Page 19: of Maritime Reporter Magazine (February 2004)

The Tanker Yearbook: ATB Edition

Read this page in Pdf, Flash or Html5 edition of February 2004 Maritime Reporter Magazine

The Shipbuilding Report

SHIPBUILDING

China Preps To Take World Lead

Rapidly rising prices for steel plate in

China may be taking the edge off the financial performance at some Chinese shipbuilders. But it will take a lot more than that to undermine shipyards' dra- matic expansion plans aimed at ensuring the country's builders produce more ships than any other nation by 2015. In the short run, however, the country's rel- atively inexperienced builders seem to have failed to read the steel supply signs. They have found themselves caught out by a number of factors driv- ing up ship steel prices. These have risen by almost 60% over the last 30 months or so and now stand close to $400 a ton.

On the one hand, soaring steel demand in other sectors of the Chinese economy has left the country's steel producers with a choice of market outlets — wide steel plate used in the shipbuilding industry is not its product of choice.

Meanwhile, shipyard marketing teams were very successful during 2003 in booking large numbers of export con- tracts at prices significantly below those prevailing in South Korea and Japan.

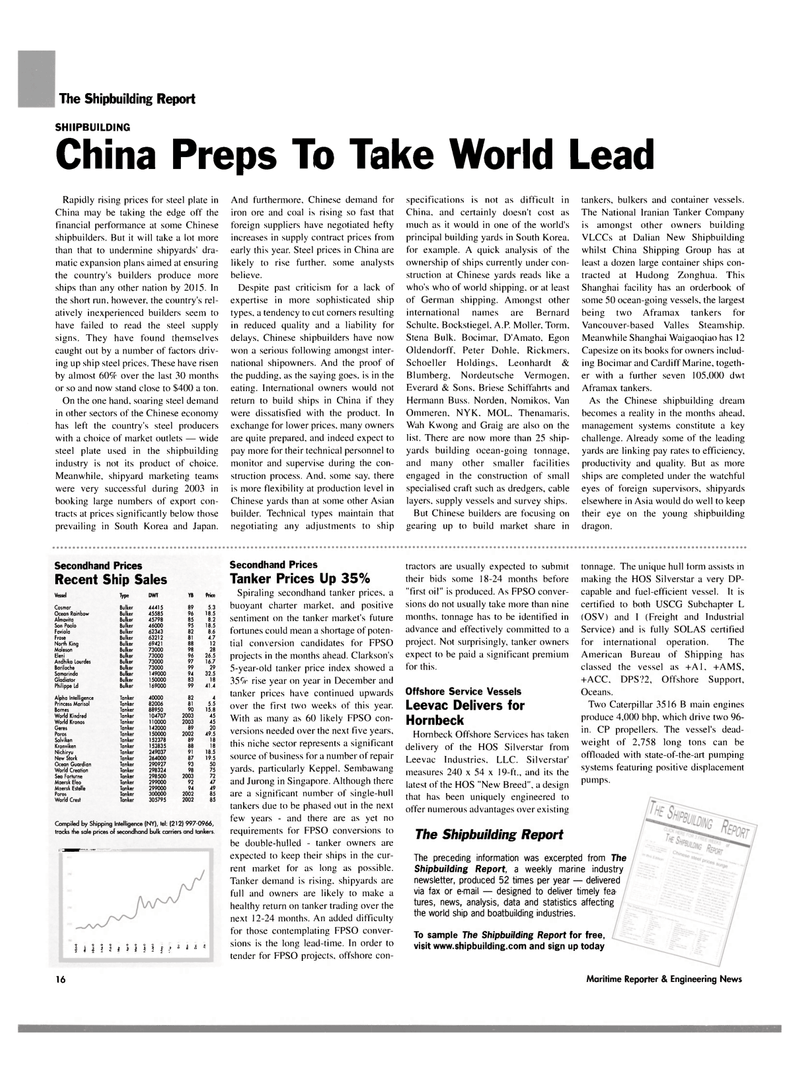

Secondhand Prices

Recent Ship Sales

Vessel Type DWT Y! Price

Cosmar Bulker 44415 89 5.3

Ocean Rainbow Bulker 45585 96 18.5

Almavita Bulker 45798 85 8.2

Son Paolo Bulker 46000 95 18.5

Faviola Bulker 62343 82 8.6

Frose Bulker 63212 81 4.7

North King Bulker 69421 88 12

Moleson Bulker 73000 98 28

Eleni Bulker 73000 96 26.5

Andhika lourdes Bulker 73000 97 16.7

Bariloche Bulker 73000 99 29

Samarinda Bulker 149000 94 32.5

Gladiator Bulker 150000 83 18

Philippe Ld Bulker 169000 99 41.4

Alpha Intelligence Tanker 40000 82 4

Princess Marisol Tanker 82006 81 5.5

Bornes Tanker 88950 90 15.8

World Kindred Tanker 104707 2003 45

World Kronos Tanker 110000 2003 45

Geres Tanker 142000 89 20

Poros Tanker 150000 2002 49.5

Solviken Tanker 152378 89 18

Kronviken Tanker 152835 88 18

Nichiryu Tanker 249037 91 18.5

New Stork Tanker 264000 87 19.5

Ocean Guardian Tanker 290927 93 50

World Creation Tanker 298324 98 75

Sea Forturne Tanker 298500 2003 72

Maersk Eleo Tanker 299000 92 47

Moersk Esteile Tanker 299000 94 49

Poros Tanker 300000 2002 85

World Crest Tanker 305795 2002 85

Compiled by Shipping Intelligence (NY), tel: (212) 997-0966, tracks the sale prices of secondhand bulk carriers and tankers.

