Page 35: of Maritime Reporter Magazine (June 2, 2010)

Read this page in Pdf, Flash or Html5 edition of June 2, 2010 Maritime Reporter Magazine

June 2010 www.marinelink.com 35

All of this is driven by the projection that the world oil demand is pegged to grow from the present 85 mil- lion b/d to around 107 million b/d by 2030.

Local shipbuilders are eyeing the opportunity to mod- ernize production lines and methods. EAS (Atlantico

Sul Shipyard) – which has the most modern and highly automated production line in the Brazilian shipbuilding industry – has planned a 20% increase in IT investments for its production plants and hope to be in position to compete in equal terms with the major players in the fu- ture, targeting the highly competitive cruise ship con- struction industry as an objective to diversity its operations when demand from O&G slips.

The Demand for Drillships

Petrobras announced its drillship construction pro- gram, which will be through direct acquisition or leas- ing. Twelve drillships will be or are being built in shipyards outside Brazil (three units of this first batch will be built by Brazilian Odebrecht in a new shipyard in the state of Bahia). Twenty-eight drillships will be built in Brazilian shipyards. The local tender process will start with nine drillships, with deliveries set from 2013 to 2018 and local content increasing between 55% and 65%.

The modern deepwater drillships are being leased from specialized companies such as Seadrill, which has recently delivered a third deepwater drill rig to Petro- bras. At press time the rig was sailing to Brazil from Sin- gapore´s Jurong Shipyard and is expected to start operations in July. Alf C Thorkildsen, CEO of Seadrill

Management AS, said, "We are pleased to report the third consecutive on-time, on-budget delivery of a semi- submersible drilling rig to Seadrill from the Jurong ship- yard. This is the third deepwater newbuild delivered to

Seadrill that starts a long-term contract with Petrobras.”

The West Orion is a sixth generation, high specification, ultra-deepwater, state-of-the-art semi-submersible drilling unit. The rig has a high load carrying capacity, an efficient drilling floor layout with improved safety and working environment measures. West Orion is de- signed with a dynamic positioning system and a water depth capacity up to 3,000 m. It has one of the highest day-rates going: $615,000 p/d, losing out only to the

West Taurus, which runs at $647,000 p/d.

A new deepwater drillship concept will soon be intro- duced with the recent arrival in Brazil of Sevan Marine´s

Deepwater Driller, which is a circular design MODU operated by eight thrusters and is designed to be more stable, safer and also more cost effective than traditional ship hulled or platform deepwater drilling units. The

Sevan Driller will be working on a six-year fixed con- tract with Petrobras. As a new, one of a kind, proprietary model by Sevan Marine, it will have to be tested through time, but Petrobras´ E&P executives are excited by the preliminary drilling tests and according to William

Glover, Operations Manager for Sevan Drilling Units, “The drilling tests have gone very well, with no major issues and the core crew on the rig has been handpicked by me from the best in the market. I consider them to be the best in the business. We work under a very strict safety policy, where safety always comes first, even if that affects our up time.” Petrobras is so enthusiastic that it has already ordered another Sevan drilling unit (Sevan

Driller II), which is currently being built in China, with

He finds his calling in the engine department.

Deck Engineer Machinist John Smith

USNS Lewis and Clark sealiftcommand.com (Photo )Regys Lour eir o de Macêdo)

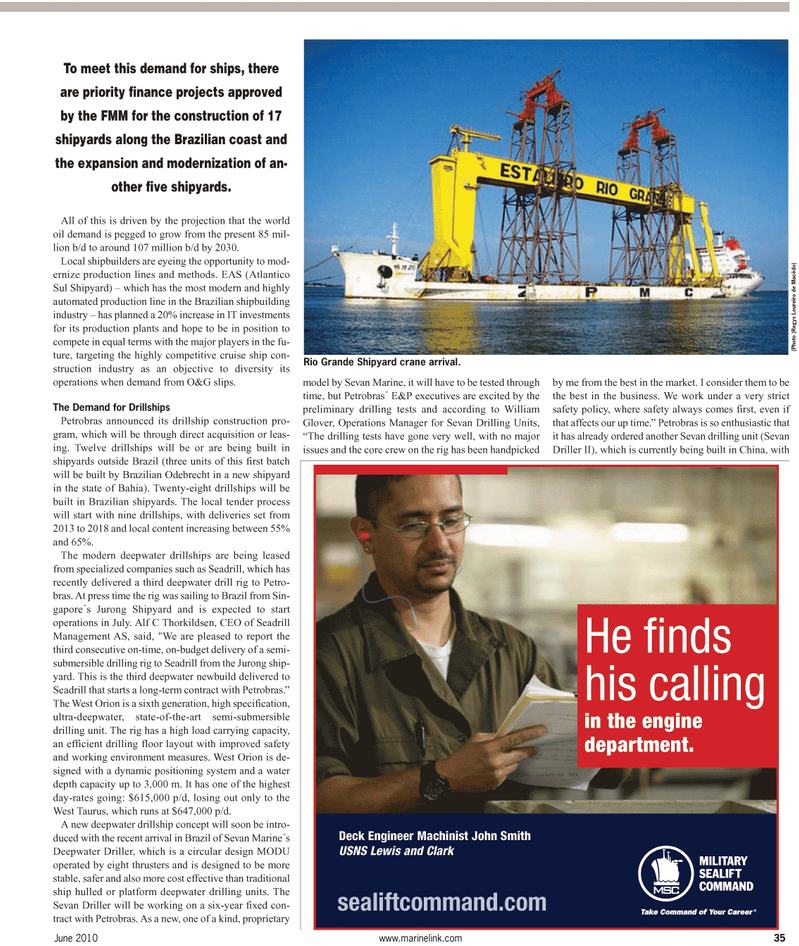

Rio Grande Shipyard crane arrival.

To meet this demand for ships, there are priority finance projects approved by the FMM for the construction of 17 shipyards along the Brazilian coast and the expansion and modernization of an- other five shipyards.

34

34

36

36