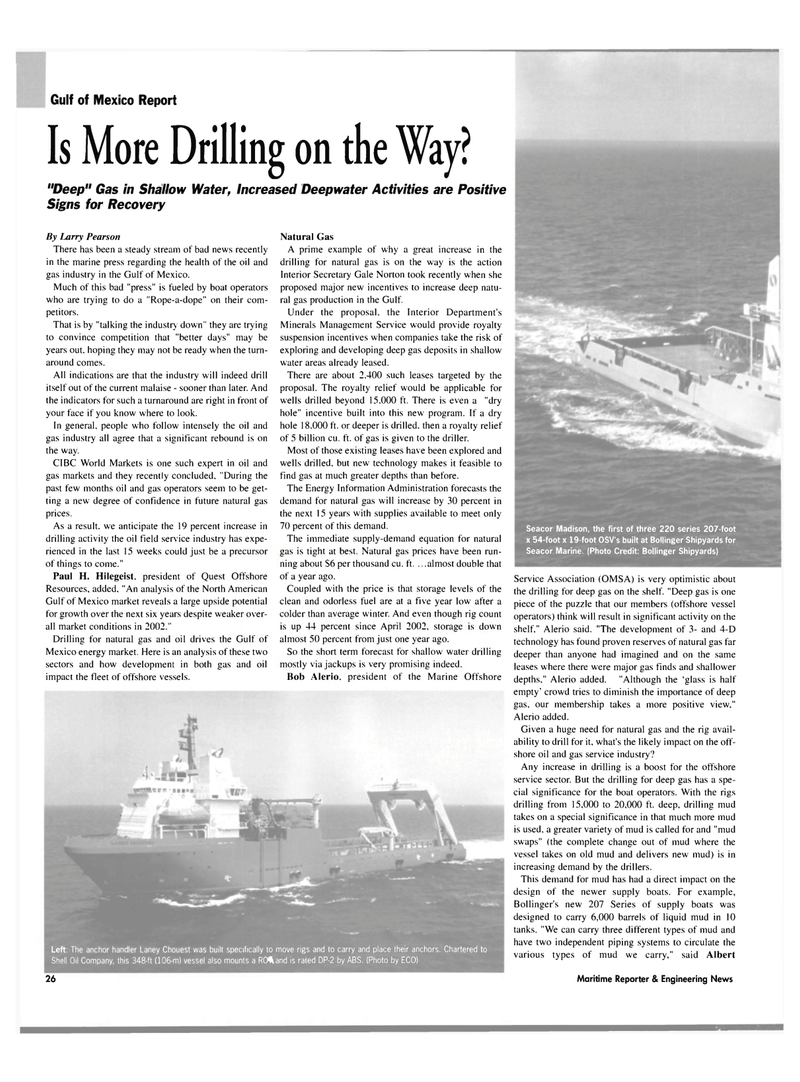

Left: The anchor handler Laney Chouest was built specifically to move rigs and to carry and place their anchors. Chartered to

Shell Oil Company, this 348-ft (106-m) vessel also mounts a RO^and is rated DP-2 by ABS. (Photo by ECO)

Seacor Madison, the first of three 220 series 207-foot x 54-foot x 19-foot OSV's built at Bollinger Shipyards for

Seacor Marine. (Photo Credit: Bollinger Shipyards)

Service Association (OMSA) is very optimistic about the drilling for deep gas on the shelf. "Deep gas is one piece of the puzzle that our members (offshore vessel operators) think will result in significant activity on the shelf." Alerio said. "The development of 3- and 4-D technology has found proven reserves of natural gas far deeper than anyone had imagined and on the same leases where there were major gas finds and shallower depths," Alerio added. "Although the 'glass is half empty' crowd tries to diminish the importance of deep gas, our membership takes a more positive view,"

Alerio added.

Given a huge need for natural gas and the rig avail- ability to drill for it, what's the likely impact on the off- shore oil and gas service industry?

Any increase in drilling is a boost for the offshore service sector. But the drilling for deep gas has a spe- cial significance for the boat operators. With the rigs drilling from 15,000 to 20,000 ft. deep, drilling mud takes on a special significance in that much more mud is used, a greater variety of mud is called for and "mud swaps" (the complete change out of mud where the vessel takes on old mud and delivers new mud) is in increasing demand by the drillers.

This demand for mud has had a direct impact on the design of the newer supply boats. For example,

Bollinger's new 207 Series of supply boats was designed to carry 6,000 barrels of liquid mud in 10 tanks. "We can carry three different types of mud and have two independent piping systems to circulate the various types of mud we carry," said Albert 26 Maritime Reporter & Engineering News

23

23

25

25