Page 26: of Maritime Reporter Magazine (February 2014)

Cruise Shipping Edition

Read this page in Pdf, Flash or Html5 edition of February 2014 Maritime Reporter Magazine

26 Maritime Reporter & Engineering News • FEBRUARY 2014

CRUISE SHIPPING

T he global cruise industry and its fl eet of increasingly large, ultra-modern ships is projected to continue its steady growth in 2014, powered by growth overseas, par- ticularly in the German market, as well as the adoption of faster, stronger and generally better satellite communication technology that is moving toward the level of seamless, cost-effective commu- nication connections that can be expect- ed at a land-based vacation destination.

The Cruise Lines International Associ- ation (CLIA), the trade association rep- resenting the $32b global cruise indus- try, projects that 21.7 million people will take a cruise in 2014, up slightly from the 21.3 million that were estimated to take a cruise in 2013. CLIA is comprised of 63 cruise line members representing more than 95% of global cruise capacity.

The CLIA global fl eet comprises 410 ships (including river cruise member vessels) with a cumulative 467,629 beds.

The CLIA fl eet will add 29 new ships with a capacity of more than 34,000 passengers in 2013 / 2014, with an ad- ditional 20 ships and 52,000 beds slated to come online between 2015-2018.

While the U.S. maintains its strong global hold on market share, with an es- timated 51.7% of all cruise passengers coming from the U.S., there are strong pockets of growth internationally, with

Germany (7.7% total) driving strong demand in Europe. Current projections forecast Germany overtaking the UK and Ireland (8.1%) as the world’s second largest cruise market.

Technology Onboard

While innovative ship designers and builders continue to conceive and bring to life increasingly sophisticated ships to attract and retain a broadening cruise demographic, according to Jim Ber- ra, Chief Marketing Offi cer, Carnival

Cruise Lines and Chair, CLIA Market- ing Committee, better, cheaper satellite communication capability is the defi ning technology trend on cruise ships today. “There are some emerging technolo- gies that could open up signifi cantly more bandwidth,” said Berra. “One of these is what is called Low Orbital

Satellites. That will allow you to fl ood a ship with far more bandwidth. I think as that technology proves out and becomes more prevalent, that type of satellite bandwidth will allow for the types of speeds you need to watch streaming movies. As that satel- lite technology unfolds, that could be a tipping point.”

Early in 2013 O3b Networks signed a second, multi-year deal with Royal

Caribbean Cruises Ltd. to provide high- speed satellite-delivered broadband ser- vice aboard Allure of the Seas, which enabled more than 8,000 guests, staff and crew to connect at fi ber-like speeds at sea. Royal Caribbean was the fi rst to enlist O3b’s new maritime offering O3b-

Maritime aboard, and Allure of the Seas’ sister ship, Oasis of the Seas, fi rst signed for the services in the summer of 2012.

While the new low orbit technology holds plenty of promise, existing tech- nology still holds a fi rm spot onboard cruise ships. “In the current satellite de- ployment (Ka and Ku band) that band- width is becoming more prevalent and less expensive so you’re seeing cruise lines starting to buy more bandwidth, which will create a better experience for guests. If low orbital takes off and really becomes viable, that could be the tip- ping point for having ‘land-like levels’ of bandwidth at sea,” said Berra.

While advanced communication tech- nology is a visible upgrade to cruise pas- sengers, a bigger investment in cruise ship technology upgrade falls well be- low the consciousness of the everyday cruise passenger: emissions reduction technology driven by the North Ameri- can Emission Control Area (ECA). “I don’t think the cruise industry is frightened as much as the cruise industry is frustrated that we’ve got the ECA,” said Christine Duffy, President & CEO,

CLIA, in response to a question at CLIA ‘State of the Industry’ press conference. “While there is emerging technology and signifi cant investment being made by the cruise industry to determine how they will reduce emissions, we are in some ways playing catch up.” Carnival’s Ber- ra, however, said that there is positive movement. “During the last year and a half the progression of (emissions) tech- nology has moved quite quickly,” said

Berra. “We’re at a place now where we are pretty confi dent in the technology, and we’re in the process of implement- ing it across a number of ships.”

The Ships

While the focus on the consumer marketing end of the cruise industry is squarely on the experience and multi- tude of specialty entertainment options, the continued design and construction of new ships and the major modifi cation