IBMIIIRMNMIMVMNMMIMMNMMMNMnM | | | | J j J. J j J | f i i s i

And furthermore. Chinese demand for iron ore and coal is rising so fast that foreign suppliers have negotiated hefty increases in supply contract prices from early this year. Steel prices in China are likely to rise further, some analysts believe.

Despite past criticism for a lack of expertise in more sophisticated ship types, a tendency to cut corners resulting in reduced quality and a liability for delays. Chinese shipbuilders have now won a serious following amongst inter- national shipowners. And the proof of the pudding, as the saying goes, is in the eating. International owners would not return to build ships in China if they were dissatisfied with the product. In exchange for lower prices, many owners are quite prepared, and indeed expect to pay more for their technical personnel to monitor and supervise during the con- struction process. And. some say. there is more flexibility at production level in

Chinese yards than at some other Asian builder. Technical types maintain that negotiating any adjustments to ship

Secondhand Prices

Tanker Prices Up 35%

Spiraling secondhand tanker prices, a buoyant charter market, and positive sentiment on the tanker market's future fortunes could mean a shortage of poten- tial conversion candidates for FPSO projects in the months ahead. Clarkson's 5-year-old tanker price index showed a 359r rise year on year in December and tanker prices have continued upwards over the first two weeks of this year.

With as many as 60 likely FPSO con- versions needed over the next five years, this niche sector represents a significant source of business for a number of repair yards, particularly Keppel. Sembawang and Jurong in Singapore. Although there are a significant number of single-hull tankers due to be phased (Hit in the next few years - and there are as yet no requirements for FPSO conversions to be double-hulled - tanker owners are expected to keep their ships in the cur- rent market for as long as possible.

Tanker demand is rising, shipyards are full and owners are likely to make a healthy return on tanker trading over the next 12-24 months. An added difficulty for those contemplating FPSO conver- sions is the long lead-time. In order to tender for FPSO projects, offshore con- specifications is not as difficult in

China, and certainly doesn't cost as much as it would in one of the world's principal building yards in South Korea, for example. A quick analysis of the ownership of ships currently under con- struction at Chinese yards reads like a who's who of world shipping, or at least of German shipping. Amongst other international names are Bernard

Schulte. Bockstiegel. A.P. Moller, Torm,

Stena Bulk. Bocimar, D'Amato, Egon

Oldendorff, Peter Dohle, Rickmers.

Schoeller Holdings, Leonhardt &

Blumberg, Nordeutsche Vermogen.

Everard & Sons. Briese Schiffahrts and

Hermann Buss. Norden, Nomikos, Van

Ommeren, NYK, MOL. Thenamaris.

Wah Kwong and Graig are also on the list. There are now more than 25 ship- yards building ocean-going tonnage, and many other smaller facilities engaged in the construction of small specialised craft such as dredgers, cable layers, supply vessels and survey ships.

But Chinese builders are focusing on gearing up to build market share in tankers, bulkers and container vessels.

The National Iranian Tanker Company is amongst other owners building

VLCCs at Dalian New Shipbuilding whilst China Shipping Group has at least a dozen large container ships con- tracted at Hudong Zonghua. This

Shanghai facility has an orderbook of some 50 ocean-going vessels, the largest being two Aframax tankers for

Vancouver-based Valles Steamship.

Meanwhile Shanghai Waigaoqiao has 12

Capesize on its books for owners includ- ing Bocimar and Cardiff Marine, togeth- er with a further seven 105,000 dwt

Aframax tankers.

As the Chinese shipbuilding dream becomes a reality in the months ahead, management systems constitute a key challenge. Already some of the leading yards are linking pay rates to efficiency, productivity and quality. But as more ships are completed under the watchful eyes of foreign supervisors, shipyards elsewhere in Asia would do well to keep their eye on the young shipbuilding dragon. tractors are usually expected to submit their bids some 18-24 months before "first oil" is produced. As FPSO conver- sions do not usually take more than nine months, tonnage has to be identified in advance and effectively committed to a project. Not surprisingly, tanker owners expect to be paid a significant premium for this.

Offshore Service Vessels

Leevac Delivers for

Hornbeck

Hornbeck Offshore Services has taken delivery of the HOS Silverstar from

Leevac Industries. LLC. Silverstar' measures 240 x 54 x 19-ft., and its the latest of the HOS "New Breed", a design that has been uniquely engineered to offer numerous advantages over existing

The Shipbuilding Report

The preceding information was excerpted from The

Shipbuilding Report, a weekly marine industry newsletter, produced 52 times per year — delivered via fax or e-mail — designed to deliver timely fea- tures, news, analysis, data and statistics affecting the world ship and boatbuilding industries.

To sample The Shipbuilding Report for free, visit www.shipbuilding.com and sign up today tonnage. The unique hull torm assists in making the HOS Silverstar a very DP- capable and fuel-efficient vessel. It is certified to both USCG Subchapter L (OSV) and I (Freight and Industrial

Service) and is fully SOLAS certified for international operation. The

American Bureau of Shipping has classed the vessel as +A1, +AMS, +ACC. DPS?2, Offshore Support,

Oceans.

Two Caterpillar 3516 B main engines produce 4,000 bhp, which drive two 96- in. CP propellers. The vessel's dead- weight of 2,758 long tons can be offloaded with state-of-the-art pumping systems featuring positive displacement pumps. 16 Maritime Reporter & Engineering News

18

18

20

20