Page 60: of Maritime Reporter Magazine (June 2011)

Feature: Annual World Yearbook

Read this page in Pdf, Flash or Html5 edition of June 2011 Maritime Reporter Magazine

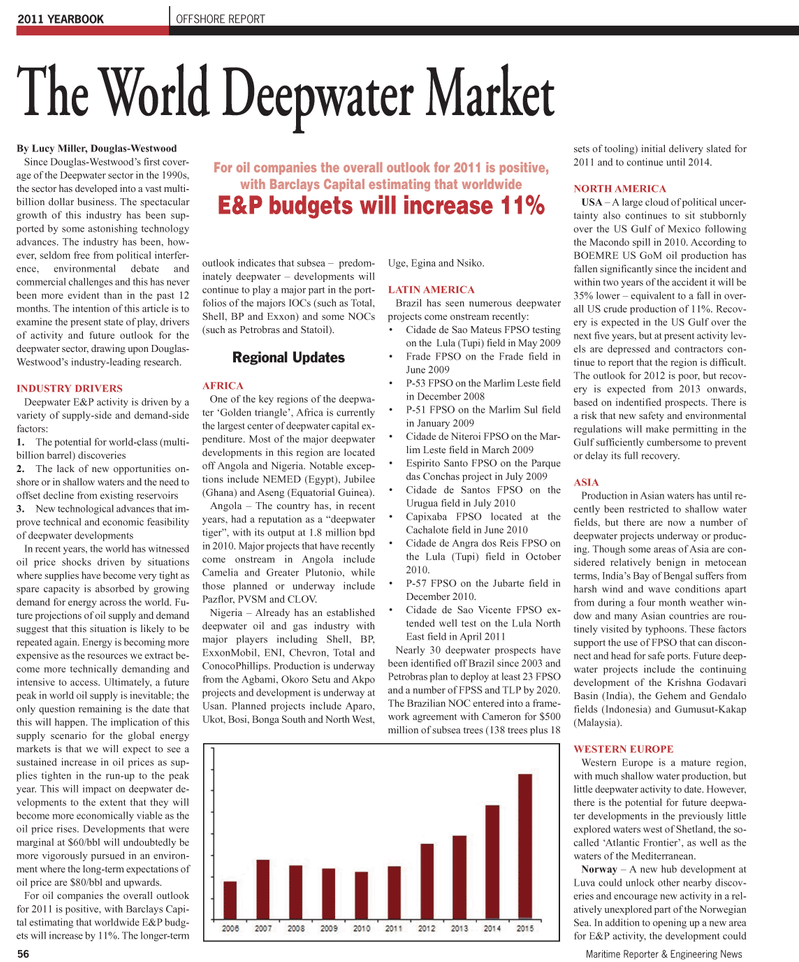

56Maritime Reporter & Engineering News 2011 YEARBOOKOFFSHORE REPORTBy Lucy Miller, Douglas-Westwood Since Douglas-Westwoods first cover- age of the Deepwater sector in the 1990s, the sector has developed into a vast multi- billion dollar business. The spectacular growth of this industry has been sup- ported by some astonishing technologyadvances. The industry has been, how- ever, seldom free from political interfer- ence, environmental debate and commercial challenges and this has never been more evident than in the past 12 months. The intention of this article is to examine the present state of play, drivers of activity and future outlook for the deepwater sector, drawing upon Douglas- Westwoods industry-leading research. INDUSTRY DRIVERS Deepwater E&P activity is driven by a variety of supply-side and demand-side factors: 1.The potential for world-class (multi- billion barrel) discoveries 2.The lack of new opportunities on- shore or in shallow waters and the need to offset decline from existing reservoirs 3.New technological advances that im- prove technical and economic feasibility of deepwater developments In recent years, the world has witnessed oil price shocks driven by situations where supplies have become very tight as spare capacity is absorbed by growing demand for energy across the world. Fu- ture projections of oil supply and demandsuggest that this situation is likely to be repeated again. Energy is becoming more expensive as the resources we extract be- come more technically demanding andintensive to access. Ultimately, a future peak in world oil supply is inevitable; the only question remaining is the date thatthis will happen. The implication of this supply scenario for the global energy markets is that we will expect to see a sustained increase in oil prices as sup-plies tighten in the run-up to the peakyear. This will impact on deepwater de- velopments to the extent that they will become more economically viable as theoil price rises. Developments that were marginal at $60/bbl will undoubtedly be more vigorously pursued in an environ- ment where the long-term expectations of oil price are $80/bbl and upwards. For oil companies the overall outlook for 2011 is positive, with Barclays Capi- tal estimating that worldwide E&P budg- ets will increase by 11%. The longer-term outlook indicates that subsea ? predom- inately deepwater ? developments will continue to play a major part in the port-folios of the majors IOCs (such as Total, Shell, BP and Exxon) and some NOCs(such as Petrobras and Statoil).Regional UpdatesAFRICA One of the key regions of the deepwa- ter Golden triangle, Africa is currentlythe largest center of deepwater capital ex- penditure. Most of the major deepwater developments in this region are located off Angola and Nigeria. Notable excep- tions include NEMED (Egypt), Jubilee(Ghana) and Aseng (Equatorial Guinea). Angola ? The country has, in recent years, had a reputation as a deepwater tiger?, with its output at 1.8 million bpdin 2010. Major projects that have recently come onstream in Angola include Camelia and Greater Plutonio, whilethose planned or underway include Pazflor, PVSM and CLOV. Nigeria ? Already has an established deepwater oil and gas industry with major players including Shell, BP, ExxonMobil, ENI, Chevron, Total and