Page 42: of Maritime Reporter Magazine (April 2017)

The Offshore Annual

Read this page in Pdf, Flash or Html5 edition of April 2017 Maritime Reporter Magazine

Offshore Report

Updated Forecast on

Floating Production System Orders

BY JIM MCCAUL, IMA/WORLD ENERGY REPORTS orld Energy Reports has Negative developments ders remains bullish. We now anticipate $50-$55 oil only a portion (~55%) are just released its midterm • Downturn in expected oil prices – orders for 32 FPSOs and 8 FPUs over expected to proceed to a FID during the ? ve year forecast of pro- while spot crude prices have increased the 2017/21 time period – 2 fewer units forecast period.

Wduction ? oater orders. due to the OPEC cuts, the futures market than the October forecast. The reduction The data section in the report provides

The forecast, detailed in the March 2017 in March sees Brent crude for delivery is the result of several FPSO orders be- details for 199 ? oater projects in the

WER report, re? ects positive and nega- ? ve years out trading 10% lower than the ing pushed beyond the ? ve year forecast planning stage, 48 production or stor- tive developments in underlying busi- projected prices last October window. Similar to our October fore- age ? oaters now on order, 294 ? oating ness drivers since WER’s ? ve year fore- • Continued inability of Petrobras to cast, we continue to anticipate orders production units currently in service cast last October. regain traction following the corruption for 25 LNG regasi? cation ? oaters and and 28 production ? oaters available for scandal – opposition to local content around 25 FSOs over the next ? ve years. redeployment contracts. Charts in the

Positive developments ? exibility has delayed procurement of In the March report is a list of 73 FPSO/ report update the location where ? oating • Likelihood that the November new FPSOs, legal challenges have pre- FPU projects that have potential to move production and storage systems are be-

U.S. election results will accelerate U.S. vented the sale of assets to improve cash to the development stage through end- ing planned, operating, being built and deepwater E&D – the new industry- position 2021. They are all announced discover- to be installed. Accompanying excel friendly administration is cutting envi- • More rapid expected increase in ies capable of moving to the EPC con- spreadsheets provide the report data in ronmental barriers, opening new areas cost of capital – US Fed targeting of tracting stage over the next ? ve years sortable format. Information is current to E&D and plans tax cuts to encourage three or four quarter point increases in – i.e., a physical backlog of potential as of March 20. domestic energy development the overnight lending rate within this project starts. The projects are segment- • Faster pace of rebound in oil com- year and likely similar tightening by ed into three time periods for possible

For more information, contact pany capital spending – ExxonMobil, other central banks will make deepwater investment decision – within the next

Jim McCaul

BP, Hess have increased their capex bud- projects more expensive 18 months, next 18 to 36 months and 36 [email protected] get for E&D in 2017, re? ecting a more Overall, the net impact of these chang- to 60 months out. Of course, timing of or bullish near-term outlook for capital es is slightly negative – but the outlook the EPC contracting decision depends on

Jean Vertucci spending than apparent last October for a ramp up in production ? oater or- the underlying business drivers – and at [email protected]

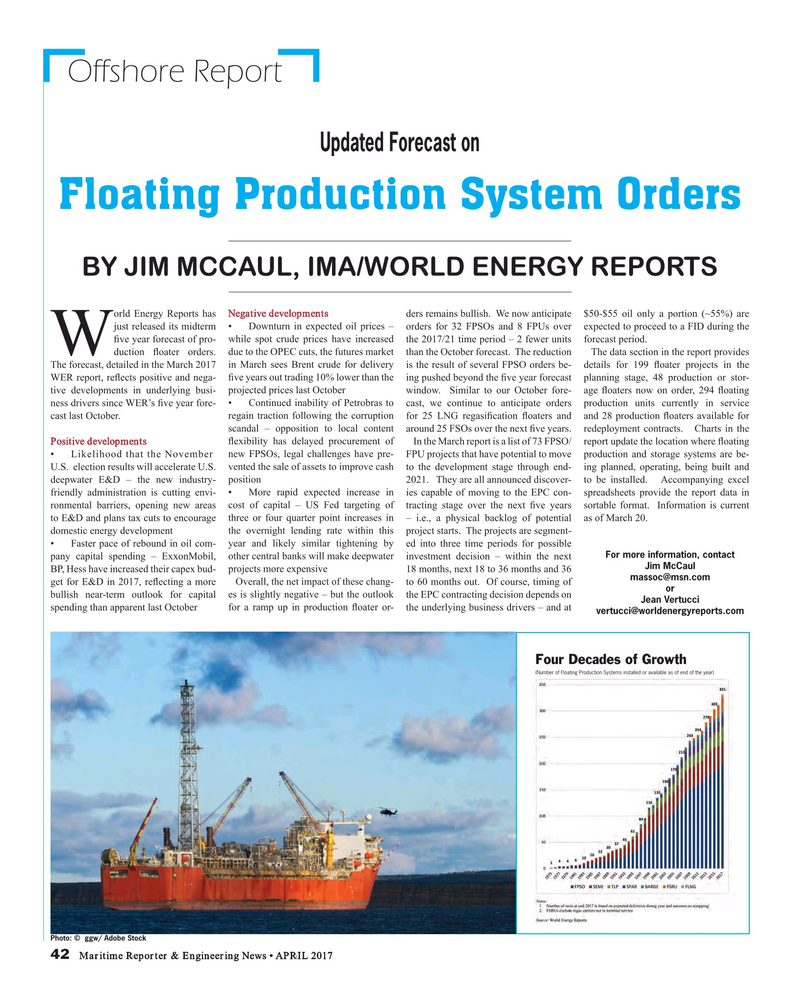

Four Decades of Growth (Number of Floating Production Systems installed or available as of end of the year)

Photo: © ggw/ Adobe Stock 42 Maritime Reporter & Engineering News • APRIL 2017

MR #4 (42-49).indd 42 MR #4 (42-49).indd 42 4/4/2017 1:30:58 PM4/4/2017 1:30:58 PM

41

41

43

43