Page 71: of Maritime Reporter Magazine (June 2012)

Annual World Yearbook

Read this page in Pdf, Flash or Html5 edition of June 2012 Maritime Reporter Magazine

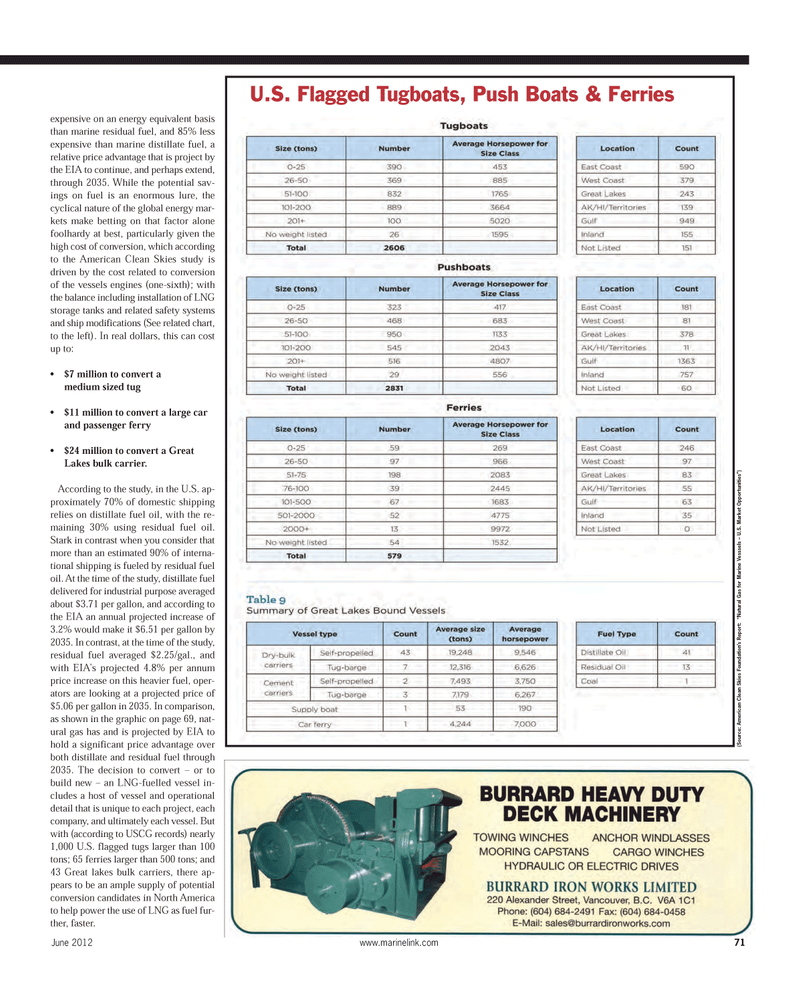

expensive on an energy equivalent basis than marine residual fuel, and 85% lessexpensive than marine distillate fuel, a relative price advantage that is project by the EIA to continue, and perhaps extend, through 2035. While the potential sav- ings on fuel is an enormous lure, thecyclical nature of the global energy mar- kets make betting on that factor alone foolhardy at best, particularly given the high cost of conversion, which according to the American Clean Skies study is driven by the cost related to conversion of the vessels engines (one-sixth); with the balance including installation of LNGstorage tanks and related safety systemsand ship modifications (See related chart, to the left). In real dollars, this can costup to:$7 million to convert a medium sized tug$11 million to convert a large car and passenger ferry$24 million to convert a Great Lakes bulk carrier. According to the study, in the U.S. ap- proximately 70% of domestic shippingrelies on distillate fuel oil, with the re-maining 30% using residual fuel oil.Stark in contrast when you consider thatmore than an estimated 90% of interna- tional shipping is fueled by residual fueloil. At the time of the study, distillate fuel delivered for industrial purpose averaged about $3.71 per gallon, and according to the EIA an annual projected increase of3.2% would make it $6.51 per gallon by 2035. In contrast, at the time of the study, residual fuel averaged $2.25/gal., and with EIA?s projected 4.8% per annum price increase on this heavier fuel, oper- ators are looking at a projected price of$5.06 per gallon in 2035. In comparison, as shown in the graphic on page 69, nat- ural gas has and is projected by EIA to hold a significant price advantage over both distillate and residual fuel through2035. The decision to convert ? or to build new ? an LNG-fuelled vessel in- cludes a host of vessel and operational detail that is unique to each project, eachcompany, and ultimately each vessel. But with (according to USCG records) nearly1,000 U.S. flagged tugs larger than 100 tons; 65 ferries larger than 500 tons; and 43 Great lakes bulk carriers, there ap- pears to be an ample supply of potentialconversion candidates in North America to help power the use of LNG as fuel fur- ther, faster. June 2012www.marinelink.com 71(Source: American Clean Skies Foundation?s Report: ?Natural Gas for Marine Vesssels ? U.S. Market Opportunities?) U.S. Flagged Tugboats, Push Boats & Ferries MR June12 # 9 (65-73):MR Template 6/12/2012 3:28 PM Page 71

70

70

72

72