Page 71: of Maritime Reporter Magazine (June 2016)

Annual World Yearbook

Read this page in Pdf, Flash or Html5 edition of June 2016 Maritime Reporter Magazine

DATA & STATISTICS

Big Ship Casualties

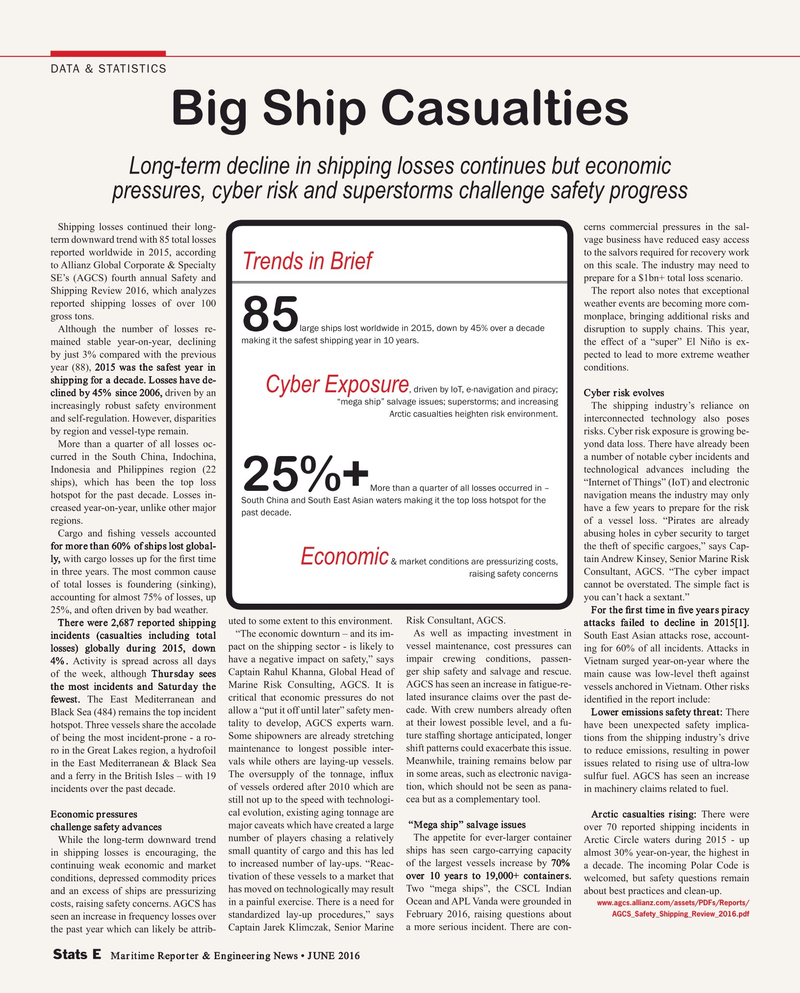

Long-term decline in shipping losses continues but economic pressures, cyber risk and superstorms challenge safety progress

Shipping losses continued their long- cerns commercial pressures in the sal- term downward trend with 85 total losses vage business have reduced easy access reported worldwide in 2015, according to the salvors required for recovery work to Allianz Global Corporate & Specialty on this scale. The industry may need to

Trends in Brief

SE’s (AGCS) fourth annual Safety and prepare for a $1bn+ total loss scenario.

Shipping Review 2016, which analyzes The report also notes that exceptional reported shipping losses of over 100 weather events are becoming more com- gross tons. monplace, bringing additional risks and 85 large ships lost worldwide in 2015, down by 45% over a decade

Although the number of losses re- disruption to supply chains. This year, making it the safest shipping year in 10 years. mained stable year-on-year, declining the effect of a “super” El Niño is ex- by just 3% compared with the previous pected to lead to more extreme weather year (88), 2015 was the safest year in conditions. shipping for a decade. Losses have de-

Cyber Exposure, driven by IoT, e-navigation and piracy; clined by 45% since 2006, driven by an Cyber risk evolves “mega ship” salvage issues; superstorms; and increasing increasingly robust safety environment The shipping industry’s reliance on

Arctic casualties heighten risk environment.

and self-regulation. However, disparities interconnected technology also poses by region and vessel-type remain. risks. Cyber risk exposure is growing be-

More than a quarter of all losses oc- yond data loss. There have already been curred in the South China, Indochina, a number of notable cyber incidents and

