Page 12: of Maritime Reporter Magazine (November 2010)

Workboat Annual

Read this page in Pdf, Flash or Html5 edition of November 2010 Maritime Reporter Magazine

12 Maritime Reporter & Engineering News

The global maritime industry has a social networking, news and information portal to call its own: MaritimeProfessional.com. Log on and network with thousands of colleagues and potential business partners from around the globe, and keep up to date on critical maritime matters via our exclusive, insightful reports from a global network of bloggers and industry insiders.

If you like what you see and want to read more for free, simply join MaritimeProfessional.com the global maritime industry’s fastest growing online social network.

BLOGS Posted on MaritimeProfessional.com

It is said that a prophet is not accepted in his own country. This could be said about the Seasnake con- cept which was created more for meeting the chal- lenges of the water transport industry in the U.S. but has generated a lot of interest in India. Heading the list is Infrastructure Leasing & Financial Services

Limited (IL&FS), one of India's leading infrastruc- ture development and finance company. “We are in talks with Seasnake World Wide Market- ing LLC,” confirmed Capt K. P. Rajagopal, Sr. Ad- visor of IL&FS Maritime Infrastructure Company

Ltd which is building two shipyards in the country one at Cuddalore in Tamil Nadu and another at Nana

Layja Shipyard in Gujarat. “We see a lot of prospects for Seasnake in India especially for ports with shal- low draft of 5m. These ship trains can bring in the same quantum of cargo as the conventional vessels at reduced costs without having to dredge and build extensive infrastructure. Compared to dead weight of present vessels to dead weight of Seasnake train the steel requirements is 20% less and may even go up to 30% as the cross section is circular. Thus the cost comes down by that much.” However, he was not willing to give more details because the discussions were at a crucial stage.

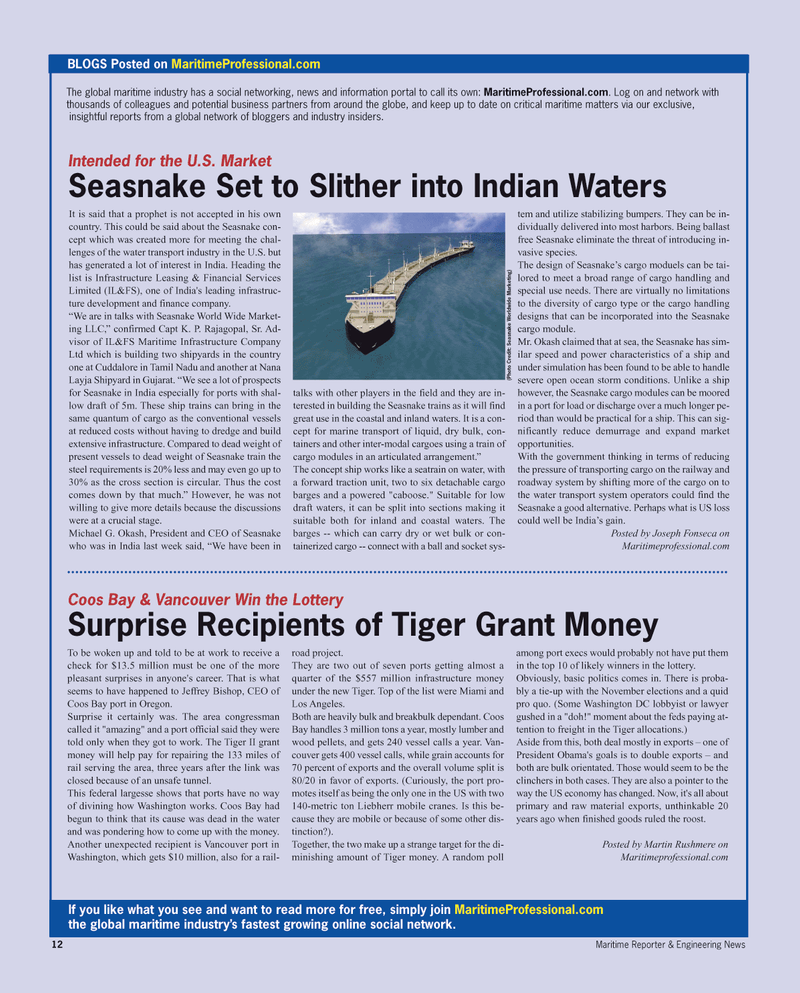

Michael G. Okash, President and CEO of Seasnake who was in India last week said, “We have been in talks with other players in the field and they are in- terested in building the Seasnake trains as it will find great use in the coastal and inland waters. It is a con- cept for marine transport of liquid, dry bulk, con- tainers and other inter-modal cargoes using a train of cargo modules in an articulated arrangement.”