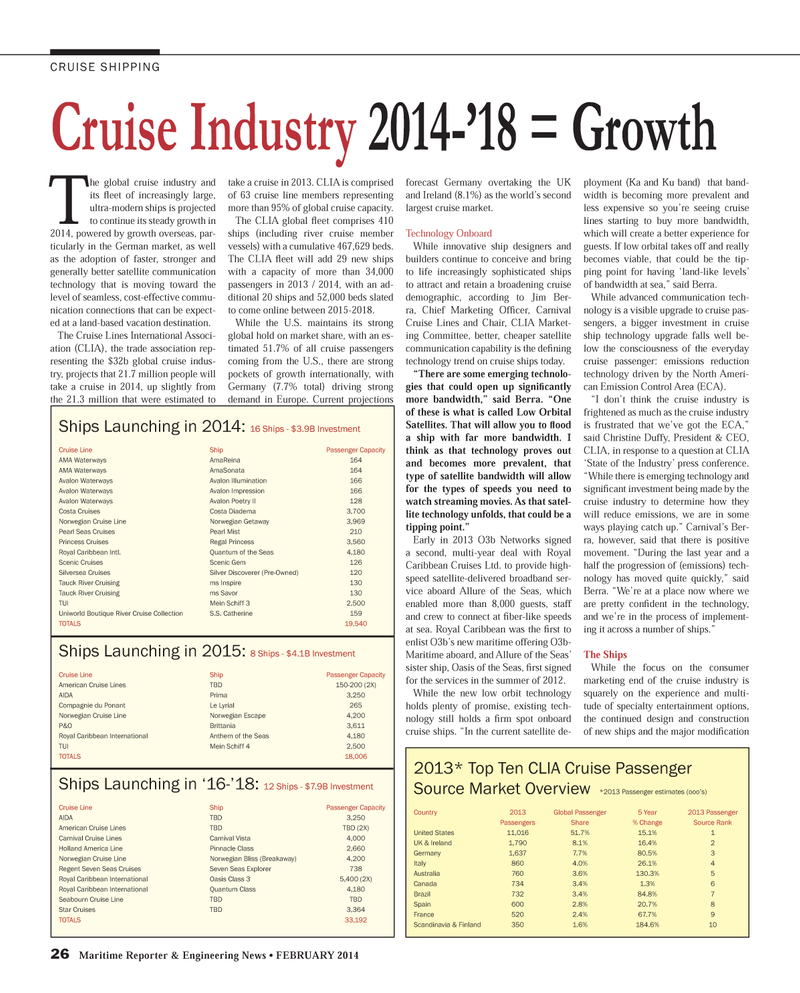

Cruise Industry 2014-’18 = Growth 2013* Top Ten CLIA Cruise Passenger

Source Market Overview *2013 Passenger estimates (ooo’s)

Country 2013 Global Passenger 5 Year 2013 Passenger Passengers Share % Change Source Rank

United States 11,016 51.7% 15.1% 1

UK & Ireland 1,790 8.1% 16.4% 2

Germany 1,637 7.7% 80.5% 3

Italy 860 4.0% 26.1% 4

Australia 760 3.6% 130.3% 5

Canada 734 3.4% 1.3% 6

Brazil 732 3.4% 84.8% 7

Spain 600 2.8% 20.7% 8

France 520 2.4% 67.7% 9

Scandinavia & Finland 350 1.6% 184.6% 10

Ships Launching in 2014: 16 Ships - $3.9B Investment

Cruise Line Ship Passenger Capacity

AMA Waterways AmaReina 164

AMA Waterways AmaSonata 164

Avalon Waterways Avalon Illumination 166

Avalon Waterways Avalon Impression 166

Avalon Waterways Avalon Poetry II 128

Costa Cruises Costa Diadema 3,700

Norwegian Cruise Line Norwegian Getaway 3,969

Pearl Seas Cruises Pearl Mist 210

Princess Cruises Regal Princess 3,560

Royal Caribbean Intl. Quantum of the Seas 4,180

Scenic Cruises Scenic Gem 126

Silversea Cruises Silver Discoverer (Pre-Owned) 120

Tauck River Cruising ms Inspire 130

Tauck River Cruising ms Savor 130

TUI Mein Schiff 3 2,500

Uniworld Boutique River Cruise Collection S.S. Catherine 159

TOTALS 19,540

Ships Launching in 2015: 8 Ships - $4.1B Investment

Cruise Line Ship Passenger Capacity

American Cruise Lines TBD 150-200 (2X)

AIDA Prima 3,250

Compagnie du Ponant Le Lyrial 265

Norwegian Cruise Line Norwegian Escape 4,200

P&O Brittania 3,611

Royal Caribbean International Anthem of the Seas 4,180

TUI Mein Schiff 4 2,500

TOTALS 18,006

Ships Launching in ‘16-’18: 12 Ships - $7.9B Investment

Cruise Line Ship Passenger Capacity

AIDA TBD 3,250

American Cruise Lines TBD TBD (2X)

Carnival Cruise Lines Carnival Vista 4,000

Holland America Line Pinnacle Class 2,660

Norwegian Cruise Line Norwegian Bliss (Breakaway) 4,200

Regent Seven Seas Cruises Seven Seas Explorer 738

Royal Caribbean International Oasis Class 3 5,400 (2X)

Royal Caribbean International Quantum Class 4,180

Seabourn Cruise Line TBD TBD

Star Cruises TBD 3,364

TOTALS 33,192

MR #2 (26-31).indd 26 2/3/2014 10:09:51 AM

25

25

27

27