Indonesia and Philippines region (22 technological advances including the ships), which has been the top loss “Internet of Things” (IoT) and electronic 25%+

More than a quarter of all losses occurred in – hotspot for the past decade. Losses in- navigation means the industry may only

South China and South East Asian waters making it the top loss hotspot for the creased year-on-year, unlike other major have a few years to prepare for the risk past decade.

regions. of a vessel loss. “Pirates are already

Cargo and ? shing vessels accounted abusing holes in cyber security to target for more than 60% of ships lost global- the theft of speci? c cargoes,” says Cap- ly, with cargo losses up for the ? rst time tain Andrew Kinsey, Senior Marine Risk

Economic & market conditions are pressurizing costs, in three years. The most common cause Consultant, AGCS. “The cyber impact raising safety concerns of total losses is foundering (sinking), cannot be overstated. The simple fact is accounting for almost 75% of losses, up you can’t hack a sextant.” 25%, and often driven by bad weather. For the ? rst time in ? ve years piracy

There were 2,687 reported shipping uted to some extent to this environment. Risk Consultant, AGCS.

attacks failed to decline in 2015[1]. “The economic downturn – and its im- incidents (casualties including total As well as impacting investment in South East Asian attacks rose, account- losses) globally during 2015, down pact on the shipping sector - is likely to vessel maintenance, cost pressures can ing for 60% of all incidents. Attacks in 4%. Activity is spread across all days have a negative impact on safety,” says impair crewing conditions, passen-

Vietnam surged year-on-year where the of the week, although Thursday sees Captain Rahul Khanna, Global Head of ger ship safety and salvage and rescue. main cause was low-level theft against the most incidents and Saturday the Marine Risk Consulting, AGCS. It is AGCS has seen an increase in fatigue-re- vessels anchored in Vietnam. Other risks fewest. The East Mediterranean and critical that economic pressures do not lated insurance claims over the past de- identi? ed in the report include:

Black Sea (484) remains the top incident allow a “put it off until later” safety men- cade. With crew numbers already often

Lower emissions safety threat: There tality to develop, AGCS experts warn. at their lowest possible level, and a fu- hotspot. Three vessels share the accolade have been unexpected safety implica- of being the most incident-prone - a ro- Some shipowners are already stretching ture staf? ng shortage anticipated, longer tions from the shipping industry’s drive ro in the Great Lakes region, a hydrofoil maintenance to longest possible inter- shift patterns could exacerbate this issue. to reduce emissions, resulting in power in the East Mediterranean & Black Sea vals while others are laying-up vessels. Meanwhile, training remains below par issues related to rising use of ultra-low and a ferry in the British Isles – with 19 The oversupply of the tonnage, in? ux in some areas, such as electronic naviga- sulfur fuel. AGCS has seen an increase of vessels ordered after 2010 which are tion, which should not be seen as pana- incidents over the past decade. in machinery claims related to fuel.

still not up to the speed with technologi- cea but as a complementary tool.

cal evolution, existing aging tonnage are

Economic pressures Arctic casualties rising: There were major caveats which have created a large “Mega ship” salvage issues challenge safety advances over 70 reported shipping incidents in

The appetite for ever-larger container Arctic Circle waters during 2015 - up While the long-term downward trend number of players chasing a relatively in shipping losses is encouraging, the small quantity of cargo and this has led ships has seen cargo-carrying capacity almost 30% year-on-year, the highest in of the largest vessels increase by 70% a decade. The incoming Polar Code is continuing weak economic and market to increased number of lay-ups. “Reac- conditions, depressed commodity prices tivation of these vessels to a market that over 10 years to 19,000+ containers. welcomed, but safety questions remain and an excess of ships are pressurizing has moved on technologically may result Two “mega ships”, the CSCL Indian about best practices and clean-up.

www.agcs.allianz.com/assets/PDFs/Reports/ costs, raising safety concerns. AGCS has in a painful exercise. There is a need for Ocean and APL Vanda were grounded in

AGCS_Safety_Shipping_Review_2016.pdf standardized lay-up procedures,” says February 2016, raising questions about seen an increase in frequency losses over

Captain Jarek Klimczak, Senior Marine a more serious incident. There are con- the past year which can likely be attrib-

Stats E Maritime Reporter & Engineering News • JUNE 2016

STATS.indd 38 STATS.indd 38 6/20/2016 4:59:36 PM6/20/2016 4:59:36 PM

70

70

72

72