Page 34: of Maritime Reporter Magazine (June 2012)

Annual World Yearbook

Read this page in Pdf, Flash or Html5 edition of June 2012 Maritime Reporter Magazine

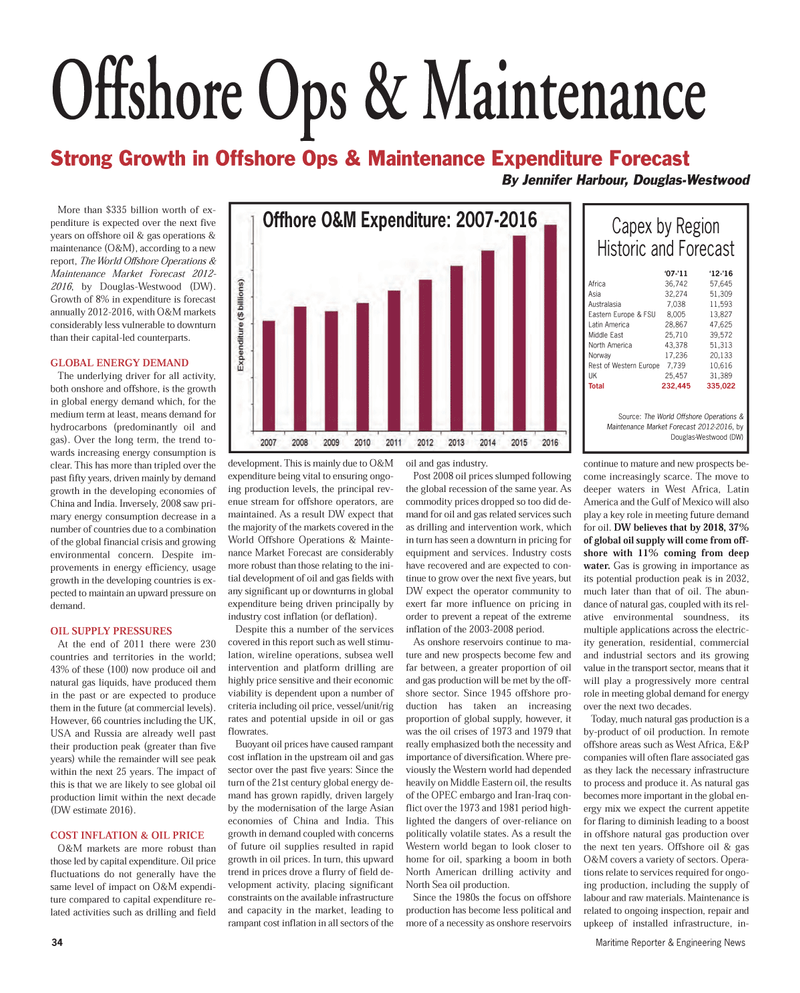

34Maritime Reporter & Engineering News Offshore Ops & Maintenance Strong Growth in Offshore Ops & Maintenance Expenditure Forecast By Jennifer Harbour, Douglas-Westwood More than $335 billion worth of ex- penditure is expected over the next five years on offshore oil & gas operations & maintenance (O&M), according to a new report, The World Offshore Operations & Maintenance Market Forecast 2012- 2016, by Douglas-Westwood (DW). Growth of 8% in expenditure is forecast annually 2012-2016, with O&M markets considerably less vulnerable to downturn than their capital-led counterparts.GLOBAL ENERGY DEMAND The underlying driver for all activity, both onshore and offshore, is the growth in global energy demand which, for the medium term at least, means demand forhydrocarbons (predominantly oil and gas). Over the long term, the trend to- wards increasing energy consumption is clear. This has more than tripled over the past fifty years, driven mainly by demand growth in the developing economies of China and India. Inversely, 2008 saw pri- mary energy consumption decrease in a number of countries due to a combinationof the global financial crisis and growing environmental concern. Despite im- provements in energy efficiency, usage growth in the developing countries is ex- pected to maintain an upward pressure on demand. OIL SUPPLY PRESSURES At the end of 2011 there were 230countries and territories in the world;43% of these (100) now produce oil and natural gas liquids, have produced them in the past or are expected to produce them in the future (at commercial levels). However, 66 countries including the UK, USA and Russia are already well pasttheir production peak (greater than five years) while the remainder will see peakwithin the next 25 years. The impact of this is that we are likely to see global oil production limit within the next decade (DW estimate 2016). COST INFLATION & OIL PRICE O&M markets are more robust than those led by capital expenditure. Oil pricefluctuations do not generally have the same level of impact on O&M expendi- ture compared to capital expenditure re- lated activities such as drilling and field development. This is mainly due to O&M expenditure being vital to ensuring ongo- ing production levels, the principal rev- enue stream for offshore operators, are maintained. As a result DW expect that the majority of the markets covered in the World Offshore Operations & Mainte- nance Market Forecast are considerably more robust than those relating to the ini- tial development of oil and gas fields with any significant up or downturns in global expenditure being driven principally by industry cost inflation (or deflation). Despite this a number of the servicescovered in this report such as well stimu- lation, wireline operations, subsea wellintervention and platform drilling are highly price sensitive and their economic viability is dependent upon a number ofcriteria including oil price, vessel/unit/rig rates and potential upside in oil or gas flowrates. Buoyant oil prices have caused rampant cost inflation in the upstream oil and gas sector over the past five years: Since the turn of the 21st century global energy de- mand has grown rapidly, driven largely by the modernisation of the large Asian economies of China and India. This growth in demand coupled with concerns of future oil supplies resulted in rapidgrowth in oil prices. In turn, this upward trend in