Page 35: of Maritime Reporter Magazine (April 2016)

The Offshore Annual

Read this page in Pdf, Flash or Html5 edition of April 2016 Maritime Reporter Magazine

Free Trial sion over the next ? ve years – assuming and to $60 to $70 in 2019/20. We have ing arrangement with resource owners. 18 months, 18 to 36 months or three to underlying drivers improve. Of the 242 also assumed Petrobras’ problems will The result will be to lower the breakeven ? ve years out.

Readers of projects in the planning pipeline, we see continue through 2017 – limiting the price of new deepwater projects.

Maritime Reporter & Engineering News 107 of these projects reaching the invest- company’s capability to ? nance new A list of 19 projects we see potentially can get a free trial the ment decision by end 2020. projects. But from 2018 onward Petro- producing orders for production or stor-

Based on our analysis, we see near to bras will be fully back in the market and/ age ? oaters over the next 18 months is mid-term projects in the planning stage or the operating rights to some pre-salt provided in the accompanying table. “Floating Production Systems

Report And Online Database” potentially generating contracts for 82 blocks offshore Brazil now managed by Details for these near term projects – as

Authored by Jim McCaul, production ? oaters between 2016/20. Petrobras will be contracted to interna- well as details for 88 other projects in by visiting:

The forecast includes 46 FPSOs, 11 oil/ tional players. the planning stage that have potential gas FPUs, 4 FLNGs and 21 FSRUs. We Further, we have assumed there will be to produce EPC contracts over the next also expect orders for around 25 FSOs. signi? cant (20 to 30%) cost reductions in 18 to 60 months -- are provided in the https://www.worldenergyreports.com/

In making this forecast, we have as- the deepwater supply chain as competi- March 2016 WER Floating Production reports/trial sumed that the price of oil will remain in tion for available contracts tightens, local Report. We indicate in the report when the $40 to $50 range through 2016 – then content requirements ease and operators the EPC contract is likely to be awarded climb to the $50 to $60 range in 2017/18 negotiate more favorable revenue shar- with the next ? ve years – within the next

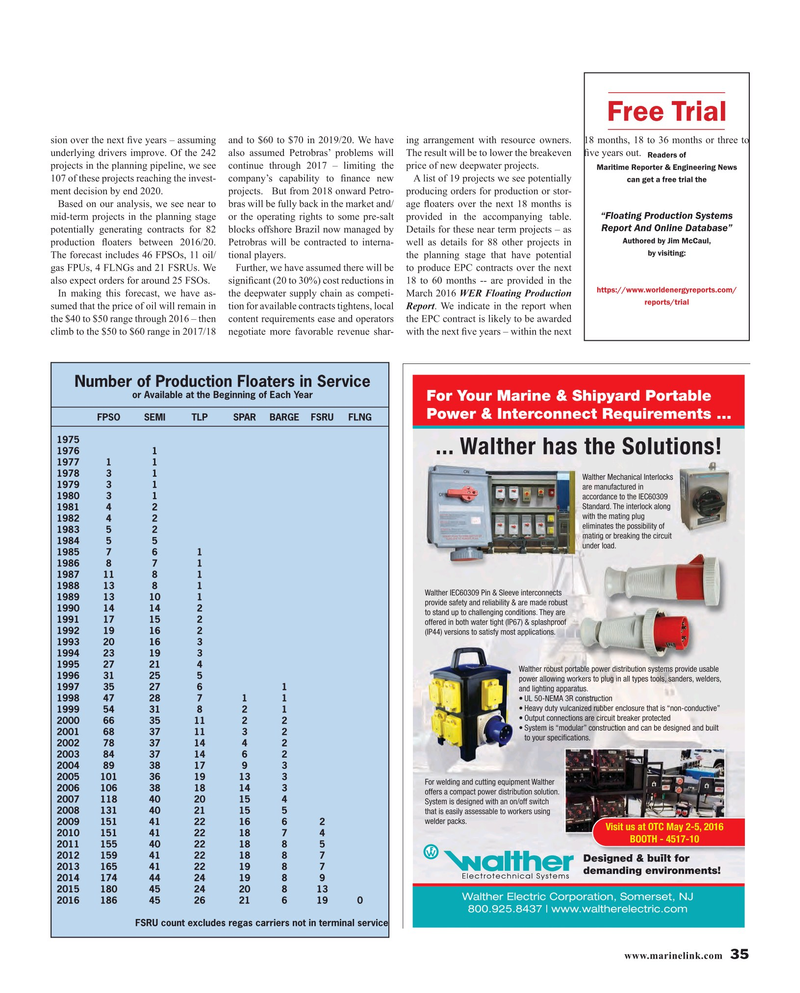

Number of Production Floaters in Service or Available at the Beginning of Each Year FPSO SEMI TLP SPAR BARGE FSRU FLNG 1975 1976 1 1977 1 1 1978 3 1 1979 3 1 1980 3 1 1981 4 2 1982 4 2 1983 5 2 1984 5 5 1985 7 6 1 1986 8 7 1 1987 11 8 1 1988 13 8 1 1989 13 10 1 1990 14 14 2 1991 17 15 2 1992 19 16 2 1993 20 16 3 1994 23 19 3 1995 27 21 4 1996 31 25 5 1997 35 27 6 1 1998 47 28 7 1 1 1999 54 31 8 2 1 2000 66 35 11 2 2 2001 68 37 11 3 2 2002 78 37 14 4 2 2003 84 37 14 6 2 2004 89 38 17 9 3 2005 101 36 19 13 3 2006 106 38 18 14 3 2007 118 40 20 15 4 2008 131 40 21 15 5 2009 151 41 22 16 6 2 2010 151 41 22 18 7 4 2011 155 40 22 18 8 5 2012 159 41 22 18 8 7 2013 165 41 22 19 8 7 2014 174 44 24 19 8 9 2015 180 45 24 20 8 13 2016 186 45 26 21 6 19 0

FSRU count excludes regas carriers not in terminal service www.marinelink.com 35

MR #4 (34-41).indd 35 4/7/2016 10:41:49 AM

34

34

36

36