Page 19: of Maritime Reporter Magazine (July 2016)

Marine Communications Edition

Read this page in Pdf, Flash or Html5 edition of July 2016 Maritime Reporter Magazine

Panama Canal Fast Facts

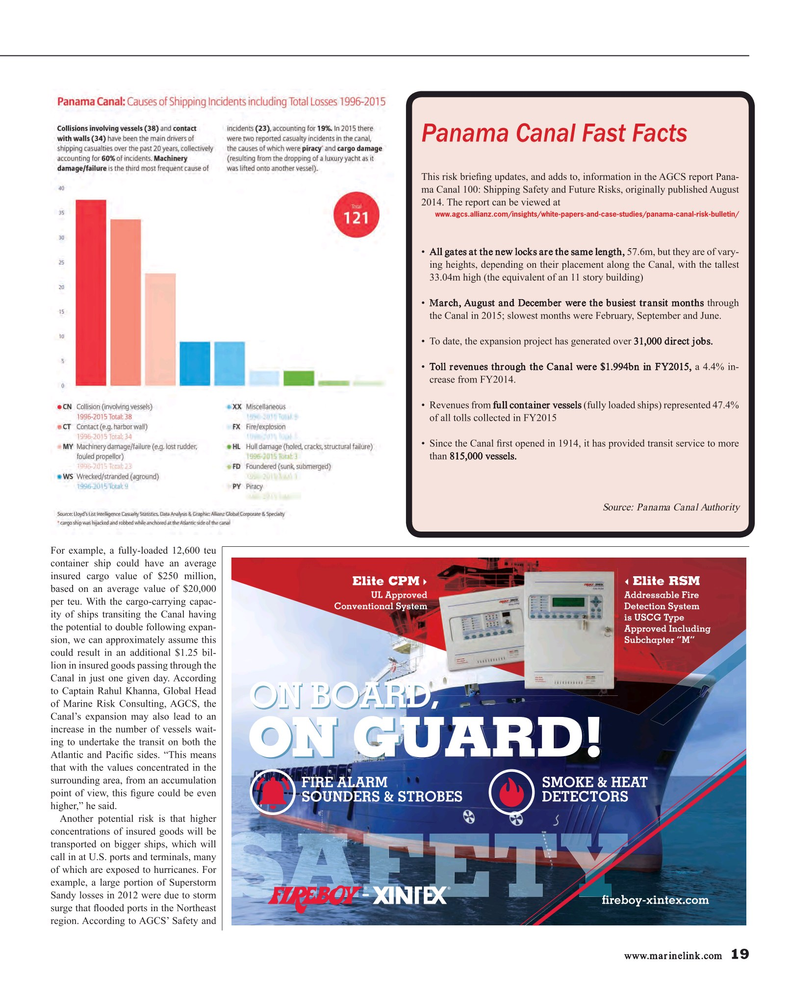

This risk brie? ng updates, and adds to, information in the AGCS report Pana- ma Canal 100: Shipping Safety and Future Risks, originally published August 2014. The report can be viewed at www.agcs.allianz.com/insights/white-papers-and-case-studies/panama-canal-risk-bulletin/ • All gates at the new locks are the same length, 57.6m, but they are of vary- ing heights, depending on their placement along the Canal, with the tallest 33.04m high (the equivalent of an 11 story building) • March, August and December were the busiest transit months through the Canal in 2015; slowest months were February, September and June.

• To date, the expansion project has generated over 31,000 direct jobs.

• Toll revenues through the Canal were $1.994bn in FY2015, a 4.4% in- crease from FY2014.

• Revenues from full container vessels (fully loaded ships) represented 47.4% of all tolls collected in FY2015 • Since the Canal ? rst opened in 1914, it has provided transit service to more than 815,000 vessels.

Source: Panama Canal Authority

For example, a fully-loaded 12,600 teu container ship could have an average insured cargo value of $250 million, based on an average value of $20,000 per teu. With the cargo-carrying capac- ity of ships transiting the Canal having the potential to double following expan- sion, we can approximately assume this could result in an additional $1.25 bil- lion in insured goods passing through the

Canal in just one given day. According to Captain Rahul Khanna, Global Head of Marine Risk Consulting, AGCS, the

Canal’s expansion may also lead to an increase in the number of vessels wait- ing to undertake the transit on both the

Atlantic and Paci? c sides. “This means that with the values concentrated in the surrounding area, from an accumulation point of view, this ? gure could be even higher,” he said.

Another potential risk is that higher concentrations of insured goods will be transported on bigger ships, which will call in at U.S. ports and terminals, many of which are exposed to hurricanes. For example, a large portion of Superstorm ®®

Sandy losses in 2012 were due to storm surge that ? ooded ports in the Northeast region. According to AGCS’ Safety and www.marinelink.com 19

MR #7 (18-25).indd 19 7/6/2016 10:41:32 AM

18

18

20

20