Page 13: of Maritime Reporter Magazine (May 2014)

Marine Electronics Edition

Read this page in Pdf, Flash or Html5 edition of May 2014 Maritime Reporter Magazine

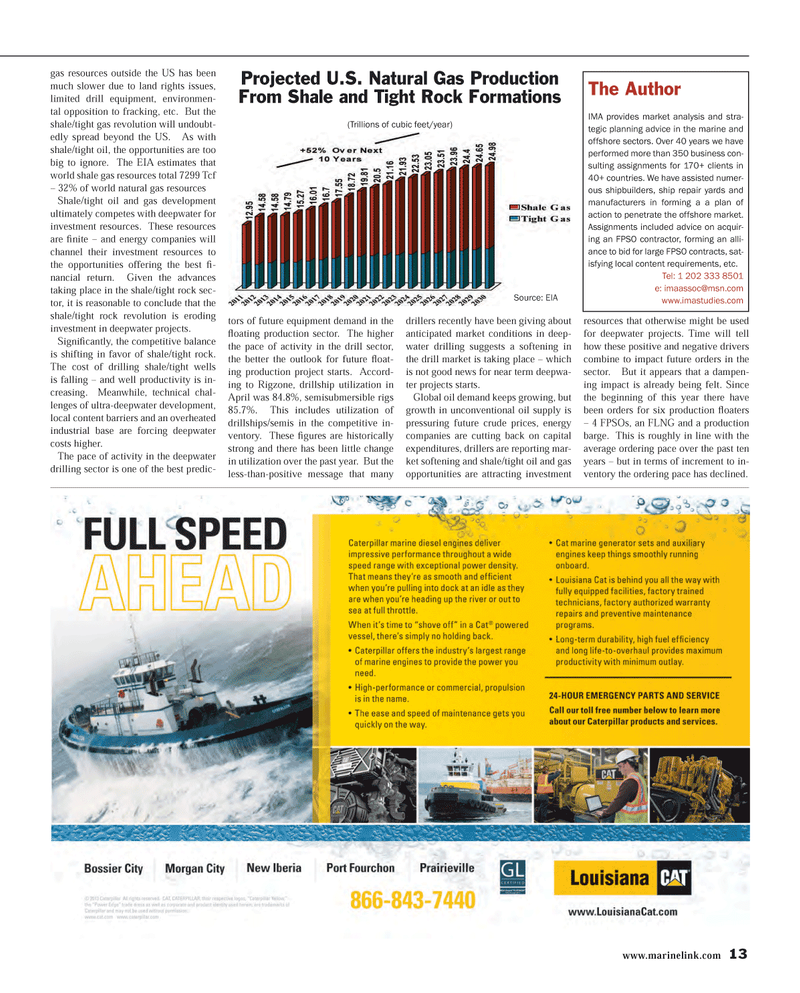

www.marinelink.com 13 gas resources outside the US has been much slower due to land rights issues, limited drill equipment, environmen- tal opposition to fracking, etc. But the shale/tight gas revolution will undoubt- edly spread beyond the US. As with shale/tight oil, the opportunities are too big to ignore. The EIA estimates that world shale gas resources total 7299 Tcf – 32% of world natural gas resources

Shale/tight oil and gas development ultimately competes with deepwater for investment resources. These resources are fi nite – and energy companies will channel their investment resources to the opportunities offering the best fi - nancial return. Given the advances taking place in the shale/tight rock sec- tor, it is reasonable to conclude that the shale/tight rock revolution is eroding investment in deepwater projects.

Signifi cantly, the competitive balance is shifting in favor of shale/tight rock.

The cost of drilling shale/tight wells is falling – and well productivity is in- creasing. Meanwhile, technical chal- lenges of ultra-deepwater development, local content barriers and an overheated industrial base are forcing deepwater costs higher.

The pace of activity in the deepwater drilling sector is one of the best predic- tors of future equipment demand in the fl oating production sector. The higher the pace of activity in the drill sector, the better the outlook for future fl oat- ing production project starts. Accord- ing to Rigzone, drillship utilization in

April was 84.8%, semisubmersible rigs 85.7%. This includes utilization of drillships/semis in the competitive in- ventory. These fi gures are historically strong and there has been little change in utilization over the past year. But the less-than-positive message that many drillers recently have been giving about anticipated market conditions in deep- water drilling suggests a softening in the drill market is taking place – which is not good news for near term deepwa- ter projects starts.

Global oil demand keeps growing, but growth in unconventional oil supply is pressuring future crude prices, energy companies are cutting back on capital expenditures, drillers are reporting mar- ket softening and shale/tight oil and gas opportunities are attracting investment resources that otherwise might be used for deepwater projects. Time will tell how these positive and negative drivers combine to impact future orders in the sector. But it appears that a dampen- ing impact is already being felt. Since the beginning of this year there have been orders for six production fl oaters – 4 FPSOs, an FLNG and a production barge. This is roughly in line with the average ordering pace over the past ten years – but in terms of increment to in- ventory the ordering pace has declined.

Source: EIA

The Author

IMA provides market analysis and stra- tegic planning advice in the marine and offshore sectors. Over 40 years we have performed more than 350 business con- sulting assignments for 170+ clients in 40+ countries. We have assisted numer- ous shipbuilders, ship repair yards and manufacturers in forming a a plan of action to penetrate the offshore market.

Assignments included advice on acquir- ing an FPSO contractor, forming an alli- ance to bid for large FPSO contracts, sat- isfying local content requirements, etc.

Tel: 1 202 333 8501 e: [email protected] www.imastudies.com

Projected U.S. Natural Gas Production

From Shale and Tight Rock Formations (Trillions of cubic feet/year)

MR #5 (10-17).indd 13 5/1/2014 10:18:47 AM

12

12

14

14