Page 12: of Maritime Reporter Magazine (January 2014)

Ship Repair & Conversion Edition

Read this page in Pdf, Flash or Html5 edition of January 2014 Maritime Reporter Magazine

12 Maritime Reporter & Engineering News • JANUARY 2014

OFFSHORE UPDATE

Floating Production

The number of fl oating production units grew 5% in 2013.

Here we examine the global market and future opportunities.

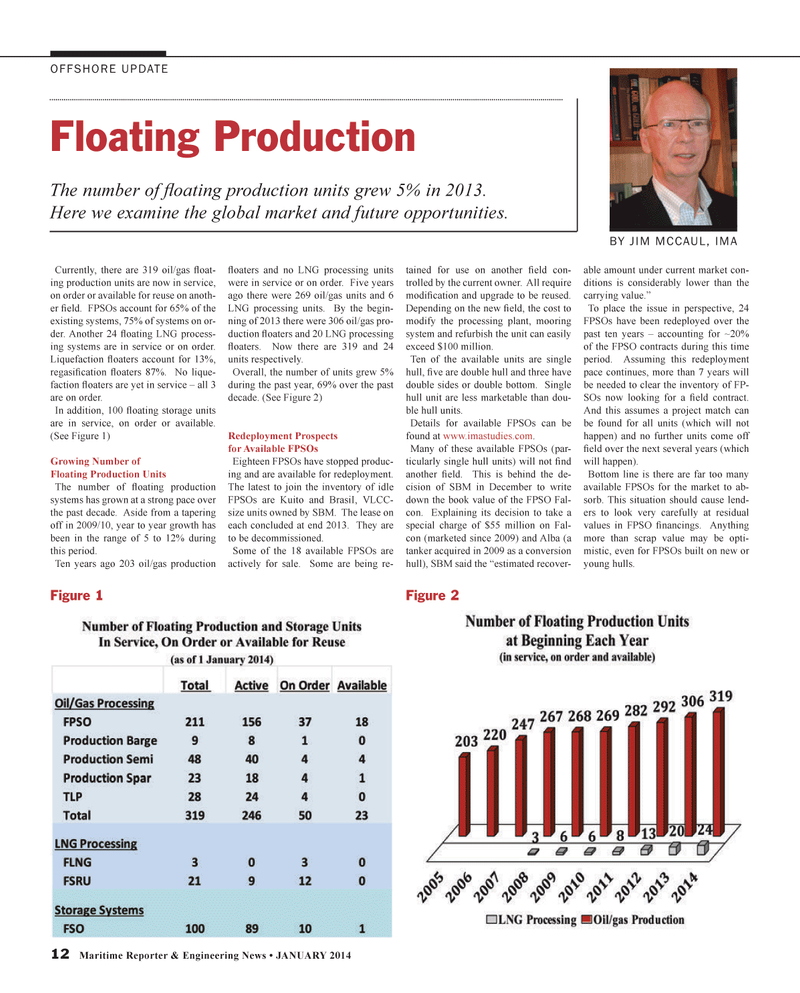

Currently, there are 319 oil/gas fl oat- ing production units are now in service, on order or available for reuse on anoth- er fi eld. FPSOs account for 65% of the existing systems, 75% of systems on or- der. Another 24 fl oating LNG process- ing systems are in service or on order.

Liquefaction fl oaters account for 13%, regasifi cation fl oaters 87%. No lique- faction fl oaters are yet in service – all 3 are on order.

In addition, 100 fl oating storage units are in service, on order or available. (See Figure 1)

Growing Number of

Floating Production Units

The number of fl oating production systems has grown at a strong pace over the past decade. Aside from a tapering off in 2009/10, year to year growth has been in the range of 5 to 12% during this period.

Ten years ago 203 oil/gas production fl oaters and no LNG processing units were in service or on order. Five years ago there were 269 oil/gas units and 6

LNG processing units. By the begin- ning of 2013 there were 306 oil/gas pro- duction fl oaters and 20 LNG processing fl oaters. Now there are 319 and 24 units respectively.

Overall, the number of units grew 5% during the past year, 69% over the past decade. (See Figure 2)

Redeployment Prospects for Available FPSOs

Eighteen FPSOs have stopped produc- ing and are available for redeployment.

The latest to join the inventory of idle

FPSOs are Kuito and BrasiI, VLCC- size units owned by SBM. The lease on each concluded at end 2013. They are to be decommissioned.

Some of the 18 available FPSOs are actively for sale. Some are being re- tained for use on another fi eld con- trolled by the current owner. All require modifi cation and upgrade to be reused.

Depending on the new fi eld, the cost to modify the processing plant, mooring system and refurbish the unit can easily exceed $100 million.

Ten of the available units are single hull, fi ve are double hull and three have double sides or double bottom. Single hull unit are less marketable than dou- ble hull units.

Details for available FPSOs can be found at www.imastudies.com.

Many of these available FPSOs (par- ticularly single hull units) will not fi nd another fi eld. This is behind the de- cision of SBM in December to write down the book value of the FPSO Fal- con. Explaining its decision to take a special charge of $55 million on Fal- con (marketed since 2009) and Alba (a tanker acquired in 2009 as a conversion hull), SBM said the “estimated recover- able amount under current market con- ditions is considerably lower than the carrying value.”

To place the issue in perspective, 24

FPSOs have been redeployed over the past ten years – accounting for ~20% of the FPSO contracts during this time period. Assuming this redeployment pace continues, more than 7 years will be needed to clear the inventory of FP-

SOs now looking for a fi eld contract.

And this assumes a project match can be found for all units (which will not happen) and no further units come off fi eld over the next several years (which will happen).

Bottom line is there are far too many available FPSOs for the market to ab- sorb. This situation should cause lend- ers to look very carefully at residual values in FPSO fi nancings. Anything more than scrap value may be opti- mistic, even for FPSOs built on new or young hulls.

BY JIM MCCAUL, IMA

Figure 1 Figure 2

MR #1 (10-17).indd 12 1/7/2014 12:22:04 PM

11

11

13

13