Page 45: of Maritime Reporter Magazine (October 2019)

Marine Design Annual

Read this page in Pdf, Flash or Html5 edition of October 2019 Maritime Reporter Magazine

HISTORY DESIGN EVOLUTION

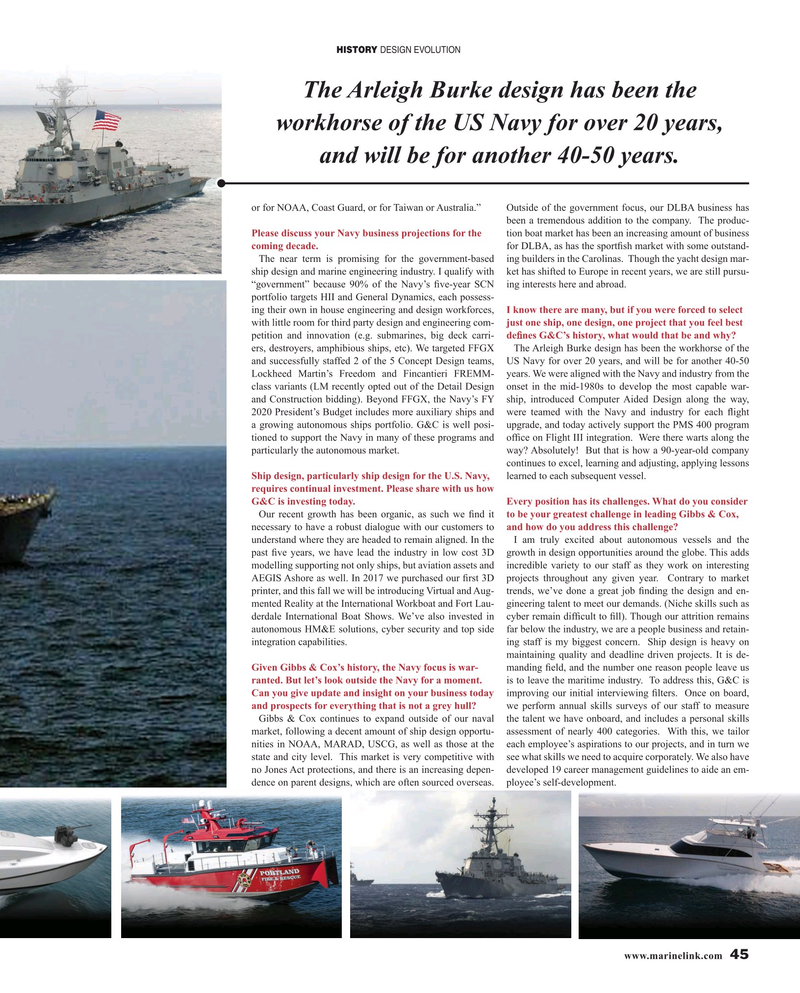

The Arleigh Burke design has been the workhorse of the US Navy for over 20 years, and will be for another 40-50 years. or for NOAA, Coast Guard, or for Taiwan or Australia.” Outside of the government focus, our DLBA business has been a tremendous addition to the company. The produc-

Please discuss your Navy business projections for the tion boat market has been an increasing amount of business coming decade. for DLBA, as has the sport? sh market with some outstand-

The near term is promising for the government-based ing builders in the Carolinas. Though the yacht design mar- ship design and marine engineering industry. I qualify with ket has shifted to Europe in recent years, we are still pursu- “government” because 90% of the Navy’s ? ve-year SCN ing interests here and abroad.

portfolio targets HII and General Dynamics, each possess- ing their own in house engineering and design workforces, I know there are many, but if you were forced to select with little room for third party design and engineering com- just one ship, one design, one project that you feel best petition and innovation (e.g. submarines, big deck carri- de? nes G&C’s history, what would that be and why?

ers, destroyers, amphibious ships, etc). We targeted FFGX The Arleigh Burke design has been the workhorse of the and successfully staffed 2 of the 5 Concept Design teams, US Navy for over 20 years, and will be for another 40-50

Lockheed Martin’s Freedom and Fincantieri FREMM- years. We were aligned with the Navy and industry from the class variants (LM recently opted out of the Detail Design onset in the mid-1980s to develop the most capable war- and Construction bidding). Beyond FFGX, the Navy’s FY ship, introduced Computer Aided Design along the way, 2020 President’s Budget includes more auxiliary ships and were teamed with the Navy and industry for each ? ight a growing autonomous ships portfolio. G&C is well posi- upgrade, and today actively support the PMS 400 program tioned to support the Navy in many of these programs and of? ce on Flight III integration. Were there warts along the particularly the autonomous market. way? Absolutely! But that is how a 90-year-old company continues to excel, learning and adjusting, applying lessons

Ship design, particularly ship design for the U.S. Navy, learned to each subsequent vessel. requires continual investment. Please share with us how

G&C is investing today. Every position has its challenges. What do you consider

Our recent growth has been organic, as such we ? nd it to be your greatest challenge in leading Gibbs & Cox, necessary to have a robust dialogue with our customers to and how do you address this challenge?

understand where they are headed to remain aligned. In the I am truly excited about autonomous vessels and the past ? ve years, we have lead the industry in low cost 3D growth in design opportunities around the globe. This adds modelling supporting not only ships, but aviation assets and incredible variety to our staff as they work on interesting

AEGIS Ashore as well. In 2017 we purchased our ? rst 3D projects throughout any given year. Contrary to market printer, and this fall we will be introducing Virtual and Aug- trends, we’ve done a great job ? nding the design and en- mented Reality at the International Workboat and Fort Lau- gineering talent to meet our demands. (Niche skills such as derdale International Boat Shows. We’ve also invested in cyber remain dif? cult to ? ll). Though our attrition remains autonomous HM&E solutions, cyber security and top side far below the industry, we are a people business and retain- integration capabilities. ing staff is my biggest concern. Ship design is heavy on maintaining quality and deadline driven projects. It is de-

Given Gibbs & Cox’s history, the Navy focus is war- manding ? eld, and the number one reason people leave us ranted. But let’s look outside the Navy for a moment. is to leave the maritime industry. To address this, G&C is

Can you give update and insight on your business today improving our initial interviewing ? lters. Once on board, and prospects for everything that is not a grey hull? we perform annual skills surveys of our staff to measure

Gibbs & Cox continues to expand outside of our naval the talent we have onboard, and includes a personal skills market, following a decent amount of ship design opportu- assessment of nearly 400 categories. With this, we tailor nities in NOAA, MARAD, USCG, as well as those at the each employee’s aspirations to our projects, and in turn we state and city level. This market is very competitive with see what skills we need to acquire corporately. We also have no Jones Act protections, and there is an increasing depen- developed 19 career management guidelines to aide an em- dence on parent designs, which are often sourced overseas. ployee’s self-development.

www.marinelink.com 45

MR #10 (42-49).indd 45 10/4/2019 11:23:09 AM

44

44

46

46