Page 10: of Maritime Reporter Magazine (March 2014)

U.S. Coast Guard Annual

Read this page in Pdf, Flash or Html5 edition of March 2014 Maritime Reporter Magazine

10 Maritime Reporter & Engineering News • MARCH 2014

OFFSHORE UPDATE

T he number of fl oating pro- duction systems continues to grow; 349 fl oating production units are now in service, on or- der or off-fi eld/being remarketed. This inventory is 5% higher than a year ago, 27% higher than fi ve years ago.

Current Inventory: Of the total, 320 units are used for oil/gas production.

Included in this fi gure are 211 FPSOs.

They are the most common type system, comprising 65% of the existing systems and 72% of the systems on order. The remaining consists of 10 production barges, 48 semis, 23 spars and 28 TLPs.

Another 29 units are fl oating LNG pro- cessing systems. This fi gure includes four liquefaction fl oaters (FLNGs), all of which are on order, and 25 regasifi - cation terminals (FSRUs) . Several of the 11 active FSRUs are interim regas units being used until the long term unit is delivered. In addition, 102 fl oating storage units are in service, on order or available. (See Chart Below).

FPSO Owners There are 66 owners of FPSOs, but this overall fi gure disguises a relatively high concentration within a few compa- nies. The top six FPSO owners own 95 units, or 45% of the FPSOs in service, available or on order. The remaining 55% is spread over 60 owners, more than half of which own only one FPSO.

Field operators own 52% of the FPSOs.

Petrobras is clearly the dominant player.

It owns 28 units, 13% of the total FPSO inventory. Other fi eld operators with large FPSO ownership are CNOOC (14 units), ExxonMobil and Total (each sev- en units), and BP, Chevron and Shell (5 units each).

Leasing operators own the remaining 48% of the FPSOs. SBM is the largest leasing company. It owns 17 units, 8% of the inventory. Next in line are BW Off- shore and Modec (each 13 units), Teekay (10 units), Bumi Armada (7 units) and

Bluewater (5 units). In terms of control of FPSOs, Petrobras is the gorilla in the sector. Counting both owned and leased units, Petrobras has 52 FPSOs under its control – 25% of the FPSOs inventory.

A list of the top FPSO owners is, right.

The full list on www.imastudies.com.

Production Floater Orders

Sixty-eight production fl oaters are cur- rently on order. The fi gure includes 36

FPSOs, 14 other oil/gas production units and 18 LNG processing units. In the later are four fl oating liquefaction plants and 14 regasifi cation terminals. The or- der backlog has remained around 70 units since mid-2012. But the composi- tion of orders has changed. In the cur- rent order backlog are signifi cantly few- er FPSOs (49 on order in mid-2012 vs. 36 now) and more regasifi cation fl oaters (9 on order in mid-2012 vs. 14 now).

Fewer FPSOs on order refl ects the slowdown in FPSO contracts during the past year. Only 11 FPSOs were ordered in 2013, down 20% from the average ordering pace over the past 10 years.

FSRUs on the other hand have been hot items. The current backlog of FSRU orders is more than 50% higher than in mid-2012. Included in the current order backlog are six speculative FSRUs be- ing built without a use contract, refl ect- ing the bullish market for regasifi cation terminals.

The market over the fi rst two months of 2014 has picked up a bit. Three pro- duction fl oater orders were placed in

January/February. • Petronas ordered a second

FLNG for use on the Rotan fi eld off Malaysia. The $2+ billion EPC contract was awarded to Samsung/

JDC. Delivery is scheduled in 2018. • ENI ordered a production barge for use on the Jangkrik fi eld off Indone- sia. The $1.1 billion EPCI contract was awarded to Saipem/Hyundai/Chiyoda/