ConocoPhillips. Production is underway from the Agbami, Okoro Setu and Akpo projects and development is underway at Usan. Planned projects include Aparo, Ukot, Bosi, Bonga South and North West, Uge, Egina and Nsiko. LATIN AMERICA Brazil has seen numerous deepwater projects come onstream recently:?Cidade de Sao Mateus FPSO testingon the Lula (Tupi) field in May 2009 ?Frade FPSO on the Frade field in June 2009?P-53 FPSO on the Marlim Leste field in December 2008?P-51 FPSO on the Marlim Sul field in January 2009?Cidade de Niteroi FPSO on the Mar- lim Leste field in March 2009 ?Espirito Santo FPSO on the Parque das Conchas project in July 2009?Cidade de Santos FPSO on the Urugua field in July 2010 ?Capixaba FPSO located at the Cachalote field in June 2010 ?Cidade de Angra dos Reis FPSO on the Lula (Tupi) field in October 2010. ?P-57 FPSO on the Jubarte field in December 2010.?Cidade de Sao Vicente FPSO ex- tended well test on the Lula NorthEast field in April 2011 Nearly 30 deepwater prospects have been identified off Brazil since 2003 and Petrobras plan to deploy at least 23 FPSO and a number of FPSS and TLP by 2020. The Brazilian NOC entered into a frame-work agreement with Cameron for $500 million of subsea trees (138 trees plus 18sets of tooling) initial delivery slated for 2011 and to continue until 2014. NORTH AMERICA USA? A large cloud of political uncer- tainty also continues to sit stubbornlyover the US Gulf of Mexico following the Macondo spill in 2010. According to BOEMRE US GoM oil production hasfallen significantly since the incident and within two years of the accident it will be 35% lower ? equivalent to a fall in over- all US crude production of 11%. Recov- ery is expected in the US Gulf over the next five years, but at present activity lev- els are depressed and contractors con-tinue to report that the region is difficult. The outlook for 2012 is poor, but recov- ery is expected from 2013 onwards, based on indentified prospects. There is a risk that new safety and environmental regulations will make permitting in the Gulf sufficiently cumbersome to prevent or delay its full recovery. ASIAProduction in Asian waters has until re- cently been restricted to shallow water fields, but there are now a number of deepwater projects underway or produc- ing. Though some areas of Asia are con- sidered relatively benign in metocean terms, Indias Bay of Bengal suffers from harsh wind and wave conditions apart from during a four month weather win-dow and many Asian countries are rou- tinely visited by typhoons. These factors support the use of FPSO that can discon-nect and head for safe ports. Future deep-water projects include the continuing development of the Krishna Godavari Basin (India), the Gehem and Gendalofields (Indonesia) and Gumusut-Kakap (Malaysia).WESTERN EUROPE Western Europe is a mature region, with much shallow water production, but little deepwater activity to date. However, there is the potential for future deepwa- ter developments in the previously little explored waters west of Shetland, the so- called Atlantic Frontier, as well as the waters of the Mediterranean. Norway? A new hub development at Luva could unlock other nearby discov- eries and encourage new activity in a rel- atively unexplored part of the Norwegian Sea. In addition to opening up a new area for E&P activity, the development could The World Deepwater Market For oil companies the overall outlook for 2011 is positive,with Barclays Capital estimating that worldwide E&P budgets will increase 11%

59

59

61

61