Page 22: of Maritime Reporter Magazine (January 2019)

Ship Repair & Conversion: The Shipyards

Read this page in Pdf, Flash or Html5 edition of January 2019 Maritime Reporter Magazine

M

MARKETS: Tankers ers who look out more than a few months. Demand the worlds of shipping and ? nance can agree on prices variations around an economic trend line include nu- for tanker hires at future dates. The outlook can be merous wildcards. The actions of OPEC+ regarding described as cautiously optimistic but not ecstatic,

The Forward Curve exports mentioned by Teekay Tankers, and the im- based on market data provided by brokers Marex pacts of the ongoing “Trade War” are examples. But Spectron. For VLCC’s, the daily fully costed break-

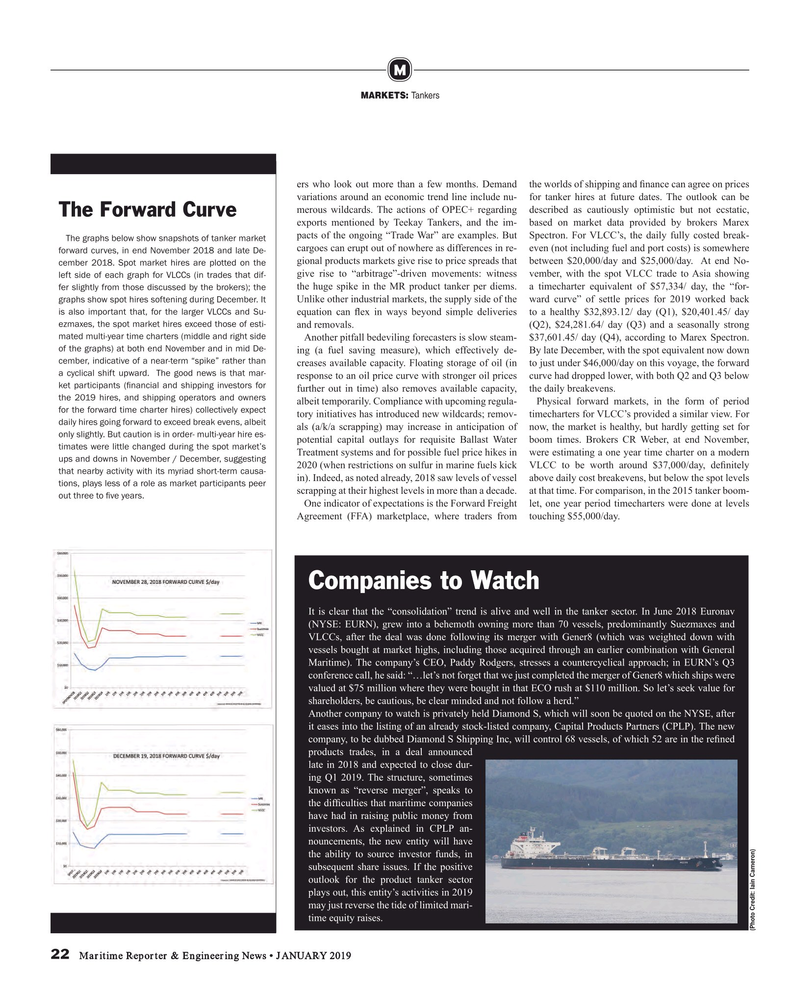

The graphs below show snapshots of tanker market cargoes can erupt out of nowhere as differences in re- even (not including fuel and port costs) is somewhere forward curves, in end November 2018 and late De- gional products markets give rise to price spreads that between $20,000/day and $25,000/day. At end No- cember 2018. Spot market hires are plotted on the give rise to “arbitrage”-driven movements: witness vember, with the spot VLCC trade to Asia showing left side of each graph for VLCCs (in trades that dif- the huge spike in the MR product tanker per diems. a timecharter equivalent of $57,334/ day, the “for- fer slightly from those discussed by the brokers); the

