Page 24: of Maritime Reporter Magazine (April 2004)

Offshore Technology Yearbook

Read this page in Pdf, Flash or Html5 edition of April 2004 Maritime Reporter Magazine

Offshore Annual Oil Prices Skyrocket but

AMERICA

An Equal Opportunity Employer

GULF OF MEXICO OPERATIONS

US FLAG DYNAMICALLY POSITIONED

SEMI-SUBMERSIBLE MSV

DP2 ROV Support Monohull

DP Master, DP Mates

Chief Engineers, Assistant Engineers,

HV Elects, E. Techs, Rig

Mechanics, Cr. Ops, AB's,

Motormen, QMeds

Qualifications required include:

Oceans Unlimited Licences

OIM Certificate for Masters

Ballast Control Certificate

Nautical Institute DP Certificates

Full up to date STCW certification

Competitive pay scales - Benefits package with Medical, Dental, Life, 40IK

Forward resumes and copies of Certificates to:

Human Resources Department

C-MAR America Inc 11231 Richmond Avenue #111D

Houston

Texas 77082

Tel 281 556 1115

Fax 281 556 1141

E-mail : [email protected]

Circle 312 on Reader Service Card

Rig Demand in the Doldrums

By Tom Marsh, ODS-Petrodata, Houston

Worldwide demand for mobile offshore drilling units remains essentially flat, according to

Houston-based offshore industry analyst ODS-

Petrodata, although offshore drilling activity is expected to increase modestly in certain areas as the year progresses.

U.S. Gulf of Mexico rig demand has fallen by eight rigs since December, but some indicators point to an increase in Gulf rig demand over the summer months. North Sea rig owners are facing a tough year, and more rigs are expected to leave the area. Other rig markets present a mixed outlook, with only West Africa likely to show a clear, sus- tained trend to increased rig demand over the next three to six months.

U.S. Gulf of Mexico

The most encouraging sign for U.S. Gulf of

Mexico rig owners is the number of drilling plans filed by operators for programs in federal waters.

As of mid-March., oil and gas companies had filed 120 drilling plans with the Minerals Management

Service (MMS), compared to 86 plans tiled over the same period last year. Well permits issued by the agency are lagging slightly behind the year-ago number, but that is likely to change over the next several months as operators act on the plans filed in the early part of the year. In addition to the MMS tilings, industry observers note that applications to drill are on the rise for work in Louisiana state waters as well.

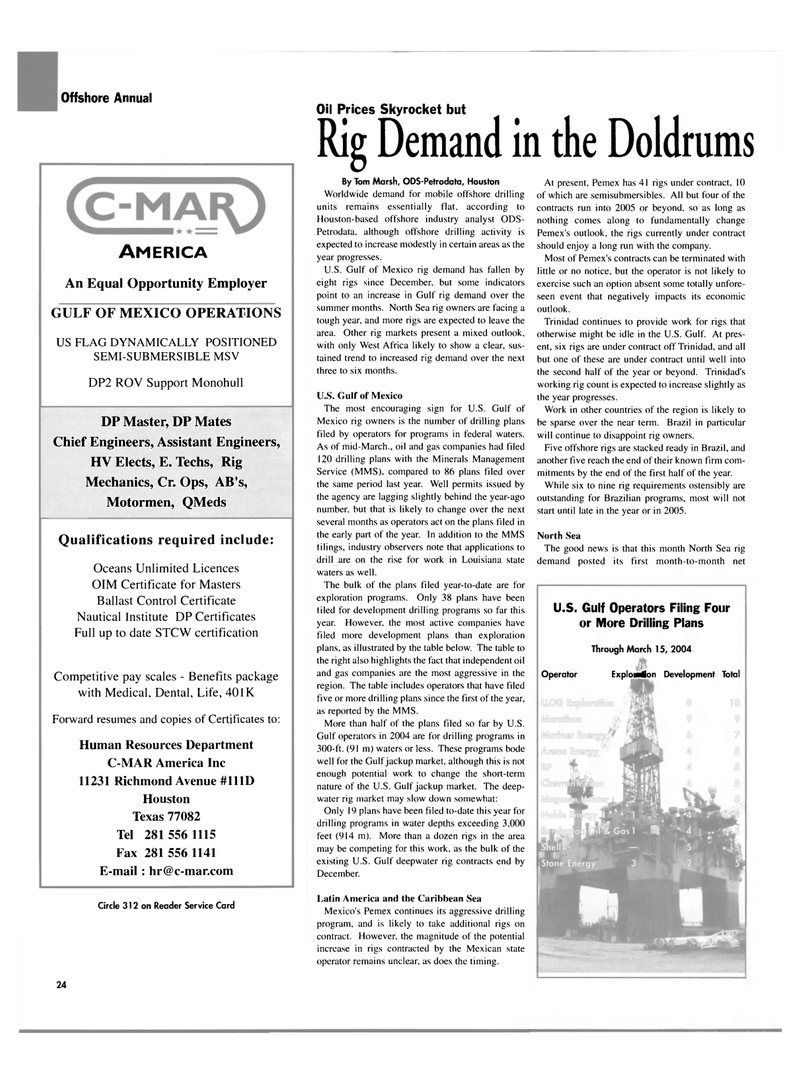

The bulk of the plans filed year-to-date are for exploration programs. Only 38 plans have been tiled for development drilling programs so far this year. However, the most active companies have filed more development plans than exploration plans, as illustrated by the table below. The table to the right also highlights the fact that independent oil and gas companies are the most aggressive in the region. The table includes operators that have filed five or more drilling plans since the first of the year, as reported by the MMS.

More than half of the plans filed so far by U.S.

Gulf operators in 2004 are for drilling programs in 300-ft. (91 m) waters or less. These programs bode well for the Gulf jackup market, although this is not enough potential work to change the short-term nature of the U.S. Gulf jackup market. The deep- water rig market may slow down somewhat:

Only 19 plans have been filed to-date this year for drilling programs in water depths exceeding 3,000 feet (914 m). More than a dozen rigs in the area may be competing for this work, as the bulk of the existing U.S. Gulf deepwater rig contracts end by

December.

Latin America and the Caribbean Sea

Mexico's Pemex continues its aggressive drilling program, and is likely to take additional rigs on contract. However, the magnitude of the potential increase in rigs contracted by the Mexican state operator remains unclear, as does the timing.

At present, Pemex has 41 rigs under contract, 10 of which are semisubmersibles. All but four of the contracts run into 2005 or beyond, so as long as nothing comes along to fundamentally change

Pemex's outlook, the rigs currently under contract should enjoy a long run with the company.

Most of Pemex's contracts can be terminated with little or no notice, but the operator is not likely to exercise such an option absent some totally unfore- seen event that negatively impacts its economic outlook.

Trinidad continues to provide work for rigs that otherwise might be idle in the U.S. Gulf. At pres- ent, six rigs are under contract off Trinidad, and all but one of these are under contract until well into the second half of the year or beyond. Trinidad's working rig count is expected to increase slightly as the year progresses.

Work in other countries of the region is likely to be sparse over the near term. Brazil in particular will continue to disappoint rig owners.

Five offshore rigs are stacked ready in Brazil, and another five reach the end of their known firm com- mitments by the end of the first half of the year.

While six to nine rig requirements ostensibly are outstanding for Brazilian programs, most will not start until late in the year or in 2005.

North Sea

The good news is that this month North Sea rig demand posted its first month-to-month net

U.S. Gulf Operators Filing Four or More Drilling Plans

Through March 15, 2004

Operator Exploration Development Total 24

23

23

25

25