prices drove a flurry of field de- velopment activity, placing significant constraints on the available infrastructure and capacity in the market, leading to rampant cost inflation in all sectors of theoil and gas industry. Post 2008 oil prices slumped following the global recession of the same year. As commodity prices dropped so too did de-mand for oil and gas related services such as drilling and intervention work, which in turn has seen a downturn in pricing for equipment and services. Industry costshave recovered and are expected to con- tinue to grow over the next five years, but DW expect the operator community to exert far more influence on pricing in order to prevent a repeat of the extreme inflation of the 2003-2008 period.As onshore reservoirs continue to ma- ture and new prospects become few and far between, a greater proportion of oil and gas production will be met by the off- shore sector. Since 1945 offshore pro- duction has taken an increasing proportion of global supply, however, it was the oil crises of 1973 and 1979 that really emphasized both the necessity andimportance of diversification. Where pre- viously the Western world had depended heavily on Middle Eastern oil, the results of the OPEC embargo and Iran-Iraq con- flict over the 1973 and 1981 period high- lighted the dangers of over-reliance on politically volatile states. As a result the Western world began to look closer to home for oil, sparking a boom in bothNorth American drilling activity and North Sea oil production.Since the 1980s the focus on offshore production has become less political andmore of a necessity as onshore reservoirs continue to mature and new prospects be- come increasingly scarce. The move to deeper waters in West Africa, Latin America and the Gulf of Mexico will also play a key role in meeting future demand for oil. DW believes that by 2018, 37% of global oil supply will come from off- shore with 11% coming from deep water. Gas is growing in importance as its potential production peak is in 2032,much later than that of oil. The abun- dance of natural gas, coupled with its rel- ative environmental soundness, its multiple applications across the electric-ity generation, residential, commercialand industrial sectors and its growing value in the transport sector, means that it will play a progressively more central role in meeting global demand for energy over the next two decades. Today, much natural gas production is a by-product of oil production. In remoteoffshore areas such as West Africa, E&P companies will often flare associated gas as they lack the necessary infrastructure to process and produce it. As natural gas becomes more important in the global en-ergy mix we expect the current appetite for flaring to diminish leading to a boostin offshore natural gas production over the next ten years. Offshore oil & gas O&M covers a variety of sectors. Opera- tions relate to services required for ongo-ing production, including the supply oflabour and raw materials. Maintenance is related to ongoing inspection, repair andupkeep of installed infrastructure, in- Offhore O&M Expenditure: 2007-2016 Capex by Region Historic and Forecast ?07-?11?12-?16 Africa36,74257,645 Asia32,27451,309 Australasia7,03811,593 Eastern Europe & FSU8,00513,827 Latin America28,86747,625 Middle East25,71039,572 North America43,37851,313 Norway17,23620,133 Rest of Western Europe7,73910,616 UK25,45731,389 Total 232,445335,022 Source: The World Offshore Operations & Maintenance Market Forecast 2012-2016 , byDouglas-Westwood (DW) MR June12 # 5 (34-41):MR Template 6/12/2012 10:15 AM Page 34

33

33

35

35