Page 24: of Maritime Reporter Magazine (February 2020)

Green Ship Technology

Read this page in Pdf, Flash or Html5 edition of February 2020 Maritime Reporter Magazine

FPSOs

Floating Production Systems

Outlook is Strong for ‘Floaters’ ctivity in the deepwater sector took a huge

The 10-Year Trend in Orders hit in the second half of last decade as a Contracts for 123 production ? oaters have been placed over result of a global oil demand/supply im- the past 10 years – an average of around 12 units annually. balance, downturn in oil prices, hiatus in FPSOs accounted for 97 of the contracts, and FPUs for 26

A

Petrobras production ? oater orders and contracts. Included in the FPU contracts were 12 production large industry cutbacks in upstream spend- semis, six tension-leg platforms (TLP), ? ve spars and three ing. The downturn was the worst to ever barges. A high of 27 contracts was reached in 2010 when hit the offshore sector. Orders for new equipment dried up, Petrobras ordered the hulls for eight serial FPSOs (two were backlog fell and many suppliers were forced to cut person- subsequently canceled, one later rebid). The low was in 2016 nel, while others were forced out of business. But the down- when no orders were placed. turn has bottomed, and orders for production ? oaters are on Orders returned in 2017 as the oil market recovered, and the uptick, a large portfolio of new projects are in the plan- over the past three years 32 production ? oaters have been ning stage and underlying market conditions are favorable to ordered, including 25 FPSOs and seven FPUs.

deepwater investment decisions. FPSO orders since 2017 include nine large units for use by Petrobras in Brazil (seven) and by ExxonMobil in Guy-

Growing Number of Production Floaters ana (two). Not counted in the FPSO total are two speculative

The number of ? oating production systems in operation has FPSO hulls ordered by SBM in December 2019 – they will steadily increased since startup of the ? rst production ? oater be included when a ? eld contract is executed. In 2020 there in the mid-1970s. Ten years were needed to reach 15 units has been one FPSO order as of mid-January. The seven FPU in operation. By the end of the second decade more than 50 contracts since 2017 include six production semis and a small units were in operation. At the end of the third decade the production barge. No production spars or TLPs have been number had grown to around 170 units in service. Now there ordered over the past ? ve years. The latest spar order was in are just under 300 production ? oaters in service or available 2012. The last TLP order was in 2013.

– and another 29 on order (Exhibit 1).

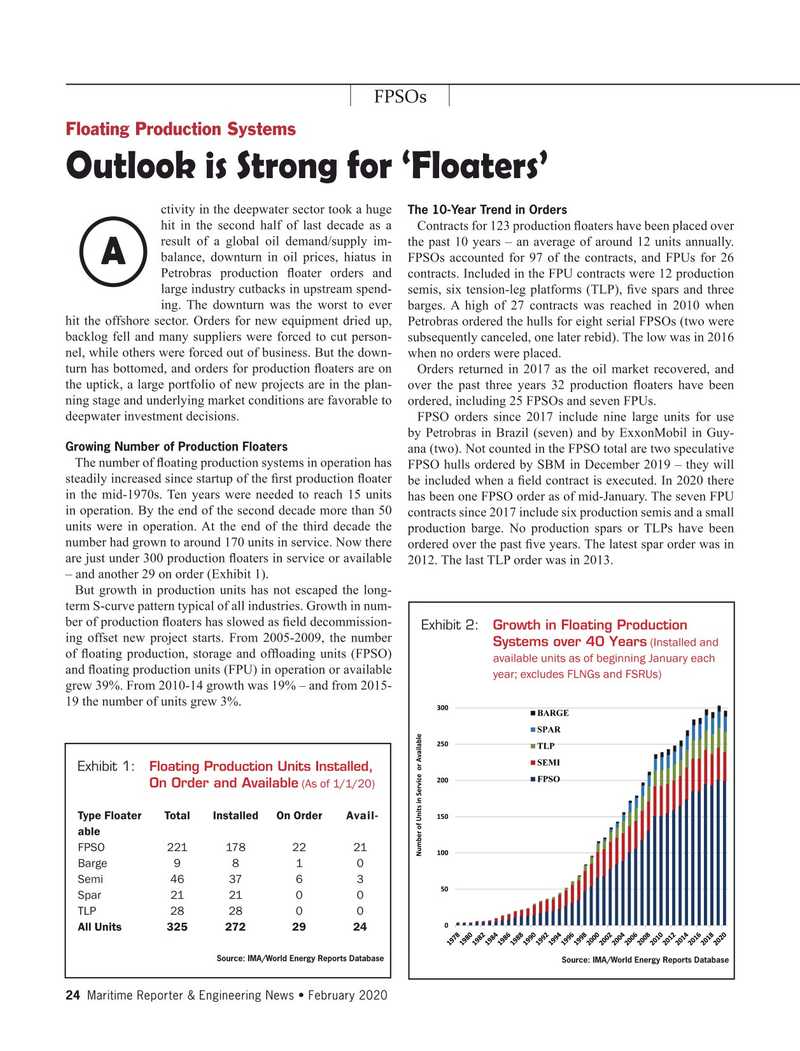

But growth in production units has not escaped the long- term S-curve pattern typical of all industries. Growth in num- ber of production ? oaters has slowed as ? eld decommission-

Exhibit 2: Growth in Floating Production ing offset new project starts. From 2005-2009, the number Systems over 40 Years (Installed and of ? oating production, storage and of? oading units (FPSO) available units as of beginning January each and ? oating production units (FPU) in operation or available year; excludes FLNGs and FSRUs) grew 39%. From 2010-14 growth was 19% – and from 2015- 19 the number of units grew 3%.

Exhibit 1: Floating Production Units Installed, On Order and Available (As of 1/1/20)

Type Floater Total Installed On Order Avail- able

FPSO 221 178 22 21

Barge 9 8 1 0

Semi 46 37 6 3

Spar 21 21 0 0

TLP 28 28 0 0

All Units 325 272 29 24

Source: IMA/World Energy Reports Database

Source: IMA/World Energy Reports Database 24 Maritime Reporter & Engineering News • February 2020

MR #2 (18-33).indd 24 2/5/2020 10:52:15 AM

23

23

25

25