Page 40: of Maritime Reporter Magazine (April 2, 2010)

Read this page in Pdf, Flash or Html5 edition of April 2, 2010 Maritime Reporter Magazine

40 Maritime Reporter & Engineering News

FEATURE OFFSHORE ANNUAL

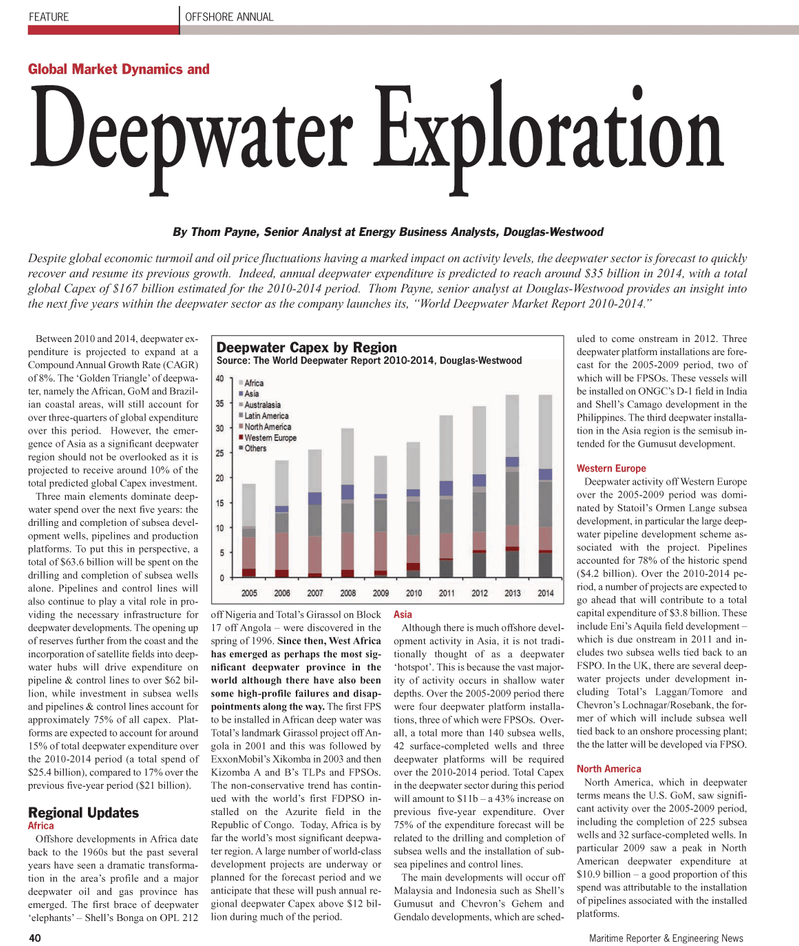

Between 2010 and 2014, deepwater ex- penditure is projected to expand at a

Compound Annual Growth Rate (CAGR) of 8%. The ‘Golden Triangle’ of deepwa- ter, namely the African, GoM and Brazil- ian coastal areas, will still account for over three-quarters of global expenditure over this period. However, the emer- gence of Asia as a significant deepwater region should not be overlooked as it is projected to receive around 10% of the total predicted global Capex investment.

Three main elements dominate deep- water spend over the next five years: the drilling and completion of subsea devel- opment wells, pipelines and production platforms. To put this in perspective, a total of $63.6 billion will be spent on the drilling and completion of subsea wells alone. Pipelines and control lines will also continue to play a vital role in pro- viding the necessary infrastructure for deepwater developments. The opening up of reserves further from the coast and the incorporation of satellite fields into deep- water hubs will drive expenditure on pipeline & control lines to over $62 bil- lion, while investment in subsea wells and pipelines & control lines account for approximately 75% of all capex. Plat- forms are expected to account for around 15% of total deepwater expenditure over the 2010-2014 period (a total spend of $25.4 billion), compared to 17% over the previous five-year period ($21 billion).