Tripatra. Delivery is to be at end 2016. • Exmar/Pacifi c Rubiales ordered

Floating Production

Floating Production inventory continues to grow; 27% higher than fi ve years ago

BY JIM MCCAUL, IMA

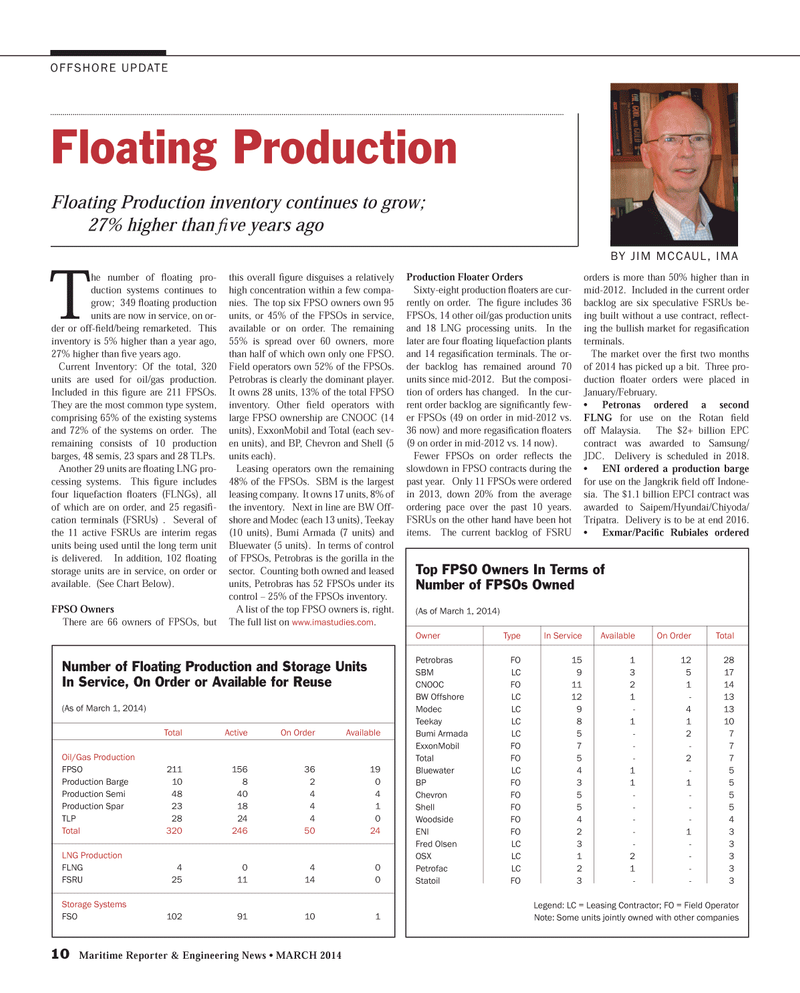

Number of Floating Production and Storage Units

In Service, On Order or Available for Reuse (As of March 1, 2014) Total Active On Order Available

Oil/Gas Production

FPSO 211 156 36 19

Production Barge 10 8 2 0

Production Semi 48 40 4 4

Production Spar 23 18 4 1

TLP 28 24 0

Total 320 246 50 24

LNG Production

FLNG 4 0 4 0

FSRU 25 11 14 0

Storage Systems

FSO 102 91 10 1

Top FPSO Owners In Terms of

Number of FPSOs Owned (As of March 1, 2014)

Owner Type In Service Available On Order Total

Petrobras FO 15 1 12 28

SBM LC 9 3 5 17

CNOOC FO 11 2 1 14

BW Offshore LC 12 1 - 13

Modec L 9 - 4 13

Teekay LC 8 1 1 10

Bumi Armada LC 5 - 2 7

ExxonMobil FO 7 - - 7

Total F 5 2 7

Bluewater LC 4 1 - 5

BP FO 3 1 5

Chevron FO 5 - - 5

Shell F 5

Woodside FO 4 - - 4

ENI F 2 1 3

Fred Olsen LC 3 - - 3

OSX L 1 2 3

Petrofac LC 2 1 - 3

Statoil FO 3 - - 3

Legend: LC = Leasing Contractor; FO = Field Operator

Note: Some units jointly owned with other companies

MR #3 (10-17).indd 10 3/4/2014 9:52:49 AM

9

9

11

11