Page 34: of Maritime Reporter Magazine (June 2004)

Annual World Yearbook

Read this page in Pdf, Flash or Html5 edition of June 2004 Maritime Reporter Magazine

2004 World Yearbook

Will Oil Continue Heading Up? "Due to increasing demand and reduc- ing reserves, oil prices currently at $40 are likely to soon enter a period of sus- tained rises resulting in a need to mas- sively develop natural gas and renew- able energy resources" according to

John Westwood of energy analysts

Douglas-Westwood. "Oil reserves are depleting and demand growing. Recent increases in oil demand from China, for example, are likely to accelerate. The average

American consumes 25 times as much oil as the average Chinese yet China has five times the population and is industri- alizing rapidly. Vehicle growth in China is rising rapidly and this will cause glob- al demand for oil to continue its increase.

Quoting from a number of new studies on oil, gas and renewable energy pub- lished by his firm, Westwood said, "Any growth in global economic activity increases oil demand such that at 1% demand growth a production peak occurs in 2016. at 2% it occurs in 2012, and at 3% it occurs in 2008. "The world's known and estimated yet-to-find reserves and resources cannot satisfy even the present level of production of some 76 million barrels per day beyond 2020."

Oil Production to Decline

Oil & gas supplies studies author Dr

Michael R. Smith of Energyfiles said "although 99 countries have produced or can produce significant oil, 52 are already well past their production peak, including the U.S., and this is now hap- pening in several more, including the

UK. Another 16 are at peak or will reach it soon. As graphically displayed in the

Energyfiles Online Database, once a country is past peak production, there is a negligible chance that it will be able to reverse its long-term decline. Of course when this happens to total global oil supply then growth in demand will be impossible." "Large capital investments within

OPEC countries are already required to rapidly increase production after 2008 by at least an additional 1 to 2 million barrels per day every year to offset declines elsewhere. It is by no means certain that such growth in output will be achieved as fast as is required. It is likely that the world will then begin to see sustained growth in oil prices.

Oil Prices to Double? "Once oil supplies begin to approach peak so oil prices will, like during the oil shocks of the 1970s, double within 3 or 4 years as the world changes from oil abundance to oil scarcity. Then prices will continue to rise until sufficient falls in oil demand are achieved. "Under such a scenario a new stable energy mix might ultimately be achieved with substitute fuels but how long this will take is uncertain. "Price rises will depend on the real global response to impending and actual shortfalls - a response that needs to be implemented immediately. Drastic con- servation will make prices fluctuate as they did in the oil shocks, always set- tling at a higher level. "Meanwhile producers will face steadily increasing government, envi- ronmental and conservation regulations.

Windfall profits arising from energy price surges, which traditionally have funded new oil and gas investment, will have to be, at least partly, employed in bringing other forms of energy to prof- itability. "Without early remedial action the discussion is not if oil prices will massively increase, but when they will."

Importance of Natural Gas "Natural gas is the only viable fuel

Offshore SCORE Continues Decline

GlobalSantaFe Corporation reported that the company's worldwide SCORE, or

Summary of Current Offshore Rig Economics, for April 2004 was down 4.5% from the previous month's SCORE. GlobalSantaFe's SCORE compares the profitability of current mobile offshore drilling rig dayrates to the profitability of dayrates at the 1980- 1981 peak of the offshore drilling cycle. In the 1980-1981 period, when SCORE averaged 100 percent, new contract dayrates equaled the sum of daily cash operating costs plus approximately $700 per day per million dollars invested. In addition to a worldwide SCORE covering key types of com- petitive offshore drilling rigs in key drilling markets, a separate SCORE is cal- culated for certain types of rigs and certain regions to indicate the relative con- dition of rig markets. The release, which is made available for publication on the third Monday of each month, includes separate SCORE calculations for the U.S.

Gulf of Mexico, the North Sea, West Africa and Southeast Asia.