Regional Updates

Africa

Offshore developments in Africa date back to the 1960s but the past several years have seen a dramatic transforma- tion in the area’s profile and a major deepwater oil and gas province has emerged. The first brace of deepwater ‘elephants’ – Shell’s Bonga on OPL 212 off Nigeria and Total’s Girassol on Block 17 off Angola – were discovered in the spring of 1996. Since then, West Africa has emerged as perhaps the most sig- nificant deepwater province in the world although there have also been some high-profile failures and disap- pointments along the way. The first FPS to be installed in African deep water was

Total’s landmark Girassol project off An- gola in 2001 and this was followed by

ExxonMobil’s Xikomba in 2003 and then

Kizomba A and B’s TLPs and FPSOs.

The non-conservative trend has contin- ued with the world’s first FDPSO in- stalled on the Azurite field in the

Republic of Congo. Today, Africa is by far the world’s most significant deepwa- ter region. A large number of world-class development projects are underway or planned for the forecast period and we anticipate that these will push annual re- gional deepwater Capex above $12 bil- lion during much of the period.

Asia

Although there is much offshore devel- opment activity in Asia, it is not tradi- tionally thought of as a deepwater ‘hotspot’. This is because the vast major- ity of activity occurs in shallow water depths. Over the 2005-2009 period there were four deepwater platform installa- tions, three of which were FPSOs. Over- all, a total more than 140 subsea wells, 42 surface-completed wells and three deepwater platforms will be required over the 2010-2014 period. Total Capex in the deepwater sector during this period will amount to $11b – a 43% increase on previous five-year expenditure. Over 75% of the expenditure forecast will be related to the drilling and completion of subsea wells and the installation of sub- sea pipelines and control lines.

The main developments will occur off

Malaysia and Indonesia such as Shell’s

Gumusut and Chevron’s Gehem and

Gendalo developments, which are sched- uled to come onstream in 2012. Three deepwater platform installations are fore- cast for the 2005-2009 period, two of which will be FPSOs. These vessels will be installed on ONGC’s D-1 field in India and Shell’s Camago development in the

Philippines. The third deepwater installa- tion in the Asia region is the semisub in- tended for the Gumusut development.

Western Europe

Deepwater activity off Western Europe over the 2005-2009 period was domi- nated by Statoil’s Ormen Lange subsea development, in particular the large deep- water pipeline development scheme as- sociated with the project. Pipelines accounted for 78% of the historic spend ($4.2 billion). Over the 2010-2014 pe- riod, a number of projects are expected to go ahead that will contribute to a total capital expenditure of $3.8 billion. These include Eni’s Aquila field development – which is due onstream in 2011 and in- cludes two subsea wells tied back to an

FSPO. In the UK, there are several deep- water projects under development in- cluding Total’s Laggan/Tomore and

Chevron’s Lochnagar/Rosebank, the for- mer of which will include subsea well tied back to an onshore processing plant; the the latter will be developed via FPSO.

North America

North America, which in deepwater terms means the U.S. GoM, saw signifi- cant activity over the 2005-2009 period, including the completion of 225 subsea wells and 32 surface-completed wells. In particular 2009 saw a peak in North

American deepwater expenditure at $10.9 billion – a good proportion of this spend was attributable to the installation of pipelines associated with the installed platforms.

Global Market Dynamics and

Deepwater Exploration

By Thom Payne, Senior Analyst at Energy Business Analysts, Douglas-Westwood

Despite global economic turmoil and oil price fluctuations having a marked impact on activity levels, the deepwater sector is forecast to quickly recover and resume its previous growth. Indeed, annual deepwater expenditure is predicted to reach around $35 billion in 2014, with a total global Capex of $167 billion estimated for the 2010-2014 period. Thom Payne, senior analyst at Douglas-Westwood provides an insight into the next five years within the deepwater sector as the company launches its, “World Deepwater Market Report 2010-2014.”

Deepwater Capex by Region

Source: The World Deepwater Report 2010-2014, Douglas-Westwood

39

39

41

41