Unlike other industrial markets, the supply side of the ward curve” of settle prices for 2019 worked back graphs show spot hires softening during December. It is also important that, for the larger VLCCs and Su- equation can ? ex in ways beyond simple deliveries to a healthy $32,893.12/ day (Q1), $20,401.45/ day ezmaxes, the spot market hires exceed those of esti- and removals. (Q2), $24,281.64/ day (Q3) and a seasonally strong mated multi-year time charters (middle and right side

Another pitfall bedeviling forecasters is slow steam- $37,601.45/ day (Q4), according to Marex Spectron. of the graphs) at both end November and in mid De- ing (a fuel saving measure), which effectively de- By late December, with the spot equivalent now down cember, indicative of a near-term “spike” rather than creases available capacity. Floating storage of oil (in to just under $46,000/day on this voyage, the forward a cyclical shift upward. The good news is that mar- response to an oil price curve with stronger oil prices curve had dropped lower, with both Q2 and Q3 below ket participants (? nancial and shipping investors for further out in time) also removes available capacity, the daily breakevens. the 2019 hires, and shipping operators and owners albeit temporarily. Compliance with upcoming regula- Physical forward markets, in the form of period for the forward time charter hires) collectively expect tory initiatives has introduced new wildcards; remov- timecharters for VLCC’s provided a similar view. For daily hires going forward to exceed break evens, albeit als (a/k/a scrapping) may increase in anticipation of now, the market is healthy, but hardly getting set for only slightly. But caution is in order- multi-year hire es- potential capital outlays for requisite Ballast Water boom times. Brokers CR Weber, at end November, timates were little changed during the spot market’s

Treatment systems and for possible fuel price hikes in were estimating a one year time charter on a modern ups and downs in November / December, suggesting 2020 (when restrictions on sulfur in marine fuels kick VLCC to be worth around $37,000/day, de? nitely that nearby activity with its myriad short-term causa- in). Indeed, as noted already, 2018 saw levels of vessel above daily cost breakevens, but below the spot levels tions, plays less of a role as market participants peer scrapping at their highest levels in more than a decade. at that time. For comparison, in the 2015 tanker boom- out three to ? ve years.

One indicator of expectations is the Forward Freight let, one year period timecharters were done at levels

Agreement (FFA) marketplace, where traders from touching $55,000/day.

Companies to Watch

It is clear that the “consolidation” trend is alive and well in the tanker sector. In June 2018 Euronav (NYSE: EURN), grew into a behemoth owning more than 70 vessels, predominantly Suezmaxes and

VLCCs, after the deal was done following its merger with Gener8 (which was weighted down with vessels bought at market highs, including those acquired through an earlier combination with General

Maritime). The company’s CEO, Paddy Rodgers, stresses a countercyclical approach; in EURN’s Q3 conference call, he said: “…let’s not forget that we just completed the merger of Gener8 which ships were valued at $75 million where they were bought in that ECO rush at $110 million. So let’s seek value for shareholders, be cautious, be clear minded and not follow a herd.”

Another company to watch is privately held Diamond S, which will soon be quoted on the NYSE, after it eases into the listing of an already stock-listed company, Capital Products Partners (CPLP). The new company, to be dubbed Diamond S Shipping Inc, will control 68 vessels, of which 52 are in the re? ned products trades, in a deal announced late in 2018 and expected to close dur- ing Q1 2019. The structure, sometimes known as “reverse merger”, speaks to the dif? culties that maritime companies have had in raising public money from investors. As explained in CPLP an- nouncements, the new entity will have the ability to source investor funds, in subsequent share issues. If the positive outlook for the product tanker sector plays out, this entity’s activities in 2019 may just reverse the tide of limited mari- time equity raises. (Photo Credit: Iain Cameron) 22 Maritime Reporter & Engineering News • JANUARY 2019

MR #1 (18-25).indd 22 MR #1 (18-25).indd 22 1/11/2019 1:38:41 PM1/11/2019 1:38:41 PM

21

21

23

23