SCORE History by Geography • 1981-2004

SCORE History by Type • 1981-2004 that can link the carbon-based global energy supply used today to a renew- ables-based energy supply that will have to be used in the future," said Smith. "It is the only relatively clean alternative to oil and coal, fully supported by com- mercially effective production and dis- tribution technologies - there is little doubt that natural gas will be the key fuel of the future. "Total remaining gas reserves and resources are huge, estimated at 275

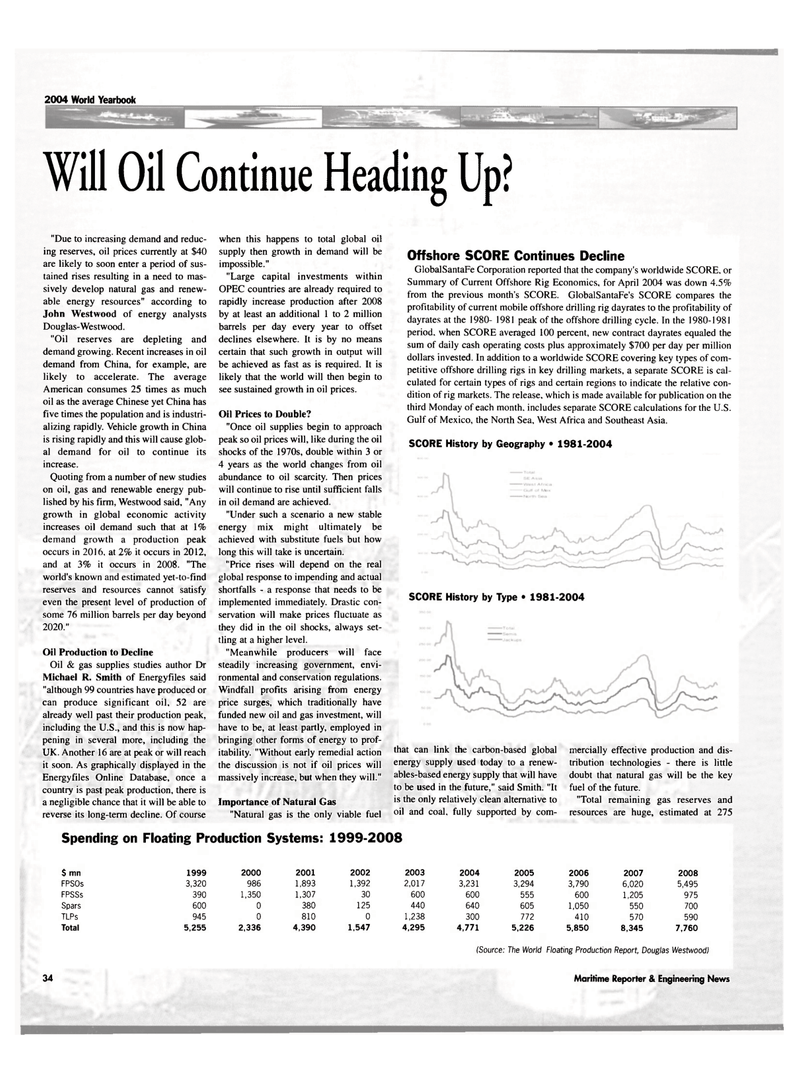

Spending on Floating Production Systems: 1999-2008 $ mn 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

FPSOs 3,320 986 1,893 1,392 2,017 3,231 3,294 3,790 6,020 5,495

FPSSs 390 1,350 1,307 30 600 600 555 600 1,205 975

Spars 600 0 380 125 440 640 605 1,050 550 700

TLPs 945 0 810 0 1,238 300 772 410 570 590

Total 5,255 2,336 4,390 1,547 4,295 4,771 5,226 5,850 8,345 7,760 (Source: The World Floating Production Report, Douglas Westwood) 34 Maritime Reporter & Engineering News

33

33

35

35