The concept ship works like a seatrain on water, with a forward traction unit, two to six detachable cargo barges and a powered "caboose." Suitable for low draft waters, it can be split into sections making it suitable both for inland and coastal waters. The barges -- which can carry dry or wet bulk or con- tainerized cargo -- connect with a ball and socket sys- tem and utilize stabilizing bumpers. They can be in- dividually delivered into most harbors. Being ballast free Seasnake eliminate the threat of introducing in- vasive species.

The design of Seasnake’s cargo moduels can be tai- lored to meet a broad range of cargo handling and special use needs. There are virtually no limitations to the diversity of cargo type or the cargo handling designs that can be incorporated into the Seasnake cargo module.

Mr. Okash claimed that at sea, the Seasnake has sim- ilar speed and power characteristics of a ship and under simulation has been found to be able to handle severe open ocean storm conditions. Unlike a ship however, the Seasnake cargo modules can be moored in a port for load or discharge over a much longer pe- riod than would be practical for a ship. This can sig- nificantly reduce demurrage and expand market opportunities.

With the government thinking in terms of reducing the pressure of transporting cargo on the railway and roadway system by shifting more of the cargo on to the water transport system operators could find the

Seasnake a good alternative. Perhaps what is US loss could well be India’s gain.

Posted by Joseph Fonseca on

Maritimeprofessional.com

Intended for the U.S. Market

Seasnake Set to Slither into Indian Waters

To be woken up and told to be at work to receive a check for $13.5 million must be one of the more pleasant surprises in anyone's career. That is what seems to have happened to Jeffrey Bishop, CEO of

Coos Bay port in Oregon.

Surprise it certainly was. The area congressman called it "amazing" and a port official said they were told only when they got to work. The Tiger II grant money will help pay for repairing the 133 miles of rail serving the area, three years after the link was closed because of an unsafe tunnel.

This federal largesse shows that ports have no way of divining how Washington works. Coos Bay had begun to think that its cause was dead in the water and was pondering how to come up with the money.

Another unexpected recipient is Vancouver port in

Washington, which gets $10 million, also for a rail- road project.

They are two out of seven ports getting almost a quarter of the $557 million infrastructure money under the new Tiger. Top of the list were Miami and

Los Angeles.

Both are heavily bulk and breakbulk dependant. Coos

Bay handles 3 million tons a year, mostly lumber and wood pellets, and gets 240 vessel calls a year. Van- couver gets 400 vessel calls, while grain accounts for 70 percent of exports and the overall volume split is 80/20 in favor of exports. (Curiously, the port pro- motes itself as being the only one in the US with two 140-metric ton Liebherr mobile cranes. Is this be- cause they are mobile or because of some other dis- tinction?).

Together, the two make up a strange target for the di- minishing amount of Tiger money. A random poll among port execs would probably not have put them in the top 10 of likely winners in the lottery.

Obviously, basic politics comes in. There is proba- bly a tie-up with the November elections and a quid pro quo. (Some Washington DC lobbyist or lawyer gushed in a "doh!" moment about the feds paying at- tention to freight in the Tiger allocations.)

Aside from this, both deal mostly in exports – one of

President Obama's goals is to double exports – and both are bulk orientated. Those would seem to be the clinchers in both cases. They are also a pointer to the way the US economy has changed. Now, it's all about primary and raw material exports, unthinkable 20 years ago when finished goods ruled the roost.

Posted by Martin Rushmere on

Maritimeprofessional.com

Coos Bay & Vancouver Win the Lottery

Surprise Recipients of Tiger Grant Money (Photo Cr edit: Seasnake W orldwide Marketing)

11

11

13

13